Credit Repair Tips {Understanding Credit} More Credit = High FICO Score!

Understanding how your credit score works and why having credit is one of the most important things you can do in relation to having a great credit score!

00:00 Introduction

0:15 Credit Availability

1:03 Authorized User

2:00 Credit Usage

2:50 Catastrophic Events

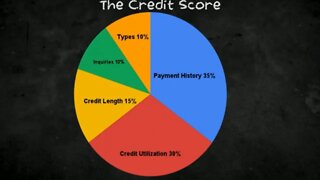

30% of your credit score is based on credit availability. That is a huge chunk of your possible credit score that you would be missing out on!

Without credit cards, you have no credit availability. An installment loan or car l9oan does not give you credit availability. If you have a 10,000 car loan and make a few payments, can you receive more credit on the same loan? If you pay off $5,000 of it can you charge up the other $5,000? No of course not - that is why there is no credit availability.

If you have a $1,000 card, you have credit availability. Obviously paying the bill on time is important, but equally important is your usage of the credit. Do you max out the limit on your credit card? If you do you'll be rewarded with a lower score!

If you keep your usage under control, perhaps no more than 30% of the credit card limit, you will be rewarded with a considerably higher score.

Also important is the age of the cards. a 6-month-old credit card has limited seasoning and history, therefore it will not tell the credit agencies much. A 10-year-old card provides a strong indicator of how you handle your finances.

So... how to do suddenly establish 10-year great credit history? You can't! But people you know with this great history can easily do this for you. If a friend or relative has this great history:

3 rules for doing this

1) less than 30% of the limit owed (otherwise you do not want it on your credit report)

2) always paid on time (otherwise you do not want it on your credit report)

3) the older the credit card the better - preferably over 5 years old,

then the credit card company will send them a credit card with your name on it. They can cut up the card. You don't use their credit.

You just get to use their great history on your credit report.

People often ask - will it affect their credit - not at all. Not even one point. It does not affect them in the slightest!

http://www.FireYourLandlord.info for FHA loan application online. Apply online. even FHA Loans bad credit!

FHA Loan guidelines for FHA mortgage loans are the same in California and nationally.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

#creditcards #creditscore #fico

Like | Share | Comment and Subscribe

Apply online now at http://www.FireYourLandlord.info

5-10 mins to get your process started. FHA loans real estate - whole loan process and Fire Your Landlord!

To learn how much mortgage can you can qualify for. Watch https://www.youtube.com/watch?v=wA8QLQysJMg&t=2s

For an FHA mortgage, or if you have an FHA loan question, call Chris an FHA Loan Officer! Fire Your Landlord with FHA loans to qualify for FHA!

Mortgage loan to buy a home with an FHA Home loan!

Chris Trapani

NMLS# 240870

Cell: 310-350-2546

Fire Your Landlord ®

800 N. Haven Ave, Suite 240

Ontario, CA 91764

-

9:32

9:32

Simon Katz

2 years agoHow To Get An Excellent Credit Score | Advice - Tips - Secrets On Fixing and Building Your Credit

1111 -

15:02

15:02

Mark Reese // Credit & Finance

3 months ago5 Steps to An 800 Credit Score (The #1 Way To Increase Your Credit Score FASTER)

105 -

2:55

2:55

EverythingCredit

6 months agoCredit Repair Consultations Across State Lines 🚫💳

74 -

2:59

2:59

savings.club

1 year ago5 Simple Ways to Build Your Credit Score

241 -

9:26

9:26

GabrielBrown

1 year agoThe Credit Game Has Changed - Credit Prepair...

132 -

3:15

3:15

Credit repair, credit counseling does it really work

3 years agoHow to read, understand a credit report

99 -

13:59

13:59

Real Deal Finances

1 year ago $0.01 earned5 Credit Tips for Beginners That Will Save You Money

43 -

16:57

16:57

Living, Loving & Selling the Florida Lifestlye

2 years agoHow Do I Fix My Credit? | Credit Tricks and Tips

33 -

8:36

8:36

Dragon Financial

1 year agoCredit Score Explained

33 -

2:50

2:50

Credit repair, credit counseling does it really work

3 years agoYOU CAN BOOST YOUR CREDIT SCORE WITH A FEW SIMPLE TIPS

3.3K1