Premium Only Content

Down Payment Assistance | FREE MONEY (2020) Zero Down Payment Loan

[Home Loans] No Down Payment [100% financing] Zero Down | Down Payment Assistance | Zero Down Payment - HOME LOAN! Real Estate Grant | Free Money [Home Loan] No Down Payment | Mortgage | Zero Down Payment.

No Money Down! "FREE MONEY?" Down Payment Assistance! Zero down mortgage loans!

With so many down payment assistance programs available, but no standard program, many cities, counties, state, and non-profit organizations have come up with numerous programs to assist renters in buying a home with zero down payment programs.

Many of these programs are loans. Some must be paid. monthly, others are paid after the sale of a home or refinance and others have a balloon-type payoff after a number of years.

There are a few grants out there that help people with free money and while some have exorbitant interest rates, the Dream House Foundation has loan amounts in the 3s!

Well here are some of the features of the program.

00:00 Do Down Payment Assistance Programs Exist?

0:33 Maximum Income Limits

1:14 What to Look For in a Program

1:33 FHA Loans

2:24 Silent Loans

2:38 State Programs

3:12 Is it Better to Use My Own Down Payment?

3:25 The Good

3:31 The Bad

3:53 The Ugly

5:59 How much can you come up with?

6:10 Contact us!

Number 1 - the borrower does not need to be a first-time homebuyer! Most down payment assistance programs require that a borrower be a first-time homebuyer. Not this program!

The borrower might have just sold a home a week ago and still qualify for the grant!

Number 2 - the minimum fico score can be as low at 620. Most down payment assistance programs require between 640, 660 sometimes 680 and 700 is even becoming a common requirement for these programs, especially during the COVID-19 pandemic, lenders risk tolerance has gone down dramatically due to the 33,000,000+ people that have been temporarily laid off.

Number 3 - Most down payment assistance programs require that the home be a single-family residence. not this program! It can be a 1, 2, 3, or 4 unit property (as long as you will live there) or even a condominium!

Number 4 - Maximum income. most programs are designed for the low income to the moderate-income range. They, unfortunately, they have a limited appeal because of income limited. I saw one recently that had a $42,000 ($3,500 a month) income limit. That may work well in some parts of the United States, but in California, most mortgage payments start at $2,500 in less expensive areas. Obviously, these programs would not work for most people.

Number 5 - 3.5% GRANT towards a down payment which is standard for an FHA or in some more limited case, someone who is short on closing costs may also use this program for that!

Number 6 - If interest rates go down you can refinance! Most loan programs will create issues with refinancing. Some grant programs require you to keep the loan for 3, 5, or even 10 years or you will have to pay the money back. Some down payment assistance programs loan you the money, but you must pay the money back through the refinance. No equity. sorry, can't refinance!

[Home Loans]

Number 7 Debt ratio! Most down payment assistance programs limit the debt to income ratio to 43, 45, and even as high as 50%. Our program offers a generous 55% debt ratio,

That means 55% of your gross income (if you are a w2 employee) is allowable for the principal, interest, taxes, insurance, and PMI payment plus monthly debts of cars, credit cards (minimum payments) installment loans, student loans (1% of the outstanding debt - even if in deferment) child support and alimony.

The program is from the Dream Foundation and CEO Jeremy Turner started the program to help renters fire their landlords!

If you are a renter that is ready to move up, just go to my website, www.fireyourlandlord.info, and click the apply button. It will only take 5 minutes to fill out the application!

if you are a broker and you would like to find out. more how you can do these loans in whatever your state is, just reach out to me and I'll put you in touch with Jeremy Turner and get you started!

No more credit worries with 620, no more Down payment worries with your down payment covered

No more debt worries with a great debt ratio of 55%

http://www.FireYourLandlord.info for FHA loan application online. Apply online. even FHA Loans bad credit!

FHA Loan guidelines for FHA mortgage loans are the same in California and nationally.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

#homeloans #ZERODOWN #NODOWNPAYMENT

Like | Share | Comment and Subscribe

Apply online now at http://www.FireYourLandlord.info

5-10 mins to get your process started. FHA loans real estate - whole loan process and Fire Your Landlord!

To learn how much mortgage can you can qualify for. Watch https://www.youtube.com/watch?v=wA8QLQysJMg&t=2s

Mortgage loan | FHA Home loan!

Chris Trapani

NMLS# 240870

Cell: 310-350-2546

Fire Your Landlord®

800 N. Haven Ave. Suite 240

Ontario, CA 91764

-

0:31

0:31

KMGH

5 years agoHome buyer assistance programs help with down payment

29 -

3:08

3:08

KNXV

5 years agoRental assistance money delayed for months

12 -

1:14

1:14

KNXV

5 years agoRental assistance money starting up

15 -

1:08

1:08

BANGBizarre

4 years agoWhatsApp has introduced a free payment service in India

114 -

0:50

0:50

KMGH

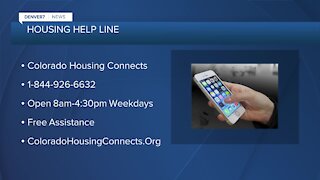

4 years agoFree helpline available for housing assistance

65 -

0:30

0:30

WFTX

5 years agoFPL wants to hear from those needing payment assistance

18 -

3:00

3:00

WPTV

4 years agoBoca Raton still has COVID-19 relief money for rental, mortgage assistance

4 -

0:49

0:49

WFTX

4 years agoFree flu shots and utilities assistance in Lee County

13 -

0:28

0:28

KMGH

4 years agoMoney Saving Monday: Free breakfast for parents/teachers

36 -

1:24

1:24

AltirasMedia

4 years agoYou Deserve a Better Payment Processor!

96