Tax-Advantaged Investing With a Health Savings Account - with Darlene Root

Learn about how to use a health savings account (HSA), a tax-advantaged medical savings account available to taxpayers in the United States as an investment vehicle with Jason Hartman and special guest Darlene Root. They will also discuss the tax advantages of traditional, self directed and Roth IRAs and why Jason never converted his plan to a Roth IRA.

0:00 Introduction

1:14 How you can use the HSA, the health savings account as an investment vehicle to buy real estate and other investments

1:56 There are two tax systems, one for the informed and one for the uninformed

5:40 So let's take advantage of every tax saving opportunity we can. Inflation as you know is a hidden tax

7:51 33% of Americans have no retirement savings whatsoever

8:46 Social Security is going down, the average check is $1400 and change per month

10:10 Healthcare is going to be about 15% of the average retirees annual expense and unlike my parents generation, I won't have access to employer or union sponsored retiree benefits

11:12 Let's talk about some of the tax advantaged, tax free and tax deferred methods, the self directed IRA, the traditional IRA which is tax deferred, the 401k also tax deferred and then the 401k Roth and CEP

12:15 HSA stands for health savings account - it's the trifecta of investing: your contribution gets a tax write off, it is tax free investing while it's in your HSA and when you take it out, it's tax free

16:22 The contribution limits for an HSA are small, $3600 if you are single, $7200 if you are a family, and catch up is $1,000, if you're 55 years or older

17:13 The contributions are tax free, invested tax free and taken out tax free, but they have to be for qualified medical expenses

21:01 You can liquidate the plan with a penalty

21:59 You can do basically any type of investment in an HSA that you can do in a self directed IRA

24:53 You can partner with your non IRA money, your other retirement accounts and other people's retirement accounts

28:00 I made 90k in rental income tax free

29:19 You can purchasing discounted notes in the Roth IRA and HSA

30:30 I have never converted my plan to a Roth, because I'm worried they'll just change the rules

31:06 When you open up a traditional IRA, you get a tax write off with the money going in and taxes deferred upon it coming out

Learn More: https://www.jasonhartman.com/

Listen to the podcast: https://www.jasonhartman.com/podcast/

Find us on other video platforms:

Rumble: https://www.jasonhartman.com/rumble

BitChute https://www.jasonhartman.com/bitchute

Odysee https://www.jasonhartman.com/odysee

Have questions or topics you want me to do a video on? Let us know in the comments below. If you love real estate investing, SUBSCRIBE!

#healthsavingsaccount #rothira #ira #retirementplan #savings

-

12:44

12:44

Florida Stacker

2 years ago $0.01 earnedBuild a Savings Account with 90% Silver Coins | Episode 4

48 -

19:42

19:42

Florida Stacker

2 years agoBuild a Savings Account with 90% Silver Coins | Episode 3

44 -

19:23

19:23

Florida Stacker

2 years agoBuild a Savings Account with 90% Silver Coins | Episode 2

69 -

16:28

16:28

Florida Stacker

2 years ago $0.07 earnedBuild a Savings Account with 90% Silver Coins | Episode 1

113 -

8:39

8:39

LeftRightOut Podcast

2 years agoYour savings account is robbing you!

80 -

6:10

6:10

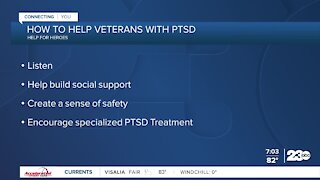

KERO

2 years agoVeterans struggle with mental health

72 -

6:00

6:00

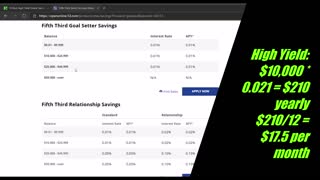

AustinOSU

3 years agoPassive income with a high yield savings account

253 -

3:43

3:43

WMAR

2 years agoHome Energy Savings with Egypt Sherrod

6 -

2:15

2:15

WTMJMilwaukee

2 years agoHelping students with mental health

21 -

1:49

1:49

WKBW

2 years agoMore schools in WNY investing in mental health

11