Premium Only Content

How To Get An Offer In Compromise From The IRS - Detailed Instructions for Latest Forms Used In 2021

An IRS Offer In Compromise is a tax settlement for less than the balance owed. Here we go through the disqualifications for an IRS Offer and the forms needed to complete it.

Please note: The IRS still is using the 2020 version of forms we cover in this video for 2021.

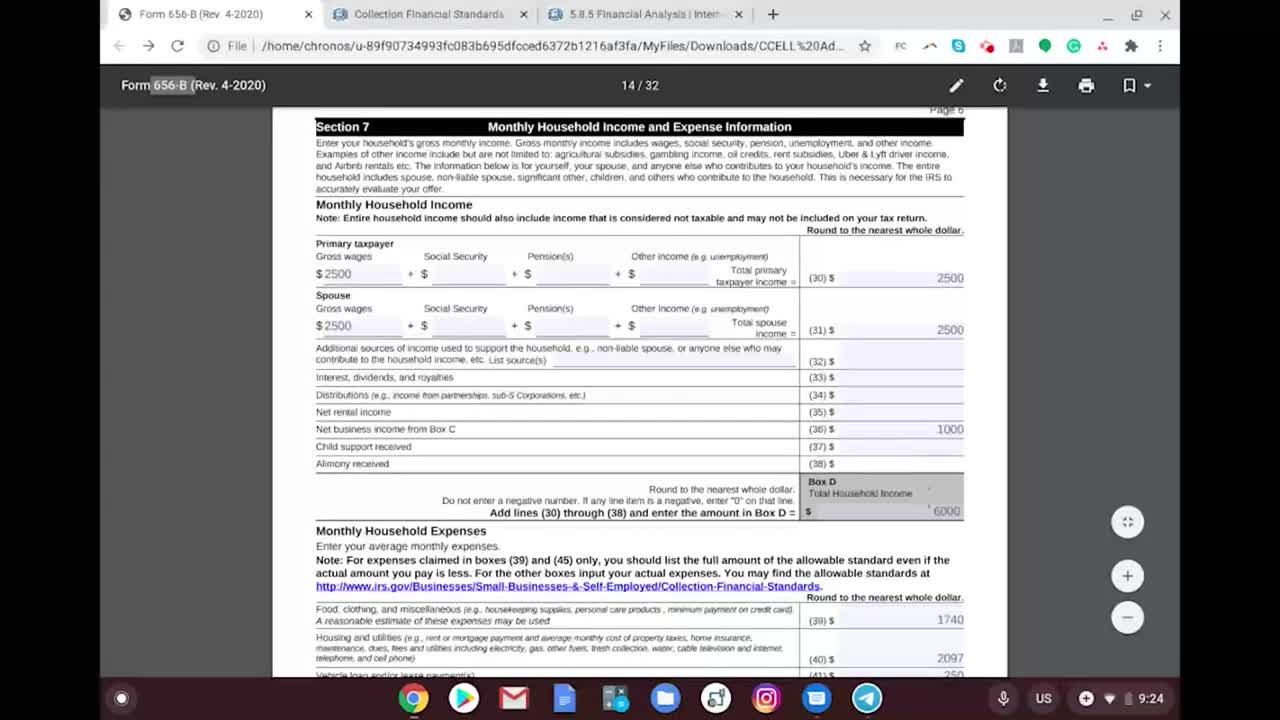

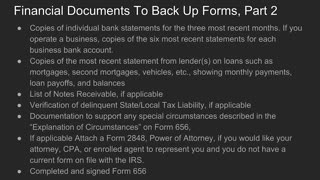

This guide includes instructions on the 2020 Offer In Compromise forms for Wage Earners and Self Employed Individuals. The forms covered are Form 433-A(OIC) and Form 656. These both can be found in the Form 656 Booklet that you can download here:

https://www.irs.gov/pub/irs-pdf/f656b.pdf

You can see our full webpage version of the Offer In Compromise Guide with forms here:

https://trp.tax/tax-guide/how-to-do-your-own-offer-in-compromise/

The written guide on filling our IRS Form 656 is here:

https://trp.tax/tax-guide/how-to-fill-out-irs-form-656/

The written guide on filling our IRS Form 433-A(OIC) is here:

https://trp.tax/tax-guide/how-to-fill-out-form-433-a-oic/

Send all correspondence with the IRS by certified mail with return receipt.

This information is not legal advice, just our attempt to give out as much free data as possible to help those that cannot afford a tax attorney and anyone to better understand the process. Consult with a tax attorney for your best options and legal advice.

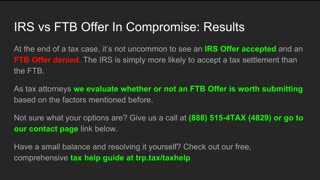

Seem too confusing and you owe over $20,000? Call us at (888) 515-4829 for a consultation with one of our tax attorneys. You can also schedule an appointment directly here:

https://trp.tax/new-client-intake/

This guide is not legal advice. Submit settlement at your own risk.

-

9:13

9:13

TaxResolutionProfessionals

3 years agoOffer In Compromise Formula: How The IRS Calculates Tax Settlements

13 -

6:43

6:43

TaxResolutionProfessionals

3 years agoHow Do I File My Offer In Compromise With The IRS?

13 -

4:16

4:16

TaxResolutionProfessionals

3 years agoIRS vs FTB Offer In Compromise: The Similarities, The DIfferences

29 -

1:33

1:33

TaxResolutionProfessionals

3 years ago5 Tips For Offer In Compromise Success by a Tax Attorney

33 -

2:25

2:25

KMTV

4 years agoLatest update from 3 News Now | May 7, 2021 | 5 PM

28 -

1:33:40

1:33:40

Mally_Mouse

9 hours agoLet's Hang!! - P.O. Box & Chill - WE HIT 10,000!!!

9.98K3 -

Playback Request Live

1 hour agoFrom Myspace to Rumble: Supmikecheck in the Creator Spotlight

2.8K1 -

LIVE

LIVE

Geeks + Gamers

30 minutes agoGeeks+Gamers Play- MARIO KART WORLD!

95 watching -

LIVE

LIVE

Clenzd Gaming

41 minutes agoDad Ranked Grind

7 watching -

31:34

31:34

Friday Beers

3 hours ago $0.36 earnedOur Horrifying Night Drunk Ghost Hunting the Manson Murders

11K6