Premium Only Content

Product Liability Insurance

Product liability insurance is designed to protect businesses and organizations from claims against loss, injury, or illness caused by their products. This policy can be bought separately as well as added under general liability insurance

The coverages available in this policy are:

1. Faulty product

2. Usage failure

3. Design defect

4. False/misleading marketing

5. False/misleading labels

6. Failure to warn

7. Product information omissions

The policy also has some exclusions like any other insurance:

1. Efficacy exclusions

2. Cost of product recalls

3. Lost inventory

4. Quality control exclusion

5. Reporting exclusions

6. Material exclusions

7. Employee injury exclusions

8. Vendor’s endorsement

The cost of product liability insurance depends on various factors like:

1. Business/Product Type

2. Position in the supply chain

3. Size of the company

4. Number of products

5. Quality control procedures

6. Loss control procedures

7. Claim history

To learn more about product liability insurance, follow this link: https://quotezebra.com/product-liability-insurance/

-

3:31

3:31

KMGH

4 years agoAAA Insurance - Insurance Coverages

91 -

4:01

4:01

Tdobert

4 years ago $0.01 earnedGreat Product

37 -

3:24

3:24

KMGH

4 years agoAAA Insurance - Wind Damage

17 -

3:36

3:36

KMGH

4 years agoAAA Insurance - Wind Damage

6 -

2:55

2:55

Photography, Video, Writing

4 years ago $0.03 earnedBivona Insurance Group

5.01K -

0:53

0:53

Apla_Tech Drywall Tools

4 years agoProduct Sample

20 -

2:50

2:50

KMGH

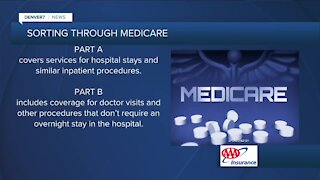

4 years agoAAA Insurance - Medicare

18 -

2:41

2:41

insurancesales823

4 years agoInsurance Sales For you

61 -

3:16

3:16

KMGH

4 years agoAAA Insurance - Wildlife

16 -

6:20

6:20

businterruptioncov4321

4 years agoBusiness Interruption Insurance

44