Premium Only Content

Offer In Compromise Formula For IRS and Most States Explained In One Minute By Tax Attorney

Here we go through Offer In Compromise formula and explain how you get it in one minute. The IRS and most states follow the principles presented in this video.

There are some exceptions:

1) Some really large balance cases you might still get through with unreasonable expenses, but the settlement amount may be quite large too.

2) When your home is unsellable you might get out of including it in your Offer calculation. An example of this was a home a client of ours had in Mexico that was on the market for two years and would not move.

3) When your home value is low and you could not afford rent somewhere else. An example of this was a client who had a $30,000 mobile home. If he had to sell it he could only afford rent for so long until he was broke and homeless.

4) Other types of Offer In Compromise: What we're covering here is financials-based Offers which are the most common. The other ones are really hard to get in most cases.

You can do an Offer yourself by checking out our complete guide here:

https://trp.tax/tax-guide/how-to-do-your-own-offer-in-compromise/

If you do not qualify for an Offer you can find other self-help options here:

If you would like one of our expert tax attorneys to help you resolve your case you can call us at (888) 515-4829 or schedule a free consultation here:

If you got a question related to Offer In Compromise or tax relief, post a comment below and one of our attorneys will answer.

-

9:13

9:13

TaxResolutionProfessionals

4 years agoOffer In Compromise Formula: How The IRS Calculates Tax Settlements

13 -

1:33

1:33

TaxResolutionProfessionals

4 years ago5 Tips For Offer In Compromise Success by a Tax Attorney

33 -

4:16

4:16

TaxResolutionProfessionals

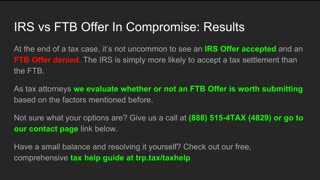

4 years agoIRS vs FTB Offer In Compromise: The Similarities, The DIfferences

29 -

6:43

6:43

TaxResolutionProfessionals

4 years agoHow Do I File My Offer In Compromise With The IRS?

13 -

0:28

0:28

GRIFFIN_GREEN_GAMER

4 years agoGTA online weekly update explained in under a minute

10 -

LIVE

LIVE

Pickleball Now

6 hours agoLive: IPBL 2025 Day 5 | Final Day of League Stage Set for Explosive Showdowns

119 watching -

9:03

9:03

MattMorseTV

19 hours ago $22.08 earnedIlhan Omar just got BAD NEWS.

52.4K108 -

2:02:41

2:02:41

Side Scrollers Podcast

23 hours agoMetroid Prime 4 ROASTED + Roblox BANNED for LGBT Propaganda + The “R-Word” + More | Side Scrollers

152K15 -

16:38

16:38

Nikko Ortiz

17 hours agoVeteran Tactically Acquires Everything…

34.4K2 -

20:19

20:19

MetatronHistory

2 days agoThe Mystery of Catacombs of Paris REVEALED

24.1K3