Understanding the Qualified Use Requirement

What are the Qualified Use Requirements?

Investors often ask "what am I allowed to do with my property?"

The properties sold and acquired in a 1031 Exchange must satisfy the Qualified Use requirement. Qualified Use means the properties must be held for rental, investment, or business use. The critical issue is that you must have the intent to hold the properties for rental or investment purposes -- not for sale. The length of time you hold the properties is one factor in determining whether you meet the "intent to hold" requirement. It is generally considered safe if you hold your property for at least two years, reasonably safe if you hold for one year, and risky if you hold for less than one year.

Investors who purchase property with the intent of fixing it up and selling it for profit (flipping), fail to meet the intent to hold test. The IRS considers flipping transactions to be held for sale -- not held for investment.

1031 Exchanges are complex, that's why you need an expert! Call Exeter 1031 at 1-619-239-3091 for visit http://www.exeterco.com

-

1:41:08

1:41:08

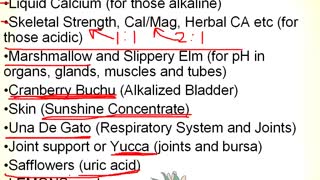

MarysHerbs

3 years agoUnderstanding pH

162 -

9:48

9:48

vivianlmiller

3 years ago $0.02 earnedCovenant Understanding

64 -

1:30

1:30

Understanding English for Amateurs

3 years agoUnderstanding Geopolitics for use in Casual Conversation

97 -

2:05

2:05

Monkee43

3 years agoUnderstanding Laws

31 -

7:04

7:04

KTNV

3 years agoUnderstanding Autism

42 -

28:46

28:46

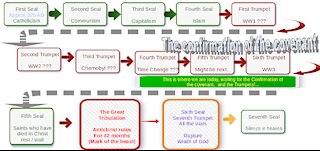

Bible Prophecy videos

3 years agoUnderstanding Revelation (Part 20)

283 -

2:01

2:01

Understanding English for Amateurs

3 years ago $1.43 earnedUnderstanding High American Prices

776 -

24:48

24:48

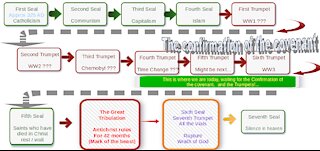

Bible Prophecy videos

3 years agoUnderstanding Revelation (Part 19)

144 -

12:33

12:33

Precision Rifle Network

18 hours agoWind Calling - Holdover vs. Dialing - Long Range Shooting

36.2K13 -

3:28:39

3:28:39

Akademiks

13 hours agoDRAKE FIRES on Kendrick Lamar ! HOLLY ! BLOCK IS BEING SPUNN!!!!!

110K104