Premium Only Content

The 62/70 Social Security Strategy

How Do Spousal Benefits Work - A Simplified Explanation

How much would my wife receive from her spousal benefit? When will she be qualified to receive my Social Security? Will she lose her own retirement benefits?

I am four years older than Charlotte. I make more money than she does. That means I will receive a higher amount of Social Security benefits. For 15 years, she didn’t work or didn’t make much income from working part-time as a teller in Bank America. She worked various odd jobs. So, her Social Security benefit will be sparse.

For simplicity, let’s say her PIA is $1,500 a month. If she takes her benefit early, it’s reduced by 30% to roughly $1,000 a month. My retirement benefit though will be $3,000 a month. Her spousal benefit will be half of mine. That’s $1,500 a month at her Full Retirement Age (FRA).

So, in this case, she’ll get $1500 a her Full Retirement Age based on her OWN work record or her Spousal Benefit. There really is not much of a difference here.

If we combine our retirement payments, we have around $4,500 a month in real money at our respective FRA’s. That’s $54,000 a year in income, completely tax-free, depending on what types of other income we have.

When I die, Charlotte will lose her own Social Security benefits but will step into my benefit. If I wait until I’m 70 to take my benefit, I’ll receive around $3,800 a month and that will be what Charlotte will get upon my death.

If my wife dies first, it’s a drawback of her not taking an early benefit because we won’t receive ANY of her benefits. And this is a big reason for the lower earning spouse to take benefits early, simply to ensure that spouse receives SOMETHING. But many contingencies are out there, and many people have studied this problem.

Despite the fact if she takes Social Security early she’ll receive a reduced benefit, it’s a good default for a spouse, especially for most women, who are often younger and have lesser income than their husbands.

The best way to figure this stuff out is to actually look at the numbers! Figure out how much you and your spouse receive from Social Security payments. Take the time to do this so you can make the most informed decision that works for you.

-

15:41

15:41

Finance and Freedom

1 year ago $0.10 earnedMedian 401k/IRA Balance Per Age Group

843 -

4:25

4:25

RoadVersion

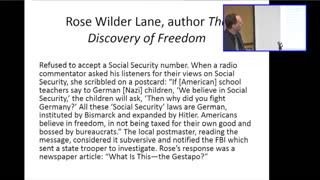

5 years ago $0.15 earnedSocial Security - History of Social Security

407 -

4:25

4:25

Bcfriz

5 years ago $0.16 earnedSocial Security History

427 -

1:00

1:00

Redwhiteblue2017

5 years agoSocial Security knowledge

182 -

0:43

0:43

WFTX

5 years agoSocial security bump in pay

1762 -

0:43

0:43

WFTX

5 years agoSocial security bump in pay

1191 -

1:44

1:44

WCPO

5 years agoSocial Security scam alert

52 -

36:04

36:04

Cundiff

5 years agoSocial Security -- The Long Slow Default

171 -

1:08

1:08

ClassicalMood

5 years agoBiden Flipflop About Social Security

9053 -

1:59

1:59

WTMJMilwaukee

5 years agoTruth be Told: Biden's Social Security record

196