Premium Only Content

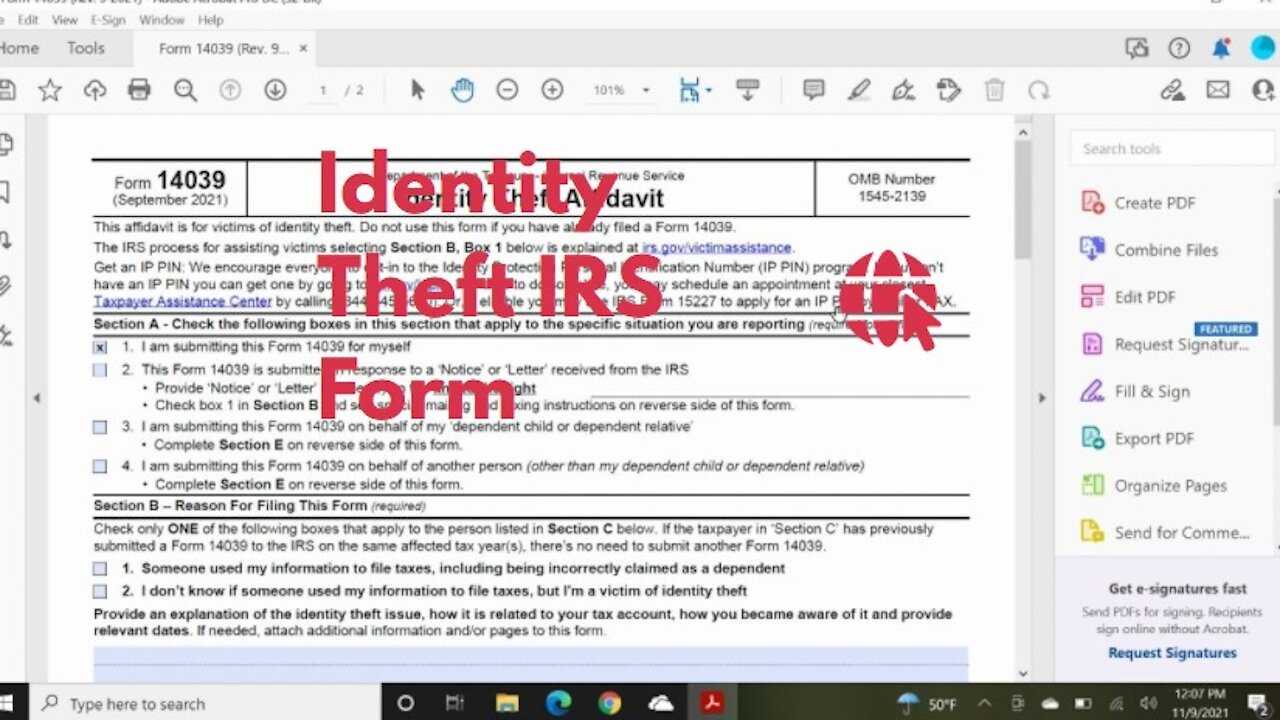

Identity Theft IRS Form - How To File IRS Identity Theft Affidavit Form 14039

Here we go over doing the form for an Identity Theft claim with the IRS.

It should be noted that a lot of the time you will get a notice from the IRS asking you to confirm your identity and you do not need to file this form.

If the IRS has not sent you a letter regarding your identity theft situation or if you were instructed to do so by an IRS agent, you should fill out Form 14039 which you can get here:

https://www.irs.gov/pub/irs-pdf/f14039.pdf

We strongly recommend to use USPS Certified Mail with Return Receipt if you are mailing your documentation. The current mailing address , if you are not sending the form with a tax return at the time of this video is:

Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0025

If you are sending your tax return with the form, send it to where you normally file.

If you are faxing in your claim, the fax number at the time of this video is:

(855) 807-5720

To get help with your tax case,, call us at (888) 515-4829 or go to:

trp.tax/start

If you are doing your case yourself, check out our free tax help guide at:

trp.tax/taxhelp

#taxes #identitytheft #irs

-

3:56:44

3:56:44

Alex Zedra

12 hours agoLIVE! Trying to get achievements in Devour

164K24 -

2:00:43

2:00:43

The Quartering

15 hours agoThe MAGA Wars Have Begun! Vivek & Elon Get Massive Backlash & Much More

175K71 -

1:25:53

1:25:53

Kim Iversen

3 days agoStriking Back: Taking on the ADL’s Anti-Free Speech Agenda

118K96 -

49:35

49:35

Donald Trump Jr.

18 hours agoA New Golden Age: Countdown to Inauguration Day | TRIGGERED Ep.202

222K202 -

1:14:34

1:14:34

Michael Franzese

17 hours agoWhat's Behind Biden's Shocking Death Row Pardons?

86.4K50 -

9:49

9:49

Tundra Tactical

16 hours ago $26.55 earnedThe Best Tundra Clips from 2024 Part 1.

154K12 -

1:05:19

1:05:19

Sarah Westall

16 hours agoDying to Be Thin: Ozempic & Obesity, Shedding Massive Weight Safely Using GLP-1 Receptors, Dr. Kazer

127K35 -

54:38

54:38

LFA TV

1 day agoThe Resistance Is Gone | Trumpet Daily 12.26.24 7PM EST

86.2K13 -

58:14

58:14

theDaily302

1 day agoThe Daily 302- Tim Ballard

79.8K14 -

13:22

13:22

Stephen Gardner

18 hours ago🔥You'll NEVER Believe what Trump wants NOW!!

127K361