Premium Only Content

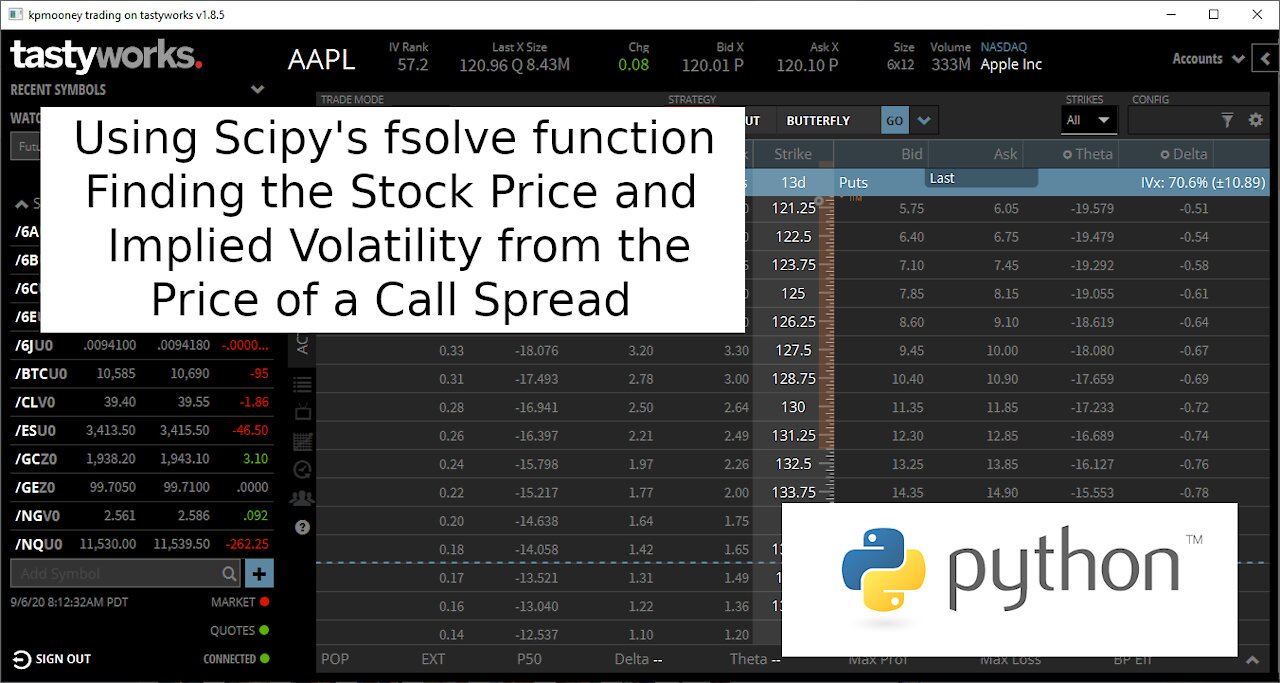

Using Scipy to Find the Prices of a Stock and its Volatility from a Call Spread Price

In a previous video, we looked at how to calculate the stock price based on an option price assuming we knew the volatility. In a comment, someone asked if the same could be done using a short call spread rather than a single option. I wasn't going to do a video on this but then after thinking about it some more, there are some interesting aspects to this problem. After writing up some test code, I realize there was a potential issue that could cause a solution to fail under certain circumstances.

In this video I will consider two scenarios. The first is where we know the price of each individual leg of the spread. We do not know the stock price or the implied volatility. In the second case, we will consider the situation where we know the price of the spread but not the individual legs. In this case we wouldn't need to know the implied volatility.

Finding Stock Prices from Option Prices: https://youtu.be/NF-XMP8RjJo

Finding Implied Volatility Using Newton’s Method: https://youtu.be/Jpy3iCsijIU

Fsolve documentation: https://docs.scipy.org/doc/scipy/reference/generated/scipy.optimize.fsolve.html

Minimize documentation: https://docs.scipy.org/doc/scipy/reference/generated/scipy.optimize.minimize.html

Tip Jar: https://paypal.me/kpmooney

-

21:36

21:36

kpmooney

4 years agoCalculating Implied Volatility from an Option Price Using Python

130 -

2:47

2:47

WKBW

4 years agoIndividual stock buyers influence stock prices

23 -

11:24

11:24

kpmooney

4 years agoCalculating the Implied Volatility of a Put Option Using Python

9 -

3:18

3:18

ChartAction

4 years agoWestern Digital Corporation Stock Price Today Triple Bottom

35 -

5:51

5:51

kpmooney

4 years agoRepurposing our IV code to solve for Stock Price.

4 -

3:41

3:41

ChartAction

4 years agoNokia Hype Stock Price Technical Analysis Crazy MOVES!

36 -

0:40

0:40

New Machinery From China LLC

4 years agoQuality Stock Prep Machinery From China

32 -

3:08

3:08

WEWS

4 years agoWhat GameStop's soaring stock prices means for stock market, retirement accounts

36 -

2:43

2:43

ChartAction

4 years agoHUYA Stock Price Today Bearish Divergence On the RSI

20 -

1:51:18

1:51:18

Redacted News

3 hours ago"There will be consequences!!!" Trump issues big threat to Putin ahead of peace summit | Redacted

97.8K69