Premium Only Content

PPP Loan Forgiveness–Finney Law Firm Discusses the Rules

Several weeks ago, Finney Law Firm (FLF) did a webinar for EmpowerU on the relief offered to small business and self-employed under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). One of the main focuses of that webinar was the Paycheck Protection Program (PPP), which offers forgivable loans to small businesses. Since that time, over 4.5 million companies have received PPP loans totaling over $510 Billion. And, approximately $100 Billion in funding for PPP loans remains unused.

If you are one of the small businesses or self-employed that received a PPP loan (or if you are considering applying for one), you’ve likely been wrestling with questions on how to make sure your loan is forgiven. The SBA has now provided significant additional guidance on PPP loan forgiveness, including, for example:

New rules on what payroll counts toward forgiveness

New rules on what you can spend PPP funds on other than payroll

New rules on when you must spend PPP funds

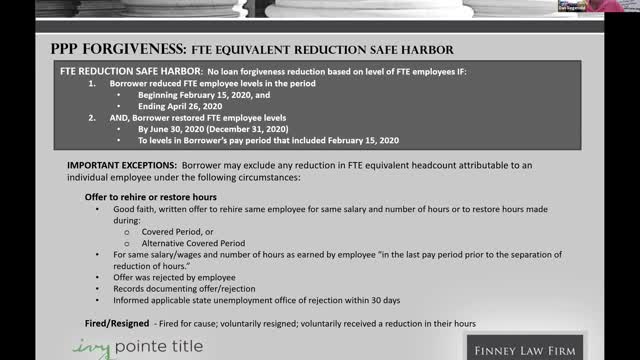

How you calculate your reduction in loan forgiveness if you decrease employees and/or compensation (including safe harbors that help preserve PPP forgiveness)

And, Congress is considering changing the rules to allow more time and flexibility in spending the funds. In this webinar, FLF will outline these new rules and the potential changes, and how to maximize your PPP loan forgiveness.

Even for small businesses that received a PPP loan, that loan is likely not the only assistance needed to survive and thrive in this changing economy. One of the lessons learned over the last several weeks is that the economic impacts of the COVID 19 pandemic are likely longer lasting and more far reaching than we originally imagined. Recognizing this reality, FLF has launched a Small Business Solutions Group, https://finneylawfirm.com/practice-areas/small-business-solutions-group/

Tuesday, June 9, the presenters will explain the the importance of how to get your PPP Loan forgiven by your financial institution and the SBA. If you have a PPP Loan don’t miss this class.

Recorded on June 9th, 2020

Learn about EmpowerU and more at empoweruamerica.org

-

1:15:08

1:15:08

EmpowerUAmerica

3 months agoDanger of COVID mRNA Vaccines with Dr. Robert Malone and Stephanie DeGaray

834 -

2:23

2:23

KERO

4 years agoElection Department discusses rules and regulations for voters at polls

23 -

2:40

2:40

The Daily Caller

4 years agoJoey Jones discusses Afghanistan withdrawal

8.41K5 -

1:06:17

1:06:17

Mike Rowe

20 hours agoThe Mastermind Behind THIS Radical Idea At WSU Tech | Sheree Utash #448 | The Way I Heard It

93.6K14 -

1:29:13

1:29:13

I_Came_With_Fire_Podcast

13 hours agoAncient Egypt's Tech & the Secret Temples of Malta

8.28K1 -

LIVE

LIVE

GritsGG

3 hours agoWin Streaking! Most Wins 3499+ 🧠

132 watching -

DVR

DVR

Bannons War Room

6 months agoWarRoom Live

34.1M8K -

LIVE

LIVE

ttvglamourx

3 hours ago $0.66 earnedPLAYING WITH VIEWERS !DISCORD

89 watching -

1:21:38

1:21:38

VapinGamers

3 hours ago $1.21 earnedTools of the Trade - EP04 Of Thumbnails and Titles, What's Important? - !rumbot !music

15.9K -

![Mr & Mrs X - [DS] Trafficking Empire – How Epstein Built His Web of Wealth and Deceit:Part 1 - Ep 5](https://1a-1791.com/video/fww1/f0/s8/1/o/k/J/d/okJdz.0kob-small-Mr-and-Mrs-X-DS-Trafficking.jpg) 52:11

52:11

X22 Report

5 hours agoMr & Mrs X - [DS] Trafficking Empire – How Epstein Built His Web of Wealth and Deceit:Part 1 - Ep 5

79.3K23