Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Recorded Webinar: How to Eliminate 99% of Capital Gains Tax Using a C.E.R.P.

3 years ago

14

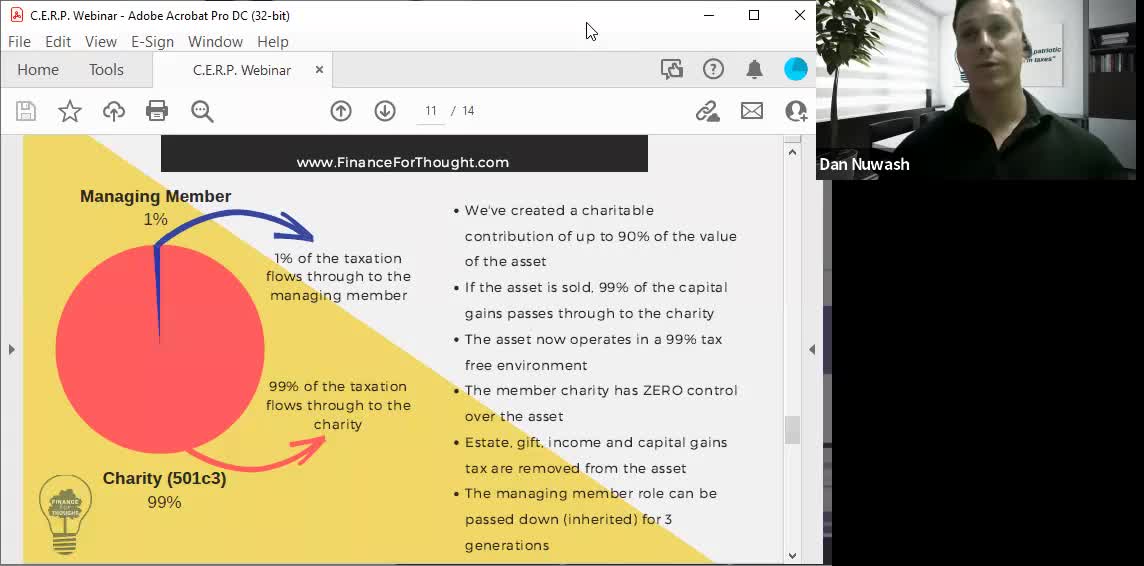

A Charitable Estate Replacement Plan (CERP) is an advanced and proprietary tax strategy that can provide the following benefits:

-A current income tax deduction which avoids up to 50% of your total tax (with a 5 year carry forward)

-Assets contributed grow without tax

-Appreciated assets contributed can be sold or liquidated without tax

-Assets are exempt from gift and estate tax

-Assets are creditor and divorce protected

-Client and heirs maintain total control over the assets in a C.E.R.P.

-Client and heirs will make substantial charitable gifts to their preferred designated charities

Loading comments...

-

5:48

5:48

One America News Network

3 years agoTipping Point - Stephen Moore - Yellen Proposes Unrealized Capital Gains Tax

1.31K14 -

1:02

1:02

BonginoReport

3 years agoBiden Admin Pitches Taxing Unrealized Capital Gains

37.6K159 -

1:02

1:02

Dinesh D'Souza

3 years agoSec Of The Treasury Wants To Tax Unrealized Capital Gains

4.32K -

2:28

2:28

CredoFinance

4 years agoCapital Gains Taxes on Crypto - Friday Wisdom

34 -

2:01:39

2:01:39

Tundra Tactical

6 hours ago $3.50 earned🛑LIVE NOW!! This spits in the face of the Second Amendment.🛑

22K1 -

2:34:46

2:34:46

DLDAfterDark

4 hours ago $0.80 earnedIt's SHTF! Do You Have What You Need?? Let's Review Items & Priorities

15.4K4 -

28:58

28:58

Stephen Gardner

6 hours ago🚨Explosive allegations: Rosie O’Donnell connects Trump to Epstein scandal!?

27.7K55 -

LIVE

LIVE

SavageJayGatsby

2 days agoSpicy Saturday | Let's Play: Grounded

400 watching -

2:06:27

2:06:27

MattMorseTV

7 hours ago $46.64 earned🔴Vance just went SCORCHED EARTH.🔴

125K179 -

46:41

46:41

The Mel K Show

12 hours agoMel K & Corey DeAngelis | The Hopelessly Captured Teacher’s Unions: Biggest Threat to Our Children & Future | 9-6-25

34.6K5