Premium Only Content

Income Averaging For IRS Offer In Compromise - How It Works, Using It To Your Advantage

Here we go through #IRS Offer In Compromise income and expense averaging. This guide is based on the information located here: https://www.irs.gov/irm/part5/irm_05-008-005r

Things change or might be inconsistent, especially for self-employed taxpayers.

This topic often is not covered in many tax relief consultations, because quite simply many tax relief salespeople (often referred to as Tax Consultants, but are typically not licensed) don't know about it, but it's crucial to your success in many OICs.

You can find our completely free tax help guide here: https://trp.tax/taxhelp/

Our guide on how to do your own OIC here: https://trp.tax/tax-guide/how-to-do-your-own-offer-in-compromise/

Comparing Bankruptcy vs Offer In Compromise: https://trp.tax/tax-guide/bankruptcy-or-offer-in-compromise/

You can get help from one of our expert tax attorneys by calling us at (888) 515-4829 or scheduling a consultation at https://trp.tax/start/

-

9:13

9:13

TaxResolutionProfessionals

3 years agoOffer In Compromise Formula: How The IRS Calculates Tax Settlements

13 -

6:43

6:43

TaxResolutionProfessionals

3 years agoHow Do I File My Offer In Compromise With The IRS?

13 -

4:16

4:16

TaxResolutionProfessionals

3 years agoIRS vs FTB Offer In Compromise: The Similarities, The DIfferences

29 -

10:59

10:59

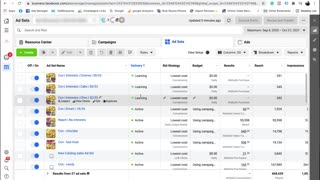

Generate Income Online Using Facebook Ads

3 years agoHow To Generate Income Online Using Facebook Ads | Video #48 Understand Your Stats

46 -

12:10

12:10

Generate Income Online Using Facebook Ads

3 years agoHow To Generate Income Online Using Facebook Ads | Video #26 Naming Your Campaigns

93 -

LIVE

LIVE

IrishBreakdown

4 hours agoNotre Dame and Miami Set To Reignite Intense Rivalry

298 watching -

1:57:07

1:57:07

The Charlie Kirk Show

2 hours agoChicago Next! + The Blue Slip Problem | Sen. Tuberville, Alex Clark | 8.25.2025

54.3K14 -

1:20:52

1:20:52

Benny Johnson

4 hours ago🚨Trump LIVE Now: Signs Executive Order ENDING Cashless Bail | Dem Cities PANIC, Which City NEXT?...

68.1K52 -

1:31:26

1:31:26

The White House

5 hours agoPresident Trump Signs Executive Orders, Aug. 25, 2025

46.3K21 -

1:36:43

1:36:43

The Mel K Show

3 hours agoMORNINGS WITH MEL K - Starving the Globalist Funded Color Revolution in America 8-25-25

20.5K10