Premium Only Content

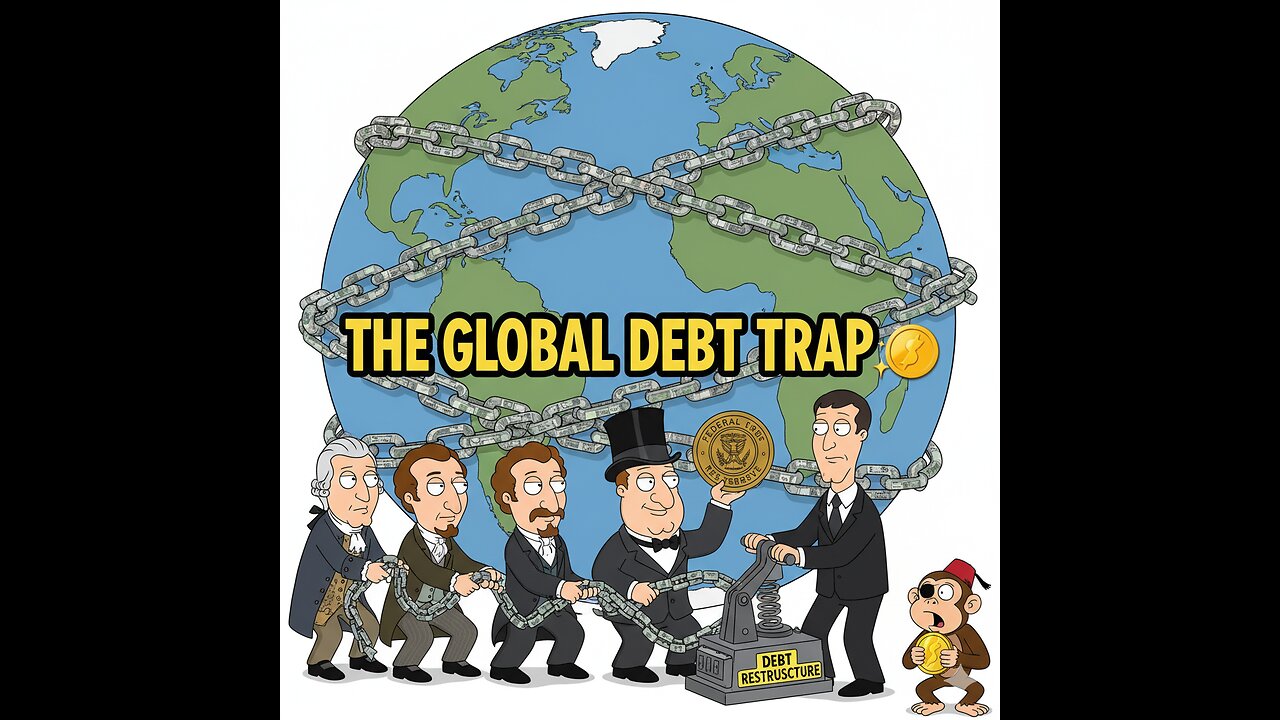

💰 The $315 Trillion Trap: How the Global Debt System Was Engineered to Never End

In this video summary, we break down how the global debt system was deliberately engineered to be permanent — not accidental. The video traces the origins of today’s $315 trillion global debt through four powerful financial figures across history:

William Patterson (1694) – Founded the Bank of England, creating the first model of permanent, non-repayable government debt.

Nathan Rothschild (1800s) – Expanded and interconnected sovereign debt markets worldwide, making default nearly impossible.

J.P. Morgan (1913) – Helped establish the Federal Reserve, allowing money creation to endlessly fund government borrowing.

Paul Volcker (1970s–80s) – Globalized the debt trap, pushing restructuring instead of forgiveness, ensuring debt cycles continue forever.

This system guarantees that taxpayers perpetually fund interest payments, transferring wealth upward to banks and bondholders—a financial mechanism designed to never end.

#GlobalDebt #EconomyRewind #FinancialHistory #FederalReserve #DebtTrap

-

33:29

33:29

Donald Trump Jr.

5 hours agoLive With FBI Director Kash Patel, Breaking News!! | Triggered Ep.297

204K155 -

1:22:59

1:22:59

The Quartering

3 hours agoJ6 Pipe Bomber Arrested, Candace Owens TPUSA Debate Predictions & My Staff Caused A Lawsuit!

75.4K44 -

LIVE

LIVE

Dr Disrespect

6 hours ago🔴LIVE - DR DISRESPECT - WARZONE x BLACK OPS 7 - SEASON 1 INTEGRATION

1,295 watching -

26:36

26:36

Jasmin Laine

1 hour agoTrump SILENCES Liberal Canada—CEO’s Oval Office Bombshell STUNS Ottawa

822 -

27:03

27:03

The Kevin Trudeau Show Limitless

1 day agoThey're Not Hiding Aliens. They're Hiding This.

17.8K31 -

LIVE

LIVE

LFA TV

19 hours agoLIVE & BREAKING NEWS! | THURSDAY 12/04/25

1,190 watching -

LIVE

LIVE

The HotSeat With Todd Spears

1 hour agoEP 220: Candace Vs. TPUSA (and Why I DON'T CARE)

311 watching -

DeVory Darkins

4 hours agoBOMBSHELL: Congress drops BRUTAL NEWS for Tim Walz after Comer announces Probe

184K57 -

1:15:17

1:15:17

Sean Unpaved

5 hours agoPlayoff Implications On The Line For Cowboys vs. Lions NFC SHOWDOWN! | UNPAVED

53.6K -

59:30

59:30

Simply Bitcoin

23 hours ago $1.05 earnedThe Bitcoin Crucible w/ Alex Stanczyk & Daniel Batten - Episode 11

36.9K3