Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

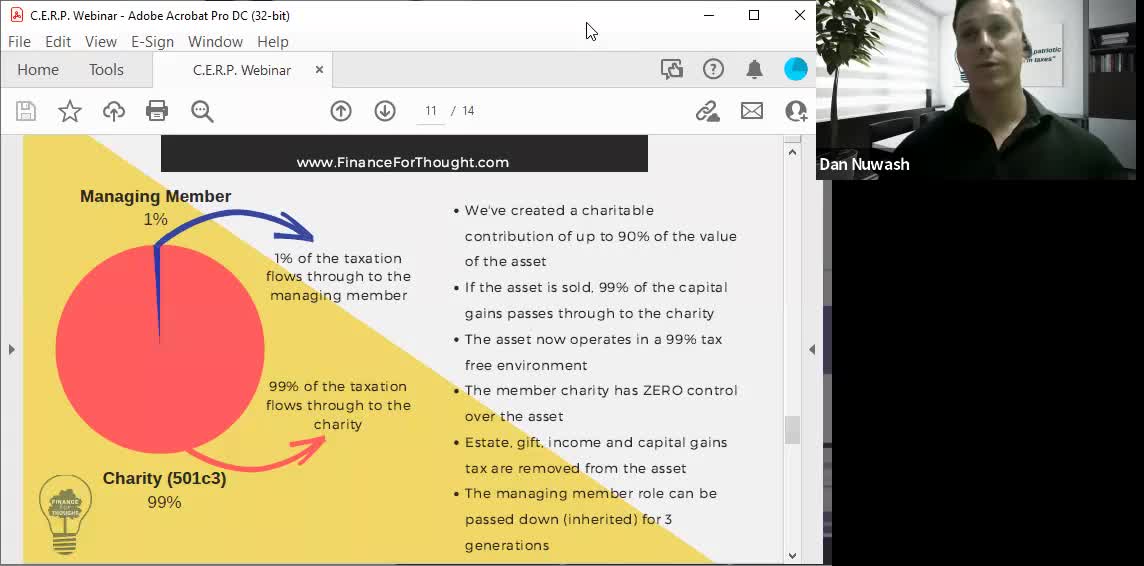

Recorded Webinar: How to Eliminate 99% of Capital Gains Tax Using a C.E.R.P.

3 years ago

14

A Charitable Estate Replacement Plan (CERP) is an advanced and proprietary tax strategy that can provide the following benefits:

-A current income tax deduction which avoids up to 50% of your total tax (with a 5 year carry forward)

-Assets contributed grow without tax

-Appreciated assets contributed can be sold or liquidated without tax

-Assets are exempt from gift and estate tax

-Assets are creditor and divorce protected

-Client and heirs maintain total control over the assets in a C.E.R.P.

-Client and heirs will make substantial charitable gifts to their preferred designated charities

Loading comments...

-

5:48

5:48

One America News Network

3 years agoTipping Point - Stephen Moore - Yellen Proposes Unrealized Capital Gains Tax

1.3K14 -

1:02

1:02

BonginoReport

3 years agoBiden Admin Pitches Taxing Unrealized Capital Gains

37.6K159 -

1:02

1:02

Dinesh D'Souza

3 years agoSec Of The Treasury Wants To Tax Unrealized Capital Gains

4.32K -

2:28

2:28

CredoFinance

3 years agoCapital Gains Taxes on Crypto - Friday Wisdom

25 -

8:36

8:36

China Uncensored

8 hours agoIs China’s EV Industry Collapsing?

138K110 -

4:17:00

4:17:00

Tundra Tactical

1 day ago $24.07 earnedSHOT SHOW 2025!!!!!! Whats Are We Looking Forward To Most

209K30 -

22:53

22:53

Film Threat

1 day agoA TRIBUTE TO VISIONARY DIRECTOR DAVID LYNCH | Film Threat News

78K8 -

20:30

20:30

Exploring With Nug

1 day ago $5.78 earnedMissing Father of 2 FOUND Underwater In Shallow Pond!

59.3K11 -

19:19

19:19

This Bahamian Gyal

1 day agoThe View PRAISES Michelle Obama for DITCHING TRUMP inauguration, "when they go LOW, go even LOWER"

49.9K59 -

14:25

14:25

Degenerate Jay

1 day ago $8.61 earnedThe Flash Movie Failed Because People Hate The Character? Sure.

140K19