Premium Only Content

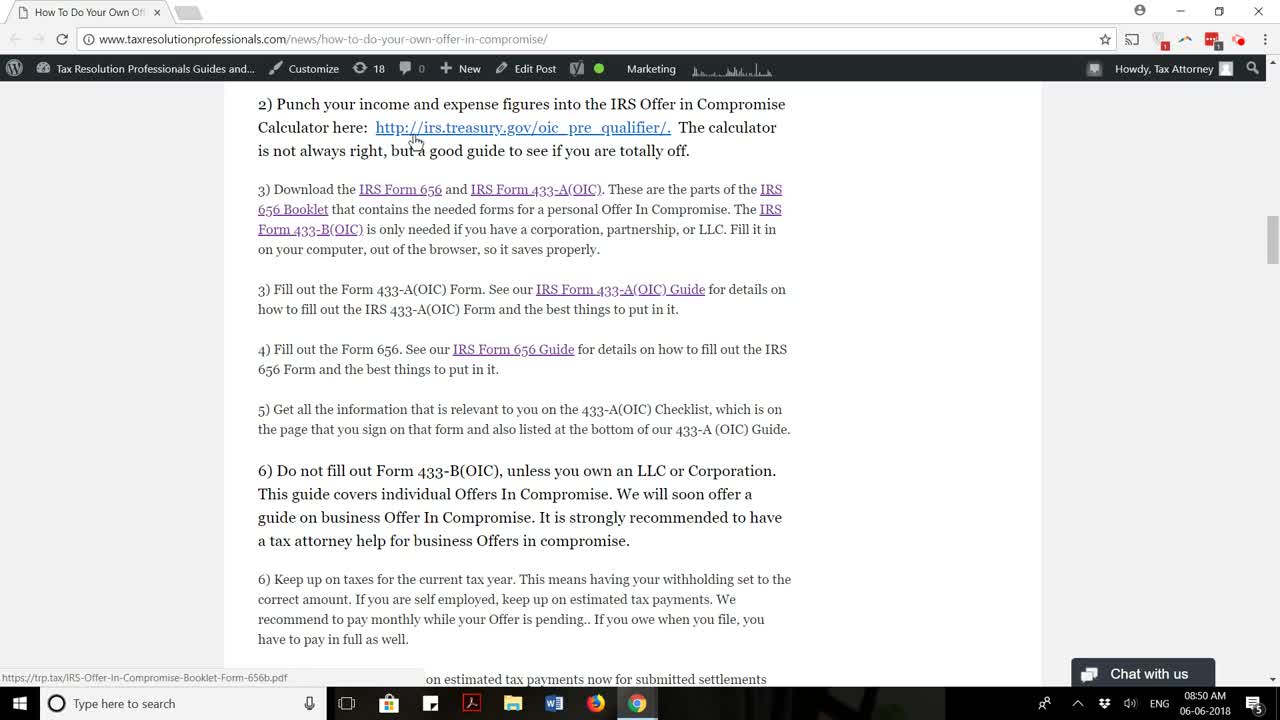

How To Get An Offer In Compromise From The IRS - Detailed Instructions

UPDATE: The new April 2020 OIC forms are out, see our updated guide here:

An IRS Offer In Compromise is a tax settlement for less than the balance owed. Here we go through the disqualifications for an IRS Offer and the forms needed to complete it. We used this same method to recently settle $245,000 of tax debt for $100!

You can see the full Offer In Compromise Guide with forms here:

https://trp.tax/tax-guide/how-to-do-your-own-offer-in-compromise/

The written guide on filling our IRS Form 656 is here:

https://trp.tax/tax-guide/how-to-fill-out-irs-form-656/

The written guide on filling our IRS Form 433-A(OIC) is here:

https://trp.tax/tax-guide/how-to-fill-out-form-433-a-oic/

Send all correspondence with the IRS by certified mail with return receipt.

This information is not legal advice, just our attempt to give out as much free data as possible to help those that cannot afford a tax attorney and anyone to better understand the process. Consult with a tax attorney for your best options and legal advice.

Seem too confusing and you owe over $20,000? Call us at (888) 515-4829 for a consultation with one of our tax attorneys.

This guide is not legal advice. Submit settlement at your own risk.

-

1:33

1:33

TaxResolutionProfessionals

4 years ago5 Tips For Offer In Compromise Success by a Tax Attorney

33 -

40:58

40:58

AriStoneArt

4 years ago $0.03 earnedDIY Plexiglass Kits - Detailed Step by Step Instructions

7681 -

8:28

8:28

Dough2go

4 years agoDOUGH-TO-GO instructions

65 -

LIVE

LIVE

The Quartering

34 minutes agoSpam Calls Are Out Of Control, Candace Hits Rock Bottom & More Poison Food

1,207 watching -

47:44

47:44

Tucker Carlson

38 minutes agoRupert Lowe Warns of the Globalist Agenda Destroying the West and the Revolution Soon to Come

3.7K9 -

2:04:26

2:04:26

The Culture War with Tim Pool

2 hours agoWoke Has INFECTED Goth, Punk, & Metal, MAGA Must Save the Art | The Culture War Podcast

85.3K22 -

1:12:25

1:12:25

Steven Crowder

2 hours agoCNN Declares J6 Pipe Bomber White & Nick Fuentes Interview Reaction

210K164 -

LIVE

LIVE

Dr Disrespect

2 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - FREE LOADOUT EXPERT

1,202 watching -

LIVE

LIVE

Rebel News

1 hour agoPublic Safety reviewing gun grab, Migrant offenders getting lighter sentences | Rebel Roundtable

302 watching -

18:38

18:38

The Illusion of Consensus

1 hour ago“Those are FIGHTING words” – Dave Smith SNAPS at Alex Over Holocaust Denial Accusations