Premium Only Content

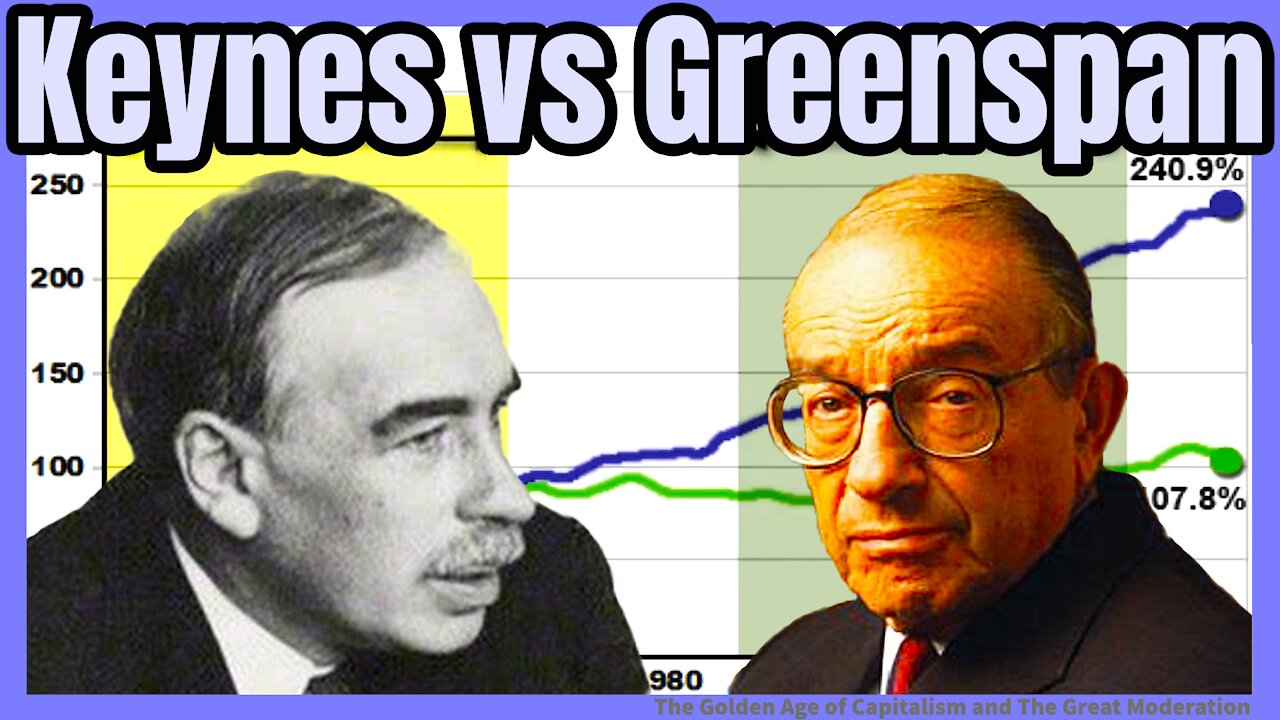

The Myth of the Great Moderation: Keynes vs Greenspan | Economics 🏘️📈

The Great Moderation is a period starting from the mid-1980s until 2007 characterized by the reduction in the volatility of business cycle fluctuations in developed nations starting compared with the decades before. It is believed to be caused by institutional and structural changes, particularly in central bank policies, in the second half of the twentieth century.

During the Great Moderation, real wages and consumer prices stopped increasing and remained stable, while interest rates reversed their upward trend and started to fall. The period also saw a large increase in household debt and economic polarization, as the wealth of the rich grew substantially, while the poor and middle class went deep into debt.

And then in 2008 the economy crashed and the global finanacial sector imploded. This video shows us why.

Chapters:

00:00 Financial crisis

00:16 Historical GDP growth

00:32 Golden Age of Capitalism vs The Great Moderation

00:56 Real hourly compensation vs net productivity

01:11 Wages vs Corporate Profits

01:23 Wages vs Household Debt

01:45 US Trade Deficit / Surplus

01:57 Sectoral (financial) balances

02:23 Finance vs Manufacturing: % of domestic profits

02:35 Household Debt vs Credit Availability

02:57 Income Inequality in the US, 1910 - 2010

03:15 Income Distribution in the US; bottom 90% vs top .01%

04:56 Keynesian Economic policies and solutions

Data:

FRED | Federal Reserve Economic Data | St Louis Fed

https://fred.stlouisfed.org/

#MMT #economics #keynes #inquality #greenspan #economy

what was the great moderation, macro economics, alan greenspan, john maynard keynes, keynes vs greenspan, economic inequality, keynesian economincs, trickle down economics, monetarism, MMT, neoliberalism, deficits, economics, what is modern monetary theory, what is modern money theory, loans create deposits, federal reserve bank, the fed, fiat money, money creation, great moderation explained

-

0:23

0:23

Data Ninja

3 years agoTax-to-GDP Ratio: Comparing Tax Systems Around the World 💰📊

971 -

0:33

0:33

GODSFAVOR

3 years agoGreat faith

136 -

LIVE

LIVE

StoneMountain64

2 hours agoBATTLEFIELD 6 BETA Training and Prepping

462 watching -

1:15:15

1:15:15

Awaken With JP

2 hours agoArrest Warrants for Dems, MSNBC Sucks, and More - LIES Ep 103

12.8K10 -

LIVE

LIVE

The HotSeat

11 minutes agoIf I Were The Devil: Part I

168 watching -

UPCOMING

UPCOMING

The Tom Renz Show

43 minutes agoBurn Bags - Epstein Story is Back On Top (No Pun Intended)

13 -

![[Ep 721] DOJ: Grand Jury on Russiagate | Rogue TX Dems - FAFO | Sam Anthony – [your]NEWS](https://1a-1791.com/video/fww1/39/s8/1/u/i/K/8/uiK8y.0kob.1-small-Ep-721-DOJ-Grand-Jury-on-Ru.jpg) UPCOMING

UPCOMING

The Nunn Report - w/ Dan Nunn

54 minutes ago[Ep 721] DOJ: Grand Jury on Russiagate | Rogue TX Dems - FAFO | Sam Anthony – [your]NEWS

12 -

1:58:54

1:58:54

The Charlie Kirk Show

3 hours agoThe Obamagate Grand Jury + The Mamdani/Warren Alliance | Prof. Steele, Brand | 8.5.2025

53.4K25 -

1:20:03

1:20:03

Sean Unpaved

3 hours agoNFL Coaching Edge: Top Staffs, Rookie Head Coaches, & NFC South Breakdown

23.5K -

LIVE

LIVE

Viss

4 hours ago🔴LIVE - Adrenaline Infused PUBG Tactics The Get Wins! - PUBG

248 watching