Premium Only Content

Terrifying Last Minute Change to Stimulus Bill

The so-called COVID-19 stimulus package has now been passed by the House of Representatives and sent to President Biden’s desk, who is expected to sign it on Friday.

Today on Sekulow, we discussed the Left’s sneak attack on conservative states. A mandate buried in the American Rescue Act prevents states receiving COVID-19 stimulus funds from cutting taxes through 2024.

There’s a provision of the American Rescue Act that comes right out and says that states receiving stimulus funds cannot cut taxes:

"A State or territory shall not use the funds provided under this section or transferred pursuant to section 603(c)(4) to either directly or indirectly offset a reduction in the net tax revenue of such State or territory resulting from a change in law, regulation, or administrative interpretation during the covered period that reduces any tax (by providing for a reduction in a rate, a rebate, a deduction, a credit, or otherwise) or delays the imposition of any tax or tax increase."

According to this provision, it is ok to do tax increases. In fact, you’ve got to keep those on track if those are already planned. A state can raise taxes however they’d like. However, if a state accepts these funds, which they are going to have to do whether they like this legislation or not because of the economic relief that are provided to its citizens, they cannot lower taxes during the time period prescribed in this bill. That’s not six months, by the way. That is through 2024.

When this is signed into law, people need to understand that their states are going to be barred from lowering taxes if they accept any of these funds. They will have to challenge that in court.

ACLJ Director of Policy Harry Hutchison gave his opinion on this provision when he said:

"I think the law right now is not necessarily clear, but the inference from my research suggests that there is indeed a basis for states to challenge the federal attempt to coerce and control the taxation power of the states. There seems to be a conflict posed by this particular legislation between the states’ interest in exercising their sovereign and essential ability to exercise taxing power and perhaps the federal government’s interest in fostering economic and political unity – and perhaps surviving the coronavirus. My interpretation and intuition is that the courts, when they get a chance to rule on this, will rule against the federal government. This bill gives huge power to an unelected individual, Secretary of the Treasury Janet Yellen, which I think is outrageous."

This is an attempt to take away an individual state’s ability to decide that maybe a tax cut will benefit it helping to stimulate that state’s economy, which in turn can generate more revenue for that state’s budget.

The full broadcast is complete with further discussion by our team of what essentially amounts to be a sneak attack on conservative, well-managed states by Congress and much more.

-

8:54

8:54

American Center for Law and Justice

2 days agoRELEASED: Iconic Rock Band Brings Gospel to Mainstream

4.49K4 -

0:59

0:59

unitedtaps

3 years agoShuffle Ball Change - 1 Minute of Tap Technique

60 -

8:08

8:08

Bryguy1955

4 years ago $0.01 earned5 Minute Oil Change at Wally World

141 -

0:35

0:35

klages044

3 years ago $0.17 earnedStimulus Bill question

1.09K5 -

0:24

0:24

WFTX

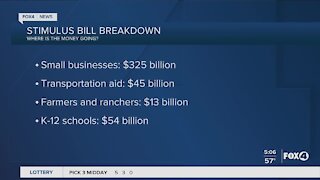

3 years agoStimulus bill breakdown

172 -

3:49

3:49

WKBW

3 years agoLAST MINUTE TECH GIFTS

265 -

3:30

3:30

KTNV

3 years agoLast Minute Shopping Tips

107 -

2:52

2:52

coltonmorgan

3 years ago $0.12 earned10 pull last minute

282 -

3:06

3:06

KERO

3 years agoLast minute gift ideas

104 -

3:46

3:46

WCPO

3 years agoFeedback Friday: Stimulus bill

22