Premium Only Content

Borrow From Your 401k and Increase Net Worth Part 1

Borrow from your 401k is fine, especially if you have expensive debt!

In this video, we actual model the results of two scenarios:

1. Borrow $10k from the 401k to pay off $10k credit card.

2. Don't borrow $10k from 401k to pay off $10k credit card.

We'll call the guy in scenario 1, Josh, and the guy in scenario 2, Joey.

They both have an expected rate of return on their 401k of 6%. They also both paying 10% interest on their credit card.

Josh says to Joey he is going to borrow from his 401k to pay off that credit card. Joey, having read ALL of the financial literature that's out there, says that's crazy and he will continue to pay the credit card debt with monthly payments.

When Josh took out the 401k loan the interest rate he paid was 4.5%. He also has to pay the loan back over 5 years, 60 months, meaning his monthly payment was $188

Joey paid the exact $188 a month towards his credit card.

Who do you think came out ahead???

Well, unsurprisingly, it was JOSH. Why? Simple, the 4.25% interest he is paying on the loan goes back to HIM! Also, each $188 monthly payment is growing at the expected rate of return of 6% as well.

Josh took out $10k to pay off $10k in debt and paid $11,280 back..100% of which went back to his account. On top of that, that $11,280 was also growing at 6%. Thus over that 60 month time frame, the $11,280 he paid back grew to $13,177!

At the end of 5 years his total account was worth $67,070.

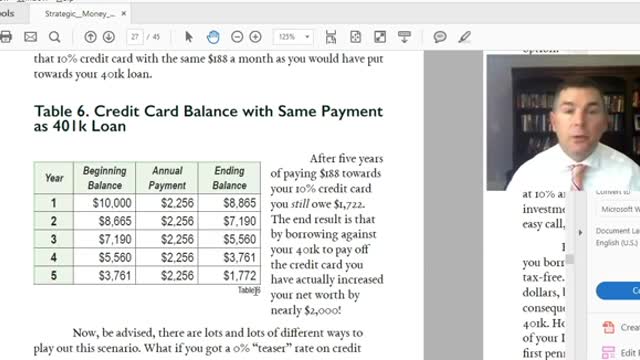

Joey, on the other hand, decided to leave his 401k untouched and instead directed his $188 a month payment towards his credit card. Unfortunately for him, after 5 years, he still had a balance of nearly $2,000 on his credit card!

Plus, while he started with more than Josh, after 5 years his 401k only grew to about $67,000 while Josh had a bit more in his account, EVEN after taking the $10k loan!

Ultimately, Josh was nearly $2,000 wealthier than Joey after borrowing from his 401k to pay off his credit card debt.

Will this scenario ring true always??? Of course not.

If your expected rate of return is higher than your credit card interest, well, you may want to reconsider. (I'd simply ask how you expect to get that return though???)

Maybe you have a 0% teaser rate on your credit card. My default is to pay down debt, but I get the arbitrage opportunity that exists by using a 0% card and allowing your investments to grow.

What if you leave your job BEFORE the 401k loan is paid off? Then you' will pay ordinary income (OI) tax on the remaining balance of the loan, PLUS if you're under 59.5 you'll also pay a 10% penalty.

So, again, proceed with caution. But don't simply just follow the herd blindly over the cliff and close your eyes to the opportunity that does exist.

Now, you can NOT borrow against an IRA. So, if you have an IRA and are considering taking a distribution in order to pay off a debt, remember, PLEASE, that each dollar you do take out will be taxed as OI AND if you're under 59.5 you're going to pay that 10% IRS penalty.

In this case a it will take more than a $15,000 distribution from an IRA for someone who is say 50 years old in a 25% tax bracket to net the $10k to pay the credit card.

Don't do that!

On the other hand, what if you have a TAXABLE account with some gains in it. Should you use that? Maybe.

Say you have an account worth $10k that consists of $5k of long term capital gains.

Well, in this case you'd pay $750 in a one-time capital gains tax to avoid the 10% interest charge, EACH YEAR!

Makes sense to me to do that. But each situation is different. So, choose your path carefully.

Finally, the best solution of course is to not have any debt! But that's a tough pill to swallow for most Americans today. Things just cost more than the cash we have available.

Going forward though TRY to get out of debt. That is the best financial planning move you can make.

I'd love to hear your thoughts. Put questions and comments below.

Stayed tuned for part 2 of how borrowing from your 401k can make you money. In this second scenario we are not even going to use the 401k loan to pay off debt.

We're just going to invest it. Watch and learn how borrowing from your 401k can actually INCREASE your net worth.

Sign up for email list here. https://mailchi.mp/0a0c258dd676/sign-up-page

Get all my books for FREE for Kindle Unlimited. https://www.amazon.com/Josh-Scandlen/e/B07BTTLJFV/ref=dp_byline_cont_pop_ebooks_1

-

11:20

11:20

Finance and Freedom

1 year ago $0.12 earnedCheck Out This Awesome Retirement Plan

5101 -

4:33

4:33

WMAR

4 years agoIncrease Your Lifespan

94 -

0:57

0:57

Parler's Realtor

4 years agoHow Homeownership Multiplies Your Net Worth

135 -

3:16

3:16

KTNV

4 years agoIs pulling from your 401K a good idea?

49 -

3:59

3:59

NEBU2

4 years ago $0.04 earnedHow to increase your followers on Parler.

294 -

0:57

0:57

HoustonAreaLuxuryHomes

5 years agoHow Homeownership Multiples Your Net Worth

137 -

20:50

20:50

Dynamic Streaming Media

5 years ago $0.01 earnedWorth Knowing - Episode 1 - Part 3

383 -

17:33

17:33

Dynamic Streaming Media

5 years ago $0.05 earnedWorth Knowing - Episode 1 - Part 2

266 -

13:39

13:39

Dynamic Streaming Media

5 years ago $0.05 earnedWorth Knowing - Episode 1 - Part 1

295 -

9:41

9:41

Lynda Cromar Online Training

5 years ago $0.01 earnedIncrease and Enlarge Your Reach and Influence

12