Premium Only Content

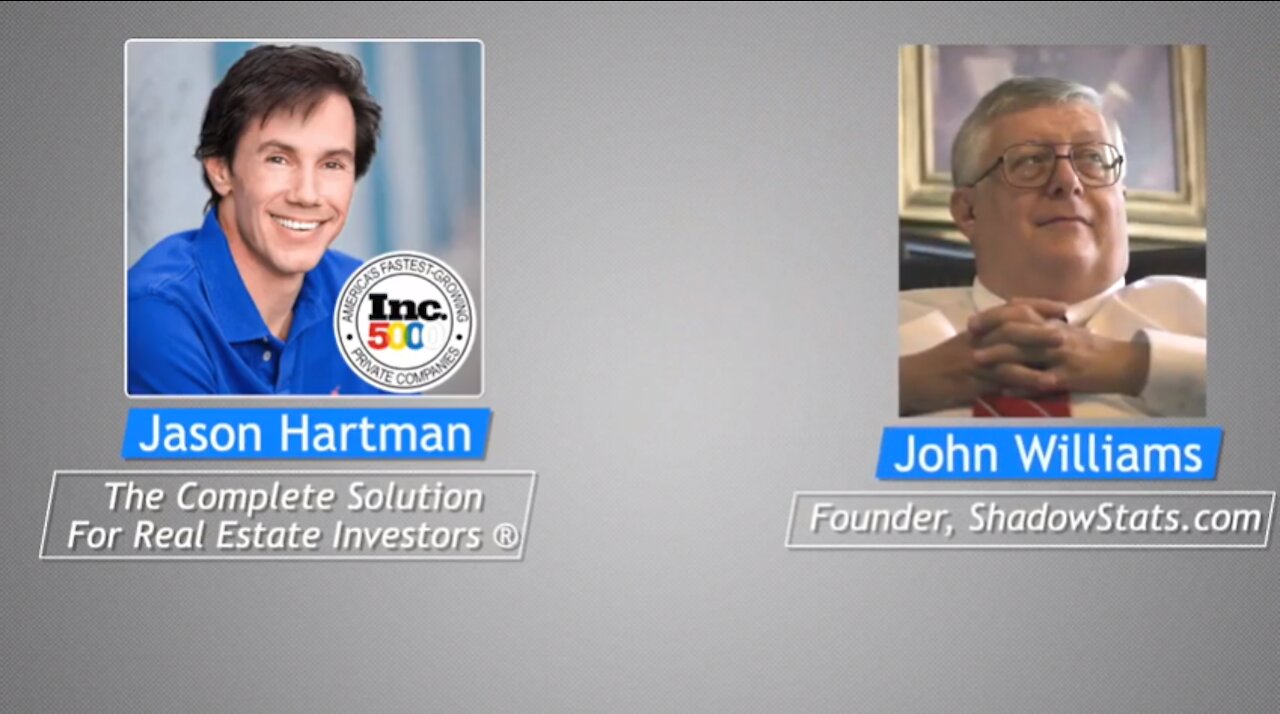

Analyzing the True Price of a House (Selling Price vs. Mortgage Payments)

In this excerpt from my podcast, we discuss the true price of a house based on payments opposed to the selling price. We talk about the average inflation rate over the last 3 decades and how important it is to factor interest rates and inflation into the value of a house.

The mainstream media will tell you the price of houses selling and say, ""We're in a bubble and you should buy as many as you can. The market is going to crash!""

We need to remember that real estate is the most debt-friendly asset and can be refinanced very easily.

People buy based on a payment, not a price, and that is an important factor to consider. The price of a house can increase 4 times while the mortgage payment only doubles. A house today in 1989 dollars cost about the same as a house in 1989.

Learn More: https://www.jasonhartman.com/

Have questions or topics you want me to do a video on? Let us know in the comments below.

If you love real estate investing, SUBSCRIBE!

-

3:18

3:18

San Diego Real Estate

4 years agoWhy It’s Important to Price Your House Right Today

25 -

0:45

0:45

PsychicreadingsbyAndre

4 years agoAion price

20 -

0:37

0:37

PsychicreadingsbyAndre

4 years agoElastos coin price

17 -

0:49

0:49

PsychicreadingsbyAndre

4 years agoXdai coin price

23 -

8:29

8:29

moneymanny1980

4 years agoCardano Price Prediction!!

88 -

0:47

0:47

KMGH

4 years agoMortgage Matters 3.8

26 -

0:51

0:51

PsychicreadingsbyAndre

4 years agoXdai coin price prediction

28 -

6:34

6:34

John Price

4 years ago $0.01 earnedJohn Price - Unmasked

171 -

0:42

0:42

PsychicreadingsbyAndre

4 years agoMYX coin price prediction

48 -

0:41

0:41

PsychicreadingsbyAndre

4 years agoUdoo coin price prediction

37