Premium Only Content

Free Stock Market Course Part 10: Using Margin

Free File downloads

Course notes, Audio files, Assessments, Transcript files, and Course Outline: https://spxinvestingblog.com/downloads/

My Exclusive Free Workshop: The Four P's of Building a Successful Investing Program → https://spxinvesting.mailchimpsites.com

Blog: https://spxinvestingblog.com

Facebook Group: https://www.facebook.com/groups/43384...

Margin Spreadsheet: https://breakingdownfinance.com/finan...

Finra.org: https://www.finra.org/#/

Chapters:

Using Margin to Buy Stocks

Margin

Margin allows for leverage.

Leverage is the ability to control an asset without having all of the required funds available.

Credit, installment loans, and mortgages are forms of leverage.

An asset is allowed to be controlled with an amount of capital much less than the value of the asset.

Margin Requirements

How long an investment is held (either long or short) will determine how margin requirements are calculated.

By default, many brokerages establish margin accounts when an account is opened.

Margin allows funds or stocks to be used as collateral to borrow additional funds.

Since 1974 in the US, the margin rate set by law is 50%.

This allows for 2:1 leverage.

Interest rates are typically low since the loan is fully collateralized.

A stock mut have a price above $5 per share. A stock can lose the ability to be margined.

Margin Rates

Listed below are the current margin rates for Charles Schwab (October, 2021):

Calculating Interest

If $10,000 is borrowed and held for one year:

Interest = $382.50

Interest is debited from an account.

Usually calculated daily:

Divide by 360.

$382.50/360 = $1.0625 per day

Please note that the use of a 360-day year results in a higher effective rate of interest than if a year of 365 days were used.

If held for 30 days = $31.875 Each month is considered to be 30 days.

Uses of Margin

Margin is typically used to buy additional shares of stock.

However, margin can be used for other reasons.

If obtaining a personal bank loan is not desirable or a viable alternative, using a margin loan may be considered.

Why?

Lower interest

More control

Repayment convenience

Interest may be tax deductible

When buying stocks in a margin account, any excess above your cash value used for purchases will be borrowed automatically, up to your available limit.

When it is desired to NOT use margin, don’t exceed the value you deposited.

Two-Edged Sword

Margin can be wonderful if profits are experienced.

Margin can be detrimental if losses are realized.

Regardless of how an investment performs, all borrowed money must be repaid.

Maintenance Margin

There are two types of margin:

1. Initial Margin (50%)

2. Maintenance Margin (25-40%)

Once a stock has been purchased, the account must maintain a certain value level.

If this level is exceeded, this will produce a Margin Call.

To fix this problem:

Sell stocks

Deposit more money

As a rule of thumb, in a fully margined account, a percentage loss will double.

A 5% decline will result in a 10% loss.

Calculating Maintenance Margin

Brokerage firms can vary in the percentage required in a margin account. By law, it is 25% but a broker can increase this amount.

This can be 25%-40%.

Spreadsheet

Risk Assessment

Each Investor must determine if using margin is appropriate for them.

The advantages and disadvantages must be weighed.

It is also necessary to control fear and greed when deciding what to do.

Margin only applies to brokerage accounts. If using Mutual Funds, margin is not used.

Margin Account Needed?

There may be instances when an investor does not wish to use margin to purchase stocks.

However, a margin account may be required if more advanced strategies are to be implemented.

This can include buying or selling options.

It may be desired to set up an account that does not purchase investments using margin but still allows for advanced strategies to be implemented.

Margin Agreements and Disclosures

If a customer trades stocks in a margin account, the customer needs to carefully review the margin agreement provided by the firm.

A firm charges interest for the money it lends its customers to purchase securities on margin, and a customer needs to understand the additional charges that may be incurred by opening a margin account.

Under the federal securities laws, a firm that loans money to a customer to finance securities transactions is required to provide the customer with a written disclosure of the terms of the loan, such as the rate of interest and the method for computing interest.

The firm must also provide the customer with periodic disclosures informing the customer of transactions in the account and the interest charged to the customer.

FINRA.ORG

view_moduleinsert_charttrending_up

-

6:01

6:01

The SPX Investing Program

2 days agoDaily Update Podcast for Wednesday October 15, 2025

31 -

21:15

21:15

The SPX Investing Program

4 years ago $0.01 earnedFree Stock Market Course. Part 6: ETFs

346 -

4:19

4:19

Fanatical Finance

4 years agoUnderstanding the Stock Market Part 2! | What is the Stock Market?

725 -

8:17

8:17

The Phil's Gang Radio Show Channel

4 years agoStock market crash starting to unfold part 22

66 -

8:51

8:51

The Phil's Gang Radio Show Channel

4 years agoStock market crash starting to unfold part 16

32 -

7:06

7:06

The Phil's Gang Radio Show Channel

4 years agoStock market crash starting to unfold part 13

21 -

2:56:34

2:56:34

Side Scrollers Podcast

18 hours agoTwitch PROMOTES DIAPER FURRY + Asmongold/Trans CONTROVERSY + RIP Itagaki + More | Side Scrollers

40.1K6 -

23:30

23:30

GritsGG

14 hours agoThis Burst AR Still SLAMS! BR Casual Solos!

6.42K1 -

1:27:43

1:27:43

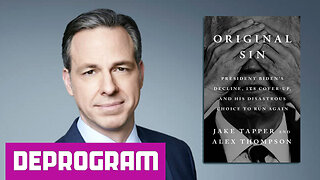

DeProgramShow

3 months agoEXCLUSIVE on DeProgram: “A Live Interview with Jake Tapper”

3.81K2 -

1:25:15

1:25:15

The HotSeat

13 hours agoHere's to an Eventful Weekend.....Frog Costumes and Retards.

9.43K8