Interpretation of First and Third Party Insurance Policies

Differences between Property and Liability PoliciesAs the California

Supreme Court observed in both Garvey v. State Farm Fire and Casualty Co., 48 Cal. 3d 395, 770 P.2d 704, 257 Cal. Rptr. 292 (Cal. 1989), 48 Cal.3d at p. 399, fn. 2, 257 Cal. Rptr. 292, 770 P. 2d 704, and Prudential-LMI, 51 Cal. 3d at pp. 698-699, 274 Cal. Rptr. 387, 798 P. 2d 1230, a first party insurance policy provides coverage for loss or damage sustained directly by the insured (e.g., life, disability, health, fire, theft, and casualty insurance).

A third party liability policy, in contrast, provides coverage for liability of the insured to a third party (e.g., a commercial general liability or CGL policy, a directors’ and officers’ liability policy, a business owners’ policy, or an errors and omissions policy).In the usual first party policy the insurer promises to pay money to the insured upon the happening of an event, the risk of which was insured. In the typical third party liability policy, the carrier assumes a contractual duty to thoroughly investigate and defend claims or suits and pay judgments the insured becomes legally obligated to pay as damages because of bodily injury or property damage accidentally caused by the insured.

The difference in the nature of the risks insured against under first party property policies and third party liability policies is also reflected in the differing causation analyses that must be undertaken to determine coverage under each type of policy. “Property insurance … is an agreement, a contract, in which the insurer agrees to indemnify the insured in the event that the insured property suffers a covered loss.” Coverage, in turn, is commonly provided by reference to causation, such as “loss caused by” certain enumerated perils.

-

10:17

10:17

Barry Zalma, Inc. on Insurance Law

3 months agoWho's on First - Defense and/or Indemnity

90 -

15:19

15:19

Barry Zalma, Inc. on Insurance Law

3 years agoA Video Explaining the First Party Property Insurance Adjuster's Duties and Obligations

141 -

0:19

0:19

RockyW36

3 years agoThe boys very first pit party

33 -

53:10

53:10

Host/ownere

3 years ago $0.17 earnedCOULD A THIRD POLITICAL PARTY ARISE OUT OF THIS ELECTION MESS?

251 -

10:35

10:35

Moandain Designs

3 years agoMy Favorite First person Shooters / Third person shooters

191 -

0:44

0:44

Aquawoman

3 years agoPost cousins first birthday party

49 -

3:09

3:09

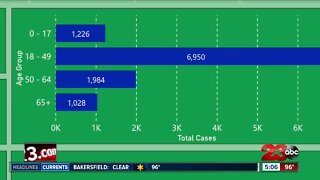

KERO

3 years agoDemand for life insurance policies on the rise amid pandemic

8 -

16:50

16:50

Barry Zalma, Inc. on Insurance Law

3 years agoA Video Explaining The Duties of the First Party Property Adjuster

69 -

2:23

2:23

KJRH

4 years agoSmall businesses find insurance policies may not cover pandemic losses

22 -

3:31

3:31

KMGH

3 years agoAAA Insurance - Insurance Coverages

91