Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Recorded Webinar: How to Eliminate 99% of Capital Gains Tax Using a C.E.R.P.

4 years ago

14

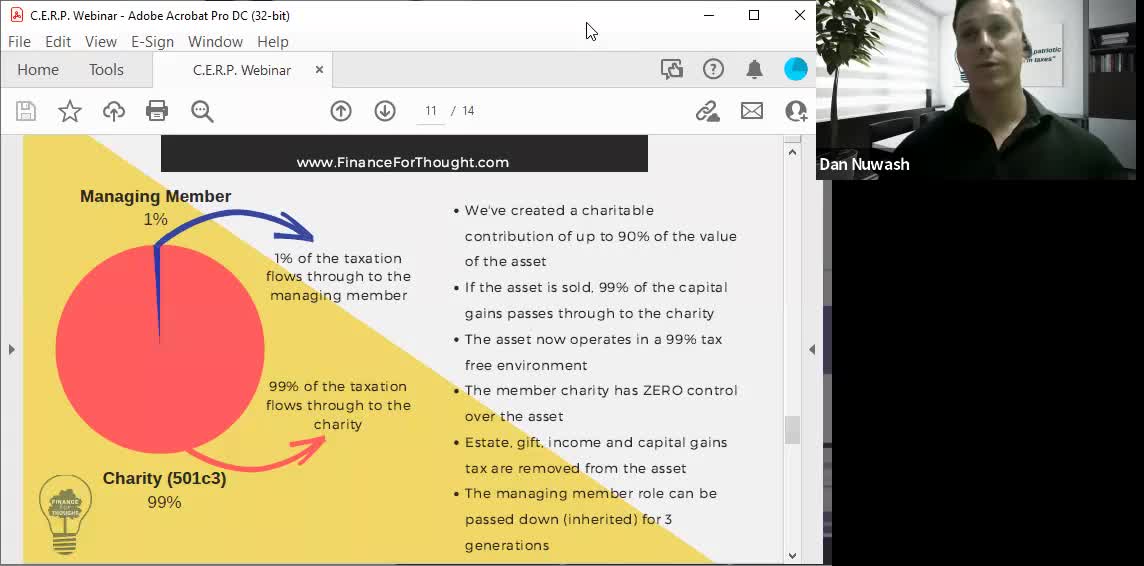

A Charitable Estate Replacement Plan (CERP) is an advanced and proprietary tax strategy that can provide the following benefits:

-A current income tax deduction which avoids up to 50% of your total tax (with a 5 year carry forward)

-Assets contributed grow without tax

-Appreciated assets contributed can be sold or liquidated without tax

-Assets are exempt from gift and estate tax

-Assets are creditor and divorce protected

-Client and heirs maintain total control over the assets in a C.E.R.P.

-Client and heirs will make substantial charitable gifts to their preferred designated charities

Loading comments...

-

5:48

5:48

One America News Network

4 years agoTipping Point - Stephen Moore - Yellen Proposes Unrealized Capital Gains Tax

1.31K14 -

1:02

1:02

BonginoReport

4 years agoBiden Admin Pitches Taxing Unrealized Capital Gains

37.6K159 -

1:02

1:02

Dinesh D'Souza

4 years agoSec Of The Treasury Wants To Tax Unrealized Capital Gains

4.32K -

2:28

2:28

CredoFinance

4 years agoCapital Gains Taxes on Crypto - Friday Wisdom

36 -

15:51

15:51

Upper Echelon Gamers

7 hours ago $1.27 earned"INFLUENCERS" - House of LIES

9.96K2 -

1:29:23

1:29:23

Glenn Greenwald

8 hours agoMarco Rubio, Europe Thwart Ukraine Peace Deal; NSA Illegally Leaks Steve Witkoff's Diplomatic Calls; Bari Weiss's Comically Out of Touch Plan for CBS | SYSTEM UPDATE #550

149K90 -

51:15

51:15

State of the Second Podcast

10 hours agoCan You Trust Paid Gun Reviews? (ft. Tactical Advisor)

31.2K3 -

8:56

8:56

MetatronGaming

8 hours agoSuper Nintendo NA vs PAL

36.7K8 -

20:02

20:02

Scammer Payback

10 hours agoHijacking a Scammer Group's Live Video Calls

16.1K4 -

3:18:30

3:18:30

Nikko Ortiz

8 hours agoArc Raiders 1st Gameplay... | Rumble LIVE

43.2K2