Premium Only Content

Just A Taste: Precious Metals Market Report with Franklin Sanders

“With the US dollar still in correction mode one would think that commodities would be going through the roof like the precious metals complex but that’s not the case. It appears that everything but the precious metals complex is starting to gather momentum to the downside.“

~ Rambus

This week on the Solari Report, Franklin Sanders of The Moneychanger joins me to take a look at precious metals markets:

How gold and silver performed in 2015…and why.

Performance to date in 2016…could the consolidation finally be over? Or is the current rally temporary as it was in early 2015?

Storage options for gold and silver – subscribers have been sending questions about global and domestic depositories.

Franklin and I will review the likelihood that the primary trend in gold and silver is returning. Franklin has more confidence in the outlook for in 2016. I am concerned that the number of plausible and unpredictable scenarios are growing across all asset classes. So expect a lively discussion!

One thing is certain – the dramatic rise in gold and silver prices in the past two weeks indicates uncertainty across global economies and markets. Below are charts of gold and silver versus the S&P 500 and aggregate bond ETF (AGG) since January 1, 2009. We will post Franklin’s charts in the subscriber area in this post on Thursday. Please make sure you login to access them as you listen to the interview audio. They will be posted in the final transcript.

(click on these images to view full-size versions)

GLD

SLV

In Let’s Go to the Movies, I will review the documentary Going Clear: Scientology and the Prison of Belief :

Thank you for your recommendations for our Money & Markets segment and your questions for Ask Catherine. Keep ’em coming!

Listen to the full interview on solari.com

-

2:42

2:42

Ifranzese

4 years ago $0.05 earnedBuy Precious Metals

3061 -

3:15

3:15

Havanajohn

4 years ago $0.11 earnedPrecious Metals

900 -

2:28

2:28

Havanajohn

4 years ago $0.01 earnedPrecious Metals IRA

573 -

2:56

2:56

scarsProspecting

4 years agoRefining precious metals platinum palladium rhodium

66 -

0:18

0:18

scarsProspecting

4 years agoPouring bars of precious metals

103 -

LIVE

LIVE

Caleb Hammer

13 hours agoMost Batsh*t Insane Woman I’ve Ever Met | Financial Audit

164 watching -

Badlands Media

10 hours agoBadlands Daily: Sept. 8, 2025

37.3K5 -

LIVE

LIVE

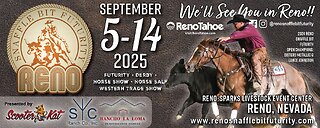

Total Horse Channel

14 hours ago2025 Reno Snaffle Bit Futurity | Monday

58 watching -

2:16:08

2:16:08

Matt Kohrs

14 hours agoNew Highs Incoming?! 🚨🚨🚨 Live Trading Futures & Options

24.2K1 -

LIVE

LIVE

Wendy Bell Radio

6 hours agoALL THE NEWS THAT'S FIT TO IGNORE

6,799 watching