Premium Only Content

Currency Wars with Simon Dixon - Full Interview

"Currency Wars with Simon Dixon"

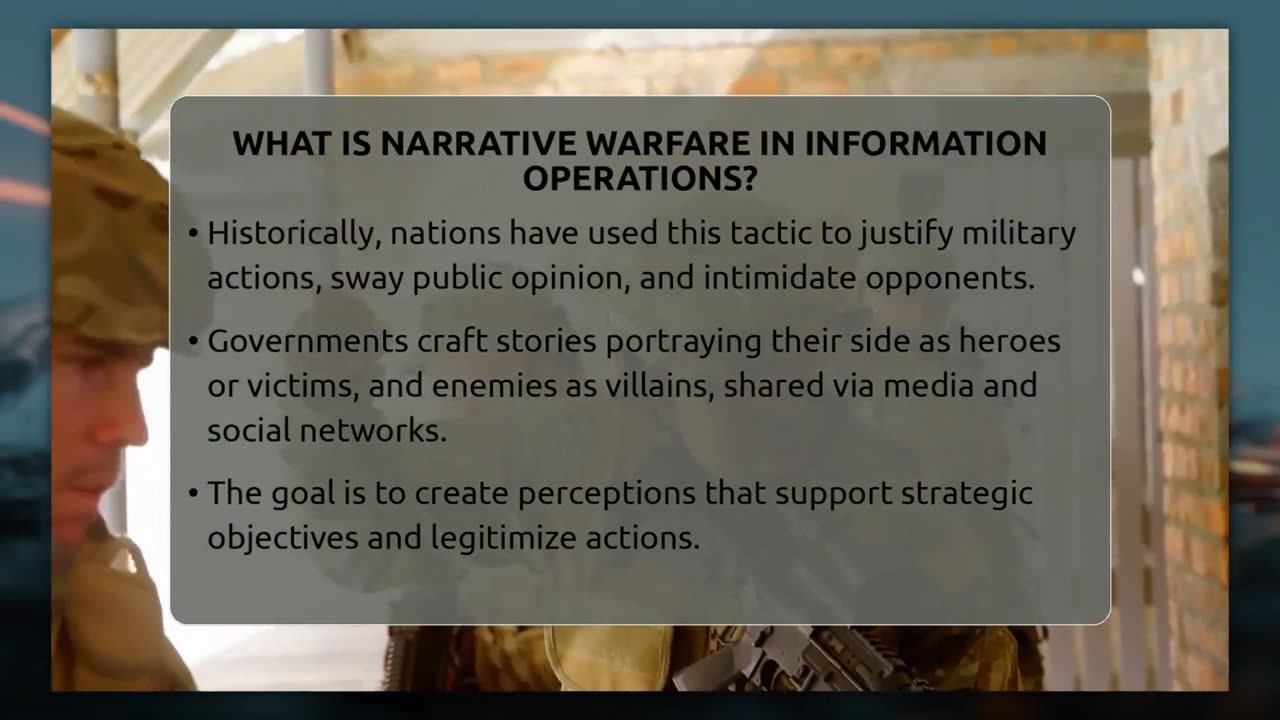

When I published The State of Our Currencies in the spring of 2020, I observed that we were in a global currency war, stating: “[I]t is essential to realize that we live and transact in a transition time between two systems.” The U.S. dollar as global reserve currency is the current system—the second system, I wrote, is “in the invention room.”

In the intervening years, the currency wars have heated up, and Mr. Global’s invention room is spitting out more and more tools to implement programmable money on distributed ledgers and the digital IDs and local hardware to make the system go. This week, British entrepreneur, Bitcoin investor, and geofinancial analyst Simon Dixon helps us take stock of these fast-moving developments. Like me, Dixon has a long-standing interest in “missing money”—which arose after the dot-com crash of 2000 wiped out his father’s pension—and like me, he found that asking inconvenient questions about a “corrupt banking and financial industry” was not compatible with his prior career in investment banking. Given our mutual passion for freedom and building wealth, this is a conversation you will not want to miss.

We start by discussing the rise of stablecoins, the passage of the GENIUS Act, and stablecoins’ potential impact on the dollar and Treasury Bill markets as well as on local economies. We also take a look at asset tokens and assess the implications of the not-yet-passed CLARITY Act. Wall Street leaders speak openly about their plans to use tokens to trade securities and assets—but the specifics of what they have in mind are far from clear. Other topics of discussion include the role of Bitcoin in the emerging financial system, the U.S. Bitcoin Strategic Reserve being funded with seizures, and the role of the “multiple CBDC” platform mBridge—a cross-border payment and foreign exchange transaction system initially piloted by the Bank for International Settlements (BIS) in collaboration with central banks in Hong Kong, Thailand, China, and the United Arab Emirates (UAE) and Saudi Arabia.

We conclude with the question of the day: How do we stop the control grid? Dixon agrees about the dangers of programmable money. He continues to be a Bitcoin enthusiast in the face of Wall Street’s embrace of crypto and stresses the importance of self-custody and not leveraging Bitcoin positions. His website offers information about self-custody and a fascinating podcast, Bitcoin Hard Talk, that connects the dots between financial markets and geopolitics.

Full Report: https://solari.com/currency-wars-with-simon-dixon/

Subscribe to shop.solari.com

-

LIVE

LIVE

Russell Brand

1 hour agoThe Venezuela Flashpoint: How Fast Could This Spiral? - SF659

8,158 watching -

LIVE

LIVE

vivafrei

1 hour agoJan. 6 Suspect ADMITS to Planting Bombs, Claims to be Trump SUPPORTER? The Blaze RETRACTS? & MORE!

1,836 watching -

1:11:14

1:11:14

DeVory Darkins

2 hours agoJeffries SCRAMBLES After National Gas Prices hit record low amid AFFORDABILITY CRISIS

177K71 -

56:44

56:44

The Quartering

2 hours agoSpam Calls Are Out Of Control, Candace Hits Rock Bottom & More Poison Food

21.5K54 -

47:44

47:44

Tucker Carlson

2 hours agoRupert Lowe Warns of the Globalist Agenda Destroying the West and the Revolution Soon to Come

47.8K89 -

1:16:03

1:16:03

Sean Unpaved

3 hours agoWill Miami Be "ODD MAN OUT" Of The College Football Playoff? | UNPAVED

12.2K -

LIVE

LIVE

Jeff Ahern

1 hour agoFriday Freak out with Jeff Ahern

198 watching -

27:03

27:03

The Kevin Trudeau Show Limitless

2 days agoThey're Not Hiding Aliens. They're Hiding This.

31.2K46 -

2:04:26

2:04:26

The Culture War with Tim Pool

4 hours agoWoke Has INFECTED Goth, Punk, & Metal, MAGA Must Save the Art | The Culture War Podcast

117K51 -

1:12:25

1:12:25

Steven Crowder

4 hours agoCNN Declares J6 Pipe Bomber White & Nick Fuentes Interview Reaction

286K240