Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

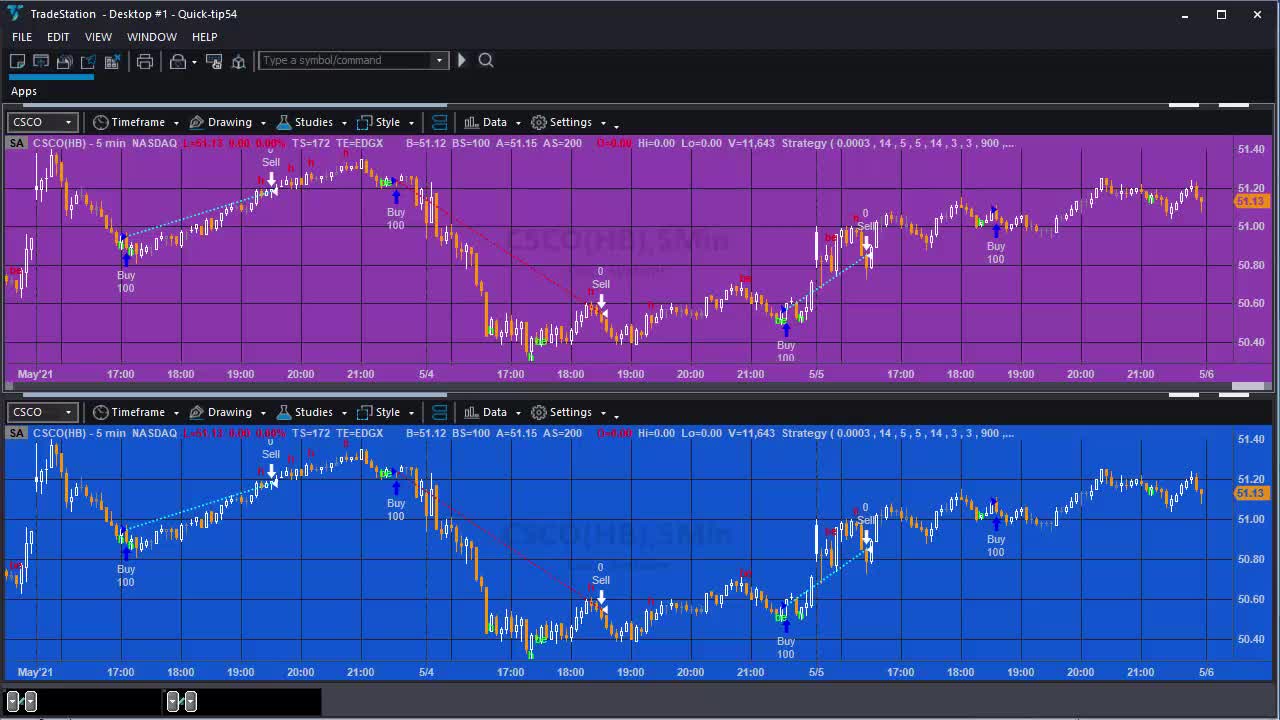

Quick-tip 54 | Modify tutorial 16 to use moving average rather than stochastics

4 years ago

41

Quick-tip 54 is TradeStation EasyLanguage tutorial that demonstrates a way of modifying tutorial 16 (https://markplex.com/free-tutorials/tutorial-16-tradestation-strategy-candlestick-patterns-stochastic-crossovers/) to use moving averages rather than stochastics.

Tutorial 16 looks for candlestick patterns, using the TradeStation standard functions, and if a certain stochastic pattern occurs enters or exits a trade. The program also uses the standard SetProfitTarget and SetProfitLoss functions.

Quick-tip 54 retains the stochastic functionality but also introduces an option to test for inequalities between 3 moving averages.

Loading comments...

-

5:01

5:01

Markplex

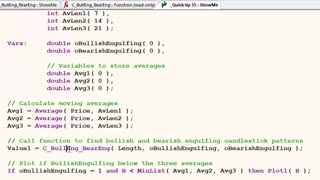

4 years agoQuick-tip 55 | Plot bullish engulfing pattern below moving averages

31 -

5:47

5:47

Markplex

4 years agoQuick-tip 53 | How to modify tutorial 116 to reload the chart data at regular intervals

65 -

2:51

2:51

ChartAction

4 years ago $0.05 earnedPLTR Stock Analysis Watching the Daily 9 Moving Average

152 -

3:58

3:58

ChartAction

4 years agoTesla TSLA Stock FINALLY Broke Weekly 9 Moving Average

49 -

13:59

13:59

wertyuiop2

4 years ago277 Obey God rather than men

37 -

6:50

6:50

Discernanddisseminate

4 years ago $0.04 earnedDiscern rather than judge

77 -

5:03

5:03

Markplex

4 years agoTutorial 167 | Using a Price Series Provider to calculate the Average True Range | Part 2

15 -

9:35

9:35

Markplex

4 years agoTutorial 167 | Using a Price Series Provider to calculate the Average True Range | Part 1

10 -

4:56

4:56

Kaceli TechTraining

4 years agoExcel 2019 Tutorial: Calculating the Max, Min, Average and Count

91 -

26:28

26:28

The PyTorch Channel

4 years agoTutorial 16: Use word embedding in NLP

73