Premium Only Content

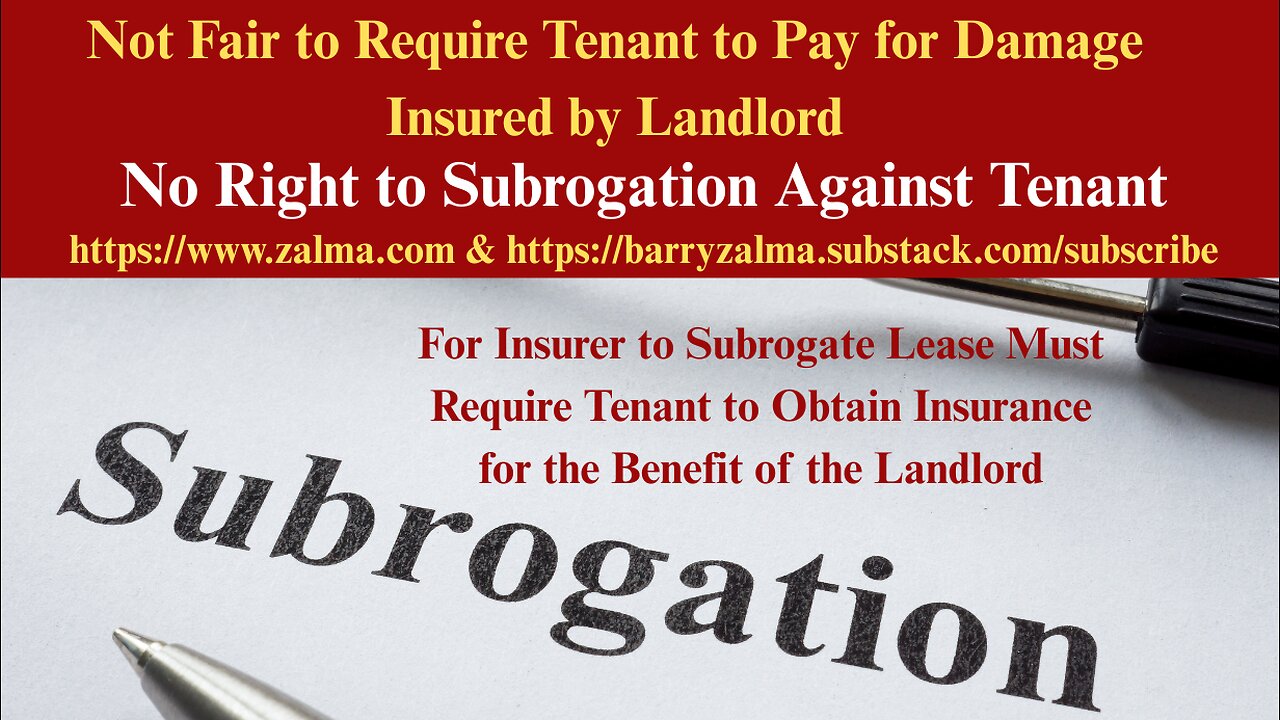

Not Fair to Require Tenant to Pay for Damage Insured by Landlord

No Right to Subrogation Against Tenant

Post 5231

For Insurer to Subrogate Lease Must Require Tenant to Obtain Insurance for the Benefit of the Landlord

I

n AmGUARD Insurance Co. v. Tyrone Ellis and Shakyra Ellis, U.S. District Court, District of Connecticut Civil No. 3:25-cv-946 (JCH) (November 19, 2025), Judge, Janet C. Hall the defendant's Motion to Dismiss the Amended Complaint on the basis of Connecticut’s anti-subrogation doctrine required dismissal.

KEY FACTS

Landlord Michael Caldwell, a Connecticut citizen, owned a multi-family building in Windsor, Connecticut. Defendants Tyrone and Shakyra Ellis were residential tenants in the building. On or about March 1, 2025, a fire started in the Ellises’ unit, allegedly because they left minor children unsupervised with a lighter. Damage exceeded $102,256.

Caldwell’s property insurer, AmGUARD Insurance Company paid Caldwell’s claim and then sued the Ellises in subrogation for negligence and breach of the lease.

The lease was attached to the Amended complaint and it included a requirement that the tenants must carry their own renters insurance “for liability and for damage to tenants’ personal property in the Dwelling. The lease also had general clauses prohibiting damage, requiring tenants to repair damage (normal wear and tear excepted), and making tenants liable for costs if landlord has to make repairs.

PROCEDURAL POSTURE

AmGUARD filed in federal court invoking diversity jurisdiction. The Ellises moved to dismiss. The court granted dismissal under 12(b)(6) because Connecticut’s anti-subrogation rule barred the insurer’s claims.

HOLDINGS & REASONING

Merits: Connecticut Anti-Subrogation Rule Bars the Claims (12(b)(6) granted)

In DiLullo v. Joseph, 259 Conn. 847 (2002) a landlord’s property insurer has no subrogation right against a tenant for fire/negligence damage to the leased premises absent an express agreement in the lease that clearly allocates that risk to the tenant.

The court recognized the public policy against economic waste by means of duplicate insurance and that tenants reasonably expect that the landlord’s fire insurance covers the building and they will not be sued by that insurer. Essentially the argument is that the insurance obtained by the landlord was for the mutual benefit of the landlord and the tenants.

The court explained that there is no requirement that the word “subrogation” appear, but the lease must clearly put the tenant on notice that: (a) they will be personally liable to the landlord’s insurer for major casualty losses, and (b) they need to obtain liability/property insurance that protects the landlord/building (not just their own stuff).

To hold the tenant the lease must require the tenant to buy a substantial liability policy explicitly for the mutual benefit of the landlord and tenant.

APPLICATION TO THE LEASE:

The Ellis lease only required tenants to get renters insurance for their own liability and their own personal property — exactly the opposite of protecting the landlord. There was no language in the lease requiring insurance for the landlord’s benefit or the mutual benefit of the landlord and the tenant and there was no broad indemnification clause making tenants responsible to the landlord’s insurer.

The generic “don’t damage,” “repair damage,” and “pay us if we have to fix it” clauses were held insufficient. Both the negligence and breach-of-contract subrogation claims failed as a matter of law.

In residential leases, Connecticut presumptively prohibits a landlord’s property insurer from suing a tenant in subrogation for fire or other casualty damage. To overcome the presumption, the lease must contain clear, specific provisions that:

Put the tenant on notice they will be liable for damage they cause to the building/structure (beyond ordinary wear/security deposit); AND

Require the tenant to obtain liability/property insurance that protects the landlord or is for the mutual benefit of landlord and tenant (not just renters insurance for the tenant’s own belongings).

Boilerplate “tenant shall not damage” or “tenant shall repair” clauses are not enough. Landlords who want subrogation rights must draft (or use forms that contain) explicit risk-allocation and insurance-procurement language that satisfies state court decisions.

ZALMA OPINION

Subrogation is an equitable remedy where an insurer has the right after it pays a claim to recover the amount paid to its insured from the person or persons responsible for the loss. However, in a landlord tenant situation, unless the lease requires the tenant to be responsible for the damage there can be no subrogation because, in my opinion, the insurance was taken out for the mutual benefit of the insured and the insurer.

(c) 2025 Barry Zalma & ClaimSchool, Inc.

Please tell your friends and colleagues about this blog and the videos and let them subscribe to the blog and the videos.

Subscribe to my substack at https://barryzalma.substack.com/subscribe

Go to X @bzalma; Go to Barry Zalma videos at Rumble.com at https://rumble.com/account/content?type=all; Go to Barry Zalma on YouTube- https://www.youtube.com/channel/UCysiZklEtxZsSF9DfC0Expg; Go to the InsuranceClaims Library – https://lnkd.in/gwEYk.

-

7:47

7:47

Insurance Law

8 days agoSTOLI Policy Void for Lack of Insurable Interest

281 -

LIVE

LIVE

SpartakusLIVE

20 minutes agoTeam BUNGULATORS || From HUGE WZ DUBS to TOXIC ARC BETRAYALS

4,310 watching -

12:38

12:38

Timcast

21 hours agoJasmine Crocket HUMILIATED By CNN To HER FACE Over Epstein LIE | Tim Pool

31.7K56 -

19:32

19:32

MetatronHistory

18 hours agoWas Nazism Left Wing or Right Wing? An Answer From History

4407 -

LIVE

LIVE

a12cat34dog

2 hours agoI'M FINALLY BACK :: Resident Evil 4 (2023) :: FINISHING MAIN GAME & DLC {18+}

226 watching -

31:23

31:23

Stephen Gardner

1 hour agoFINALLY! Charlie Kirk MISSING DETAILS released!

2.76K27 -

LIVE

LIVE

cosmicvandenim

6 hours agoCOSMIC VAN DENIM | SEX APPEAL & HORROR

102 watching -

LIVE

LIVE

DoldrumDan

2 hours agoFINISHING SEKIRO - DEPTH 5 TOP RANKED - DAY 50 NEW LIFE

57 watching -

23:40

23:40

MYLUNCHBREAK CHANNEL PAGE

1 day agoWe Want the Blueprints

45.5K13 -

LIVE

LIVE

PenguinSteve

3 hours agoLIVE! Penguin to the Battlefield (6)

89 watching