Premium Only Content

GAMESTOP DRAMA TRIGGERS MASSIVE TRANSFER OF WEALTH, NOW WHAT?

WATCH: I sit down with financial advisor, author, and podcaster Michael Wall, to discuss the latest on the GameStop saga, potential consequences, and why the story is much deeper than just stocks and shares.

------------------------

(ATLANTA, GA) - The GameStop saga may go down as one of the most pivotal stories of 2021. That's because the cultural consequences may be as far reaching as the financial ones. This single event, resulted in a massive, unexpected transfer of wealth, from the financial ruling class on Wall Street... to a group of amateur day traders on the Internet; And many in the American public, eagerly watched it all unfold.

GameStop shares were as low as $18 a pop earlier in January. But those shares skyrocketed up to $469 a share by January 28th. How? A group of ameteur day traders on the Internet banded together to beat Wall Street at its own game. Users of a popular Reddit forum called 'WallStreetBets' bought up shares of GameStop in mass, which caused the price of GameStop's stock to shoot up more than 1,700%. The massive spike meant massive losses to the tune of (an estimated) $19 billion dollars, for short-sellers.

While some political and financial elites were crying foul and calling for stringent regulations... many in the public, were defending the Reddit users, saying short-sellers have been gleefully profiting off declining companies, like GameStop for far too long.

Robinhood, the app used by these day traders to buy the GameStop stock, intervened by Thursday morning, and halted the buying of these stocks, citing "market volatility". The move drew sharp criticism from many in the public, who accused the app of trying to change the rules in the middle of the game. Some experts, even contend that the move, was illegal. Who was behind the app's decision to halt stock trades? And was it market manipulation? The Courts may ultimately have the final say. Two class action lawsuits have already been filed against Robinhood. Some in Congress subsequently called for an investigation into the matter, while the White House has largely remained quiet.

For many Americans, this was not a story about stocks and trades, but rather, a tale of David Vs. Goliath, where the little guys took on the billionaire hedge funds, and (at least for now) seems to have beaten them at their own game. A temporary shift in the balance of power on Wall Street, that gave people a personal sense of victory, even if they hadn't traded a dime.

Could this event be the catalyst for a broader populist movement?

-

7:22

7:22

Carolyn Ryan TV

1 year agoGA: 8th District GOP bans people wearing election integrity t-shirts to annual fish fry

35.9K15 -

2:44

2:44

KNXV

4 years agoWealth management advisor explains GameStop stock frenzy

44 -

7:54

7:54

Chartered Wealth Manager ® Course Lectures

4 years agoWhat is Wealth Management and Financial Planning

148 -

2:20

2:20

Wendy's Emotional Intelligence

4 years ago $0.02 earnedWhat is a Control Drama?

254 -

0:53

0:53

BonginoReport

4 years agoGameStop Stock Drama Makes It's Way Into the Press Briefing Room

33.6K114 -

14:09

14:09

Joe Pags

4 years agoWhat Is the Story Behind GameStop and Crazy Stocks?

6.45K -

2:44

2:44

KTNV

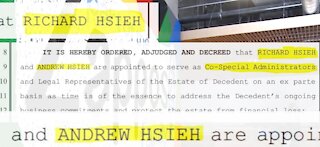

4 years agoJudge awards Tony Hsieh's father, brother administrative duties over massive wealth, estate

13 -

10:51

10:51

moneymanny1980

4 years ago $0.01 earnedGamestop Rise!!!

146 -

4:10

4:10

Roudter

4 years agoGamestop Not A Buy

473 -

2:59:23

2:59:23

Wendy Bell Radio

7 hours agoBUSTED

65.4K57