Premium Only Content

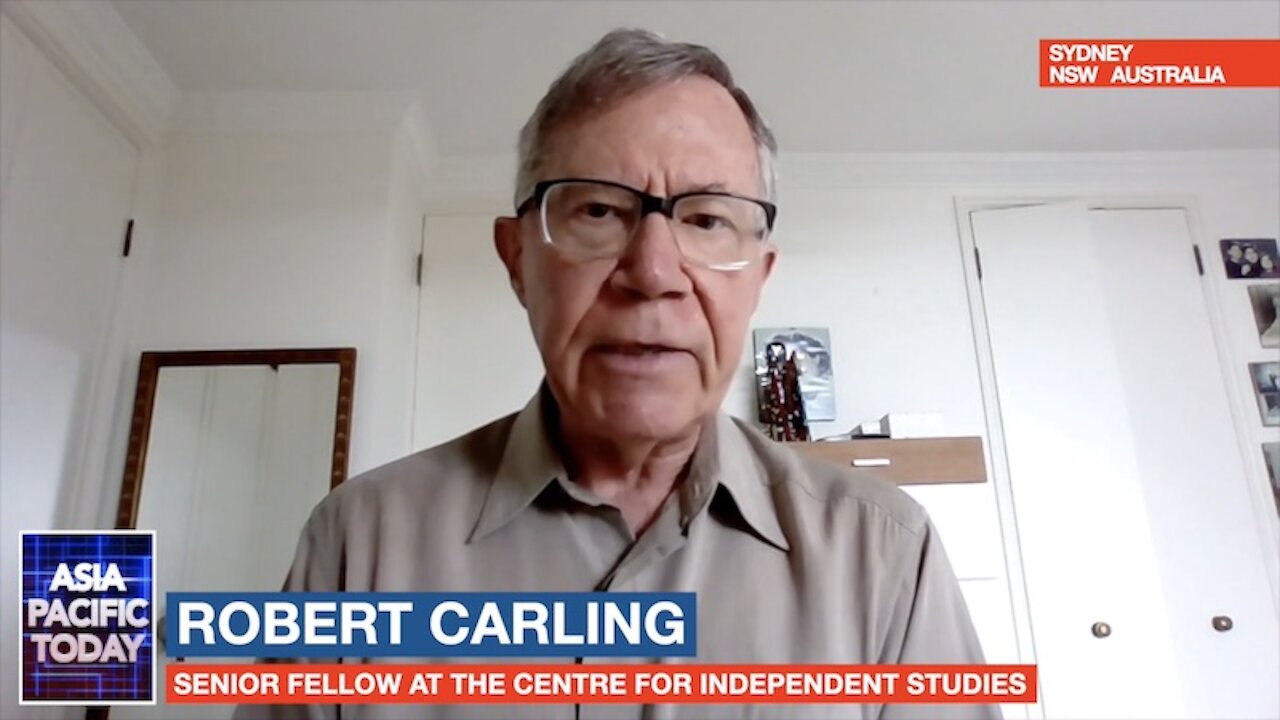

ASIA PACIFIC TODAY. Robert Carling & Australia’s post-pandemic debt risk.

While politicians, public servants and many in big business have done well during the Pandemic, the livelihoods of many in small business have been decimated.

Aside from the incalculable human cost of the lockdowns, losses have been large in trade exposed sectors such as Tourism and Hospitality, Higher Education and Agriculture. We have also seen a large rise in Federal and State Government debt to meet the costs of the Pandemic and to support employment.

No great reforms are likely with yet another State election due and a looming Federal election. Inspite of some good economic news, Australia has much to be concerned about. It seems the vaccine will not avert future lockdowns and external border restrictions continue to constrain growth.

Is bad policy, growing debt and big Government here to stay? We catch up with Robert Carling, a Senior Fellow in the Economics Program at The Centre For Independent Studies. Robert has recently published an article "The Looming Iceberg: Australia’s post-pandemic debt risk"

Prior to joining the CIS, Robert was Executive Director, Economic and Fiscal at the New South Wales Treasury from 1998 to 2006. Previous positions have been with Commonwealth Treasury, the World Bank and the International Monetary Fund. He holds academic qualifications in economics and finance from the London School of Economics and Political Science, Georgetown University and the University of Queensland.

-

![[F EM UP Friday] Take # 2 [Destiny 2] Lets Kick Some A$$! #RumbleTakeOver](https://1a-1791.com/video/s8/1/c/W/7/1/cW71u.0kob-small-F-EM-UP-Friday-Take-2-Desti.jpg) 5:16:50

5:16:50

CHiLi XDD

9 hours ago[F EM UP Friday] Take # 2 [Destiny 2] Lets Kick Some A$$! #RumbleTakeOver

41.8K1 -

5:13:43

5:13:43

ItsMossy

14 hours agoHALO WITH THE RUMBLERS (: #RUMBLETAKEOVER

39.1K1 -

1:54:08

1:54:08

INFILTRATION85

8 hours agoHi, I'm INFILTRATION

36.7K9 -

7:51:03

7:51:03

GuardianRUBY

10 hours agoRumble Takeover! The Rumblings are strong

82.1K4 -

4:28:45

4:28:45

Etheraeon

17 hours agoWorld of Warcraft: Classic | Fresh Level 1 Druid | 500 Follower Goal

56.7K -

3:17:21

3:17:21

VapinGamers

9 hours ago $3.84 earned🎮🔥Scrollin’ and Trollin’: ESO Adventures Unleashed!

38.8K2 -

LIVE

LIVE

a12cat34dog

10 hours agoGETTING AFTERMATH COMPLETED :: Call of Duty: Black Ops 6 :: ZOMBIES CAMO GRIND w/Bubba {18+}

247 watching -

8:23:18

8:23:18

NubesALot

13 hours ago $5.44 earnedDark Souls Remastered and party games

32.7K -

3:03:42

3:03:42

GamersErr0r

1 day ago $2.25 earnedits not what you think

26.5K1 -

7:15:50

7:15:50

Phyxicx

10 hours agoRocket League with Friends! - 11/22/2024

20.1K1