Premium Only Content

5 Money-Making Advantages of Multifamily

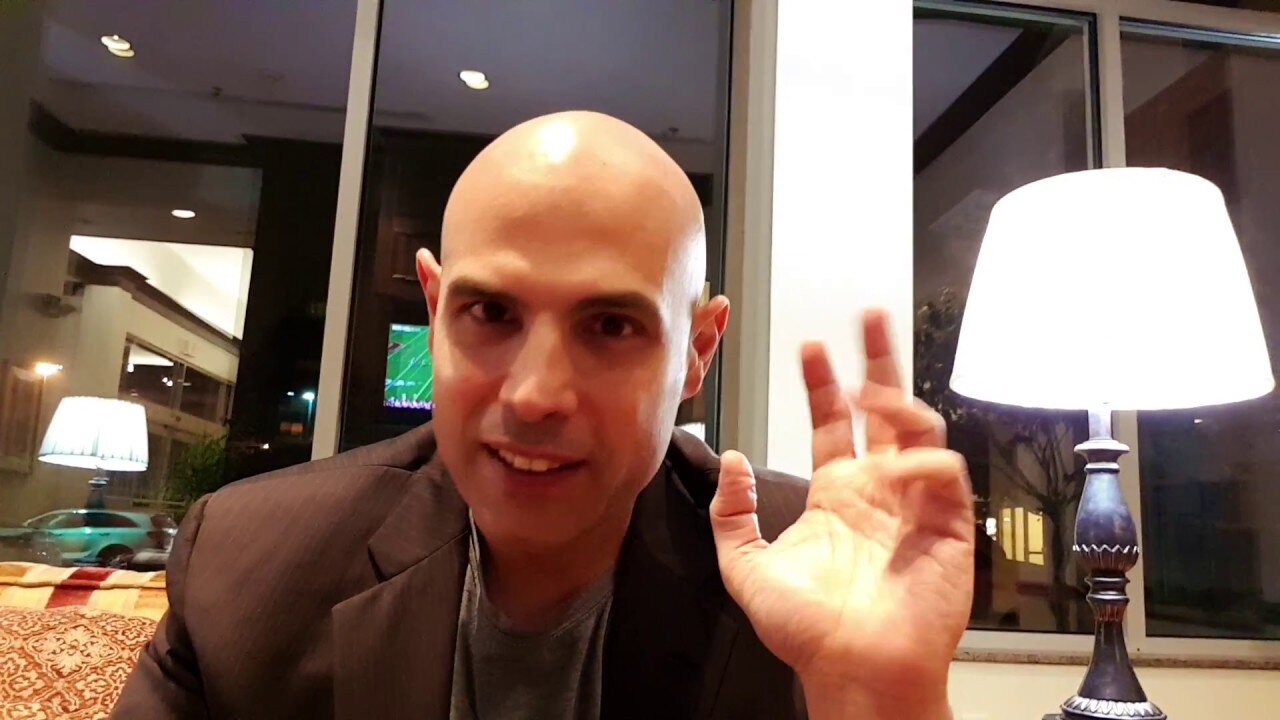

A common term I hear in real estate is "The bigger the deal, the easier it is." It wasn't until I had begun to acquire a large portfolio of single-family homes many years ago that this fully resonated with me. I can tell you from first-hand experience the bigger the deal, the easier it is and the more lucrative it is as well.

So here are my 5 Money-Making advantages of Multifamily deals

The first reason is cash flow. Because of scale, cash flow on a multifamily is always because you have more rents coming in. The bigger the deal the less risk you, your lender and your investors have. If you have a single family house and the tenant bounces, you lose 100% of your income. For some properties, this could be your entire profit for the year. If you have a 10 unit and you lose a tenant, you still have 9 rents coming in to pay your expenses, mortgage, and your stakeholders.

Secondly, the economies of scale are better. If you have 10 single family houses versus a one 10 multifamily, you have ten roofs to repair, ten lawns to mow, ten tenants spread out throughout your city or town and property management is more expensive. In your 10 unit multifamily, you have one roof, one lawn and your tenants are centrally located. Economies of scale are in your favor.

Third, because you have a larger cash flow, you can afford to hire property management to manage your tenants and keep an eye on your property. You can focus on finding and finance more deals.

Fourth, larger deals yield more cash back at sale. When you go to sell your property, you can typically get more money for them because you control the deal and you can force appreciation by making improvements. Keep in mind the multifamily is a business. You can improve the tenant experience and push up rents because people will want to live and stay in your apartment complex.

And fifth, there are so many ways to save on taxes, that there should be an entire section on this one! Unlike single family, you can do a cost-segregation study on your deal and accelerate depreciation. This means you will have tax “losses” on paper that offset investment income. You can also do a 1031 Like-Kind Exchange that allows you to move gains from real estate property to another one all tax-free. This is huge for you guys that are building wealth in single family and get hit with taxes once you move that cash out of the deal and into your bank account.

So, here are the five biggest advantages of investing in multifamily, but there are many more. If you are interested in creating more wealth at a faster rate, adding multifamily deals to your portfolio is the way to do it - either by yourself or partnering up with someone. Let me know what you think. Leave a comment.

Go out and crush your deals!

HELP US OUT

Help us reach new listeners by leaving us a rating and review on Apple Podcasts! It takes less than 30 seconds and really helps our show grow, which allows us to bring on even better guests for you! Thank you in advance! ♡

HAVE A QUESTION?

I am working on a new show where I answer your questions. To submit a question, go to www.bulletproofcashflow.com and you will see a widget where you can speak your question. If I use your question on the air, we'll send you our newly designed t-shirts.

✧✧✧✧✧✧

DOWNLOAD FREE EBOOKS

✧ Talk to Brokers: http://bit.ly/FindBroker

✧ Raise Capital: http://bit.ly/RseFunds

LISTEN TO THE PODCAST

✧ BCF on iTunes: https://apple.co/2B4AvXp

✧ BCF on Stitcher: http://bit.ly/StitcherBCF

SOCIAL MEDIA!

DM me! I want to hear from you!

✧ IG: http://www.instagram.com/bulletproofc...

✧ FB: https://www.facebook.com/bulletproofc...

✧ LI: https://www.linkedin.com/company/bull...

✧ WE: https://www.bulletproofcashflow.com

JOIN THE GROUP

✧ FB: https://www.facebook.com/groups/bulle...

♡ Be Bulletproof!

-

7:31

7:31

bulletproofcashflow

4 years ago $0.01 earned4 Powerful Tax Advantages of Multifamily Real Estate

256 -

13:02

13:02

bulletproofcashflow

4 years ago $0.01 earnedMultifamily Syndication: Basics Explained

75 -

4:31

4:31

bulletproofcashflow

4 years agoWhat is Multifamily Syndication?

128 -

9:55

9:55

bulletproofcashflow

4 years agoWhat Makes Multifamily Recession-Resistant?

1071 -

4:31

4:31

bulletproofcashflow

4 years ago $0.01 earned5 Reasons Why I Like Multifamily Deals

60 -

4:26

4:26

bulletproofcashflow

4 years ago5 Qualities to Become a Multifamily Syndicator

20 -

4:48

4:48

bulletproofcashflow

4 years agoTHREE MUST DO Multifamily Renovations

202 -

1:57

1:57

NowYouKnowEnglish

4 years agoTop 3 Advantages Of Buying Medicines Online

10 -

7:01

7:01

bulletproofcashflow

4 years ago $0.01 earned5 Multifamily Strategies to Cope with a Recession

273 -

3:21

3:21

bulletproofcashflow

4 years ago $0.01 earnedLessons Learned from Multifamily Syndicator Interviews

50