The Deep State & Budget Politics Part II with Richard Dolan

The deep state is expensive: secret space programs, underground bases, and invisible weaponry require both an enormous investment and ongoing overhead. How do you finance two civilizations using the budget of only one?

Since the passage of the National Security Act in 1947, the national security infrastructure has grown dramatically, funded by a two-tier tax system. One tax is sent to the IRS every April by millions of citizens and companies. The money is then spent without accountability – Since 1998, $21 trillion has disappeared from federal accounts. The other tax is extracted daily by financial fraud, narcotics trafficking and other criminal activities and is combined with the profits of currency debasement, bailouts and invisible skimming throughout the central bank, banking, brokerage, mortgage, and other financial transaction systems. That money is also spent without accountability.

After 9-11, budgetary tensions were exacerbated with a dramatic conversion of our republic into a national security state with exploding budgets managing billions spent on electronic surveillance, manipulation and mind control of both US and global citizens.

When citizens elect new politicians to fix an economy devastated and drained by this financial harvesting, conflict arises. How can the deep state fund its secret cash flows if we stop crime and rebuild our infrastructure and communities?

This conflict is not just a confrontation in Washington. This conflict relates to “full vertical power” because the swamp extends throughout America and networks globally Companies and employees are dependent on the purchases and contracts that flow from this financial machinery and from US military and intelligence dominance throughout the world, in order to extract natural resources globally while enjoying the dollar status as a global reserve currency. In turn, stock market investors depend on dividends and growth that flow from these companies.

New budgets and tax reform raise these issues again. Corporate revenues have exploded as a % of GNP. However, corporate taxes have fallen as a % of both GNP and total IRS tax revenues. Proposed budgets and tax reform propose to keep these two trends diverging with growing military budgets and lower corporate taxes.

Leading author, publisher and scholar Richard Dolan joins me this week to continue our discussion regarding the deep state and the budget that we began this March. (Link to Part I here) We discuss Richards new series on False Flags and how these events are used to craft official narratives that help engineer increased legal and financial control for the national security state and to shift increased resources into the United States. Is the deep state racing to tear up the US Constitution before its deep and hidden system of finance and its mysterious source of privilege are compromised or citizens demand accountability for $21 trillion missing from federal accounts?

-

1:00

1:00

WGBA

2 years agoEvers Signs State Budget

10 -

12:19

12:19

vivafrei

2 years agoThe absolute state of toxic politics

1.96K58 -

1:04

1:04

WFTX

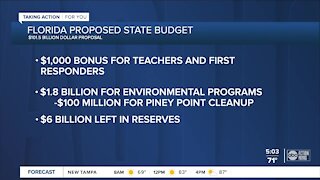

3 years agoDeSantis signs new state budget

22 -

1:17

1:17

WFTS

3 years agoAbout Florida's proposed state budget

271 -

1:35

1:35

WGBA

2 years agoIN DEPTH: Gov. Evers signs state budget

131 -

2:51

2:51

KNXV

2 years agoArizona state senate passes budget

45 -

3:42

3:42

One America News Network

3 years agoNew York State budget crisis

2.2K24 -

1:11

1:11

WGBA

2 years agoIN DEPTH: State budget as it currently stands

8 -

1:20:32

1:20:32

Kimberly Guilfoyle

5 hours agoThe Left’s Attack on the American Dream, Live with Barry Habib & Chadwick Moore Plus Special Appearance by Russell Brand | Ep. 132

13.2K16 -

DVR

DVR

Redacted News

4 hours agoHere we go! Putin WARNS NATO "stop this now" sends Russian NAVY to Cuba | Redacted w Clayton Morris

49.2K150