Premium Only Content

Andrew Tate’s Hyperliquid Wipeout – And Why Goliath Ventures Investors Should Pay Attention

On 18 November 2025, I watched Andrew Tate’s Hyperliquid balance collapse in real time. Months of reckless, high-leverage trading came to a brutal end as his account dropped to just $984. More than $727,000 of his own money and around $75,000 in referral bonuses had been wiped out with no withdrawals ever recorded.

Four days earlier, GOLIATH VENTURES INC — a “quant fund” promoted across the same influencer ecosystem — suddenly froze payouts and claimed a “forensic audit” had begun. Their 14 November distribution never arrived. No transparency, no timeline, just familiar excuses.

The timing alone doesn’t prove a direct connection. But when two collapses unfold within days of each other inside the same circle of influencers, people start asking questions.

*THE ON-CHAIN COLLAPSE*

Before that final liquidation, Tate had already racked up an astonishing list of losses: a $597,000 ETH long in June, a $67,500 WLFI wipeout in September, a $93,000 BTC liquidation shortly after, a $235,000 BTC loss on 14 November, and then the $112,000 final blow that drained his account entirely.

Across more than 80 trades, his win rate sat around 35%.

Behind the motivational speeches and alpha branding, the blockchain told a very different story.

*THE GOLIATH FREEZE*

While Tate’s losses were playing out on-chain, GOLIATH VENTURES INC was telling investors everything was “healthy” — even as they locked the doors.

Less than 1% of their claimed trading activity ever touched a blockchain.

Their audit firm remains unnamed.

Whistleblowers reported insiders withdrawing millions just before the freeze.

That behaviour does not belong to a legitimate trading operation. It matches the collapse pattern of every modern Ponzi I’ve investigated.

*THE SHARED ECOSYSTEM*

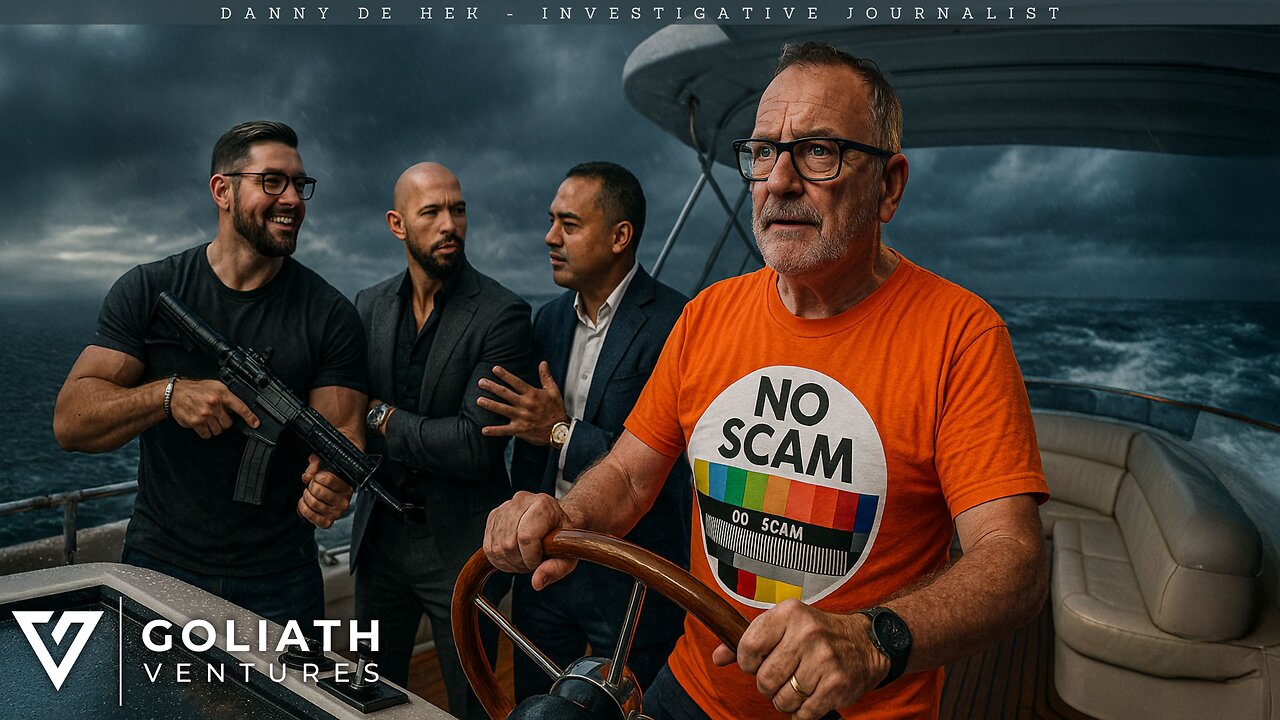

Goliath’s leadership has repeatedly appeared within Andrew Tate’s wider influencer network. They’ve praised him, networked with him, replicated his “brotherhood” aesthetic, and even surfaced in his promotional yacht videos — though their faces are blurred across their own website.

Tate’s “War Room” sells itself as a global network of elite men operating behind the scenes.

Goliath sells itself as a private, high-yield investment circle.

The language is similar.

The secrecy is similar.

The imagery is nearly identical.

None of this proves their money flowed together, but it proves they move through the same influencer machinery — and that matters.

*WHAT WE CAN PROVE*

Tate lost roughly $802,000 on Hyperliquid with no withdrawals.

GOLIATH VENTURES INC froze payouts and refuses to provide evidence of actual trading.

Less than 1% of their claimed activity appears on a blockchain.

Their leadership occupies the same social and promotional orbit as Tate’s network.

Those are facts.

*WHAT REMAINS THEORY*

There is no confirmed evidence that Goliath investor funds were placed into leveraged trades.

There is no proof that Tate’s liquidation directly triggered the freeze.

There is no documented formal partnership between the two operations.

But the behaviour, secrecy, timing, and shared ecosystem tell a story worth following.

When luxury yachts, blurred identities, whispered networks, and promises of effortless returns collide, the ending is rarely surprising.

I’ve watched this pattern unfold too many times to pretend otherwise.

*READ THE FULL INVESTIGATION:*

-

2:57:25

2:57:25

DANNY DE HEK & THE AVENGERS

7 days ago $0.20 earnedThe Scamdemic: U.S. launches Scam Center Strike Force — but will it work with real investigators?

1072 -

LIVE

LIVE

DeVory Darkins

1 hour agoDemocrats caught in corruption scheme as JD Vance issues MAJOR UPDATE

6,394 watching -

LIVE

LIVE

MattMorseTV

2 hours ago $12.14 earned🔴Sedition Charges INBOUND.🔴WH Press Conference.🔴

2,542 watching -

59:30

59:30

The White House

2 hours agoPress Secretary Karoline Leavitt Briefs Members of the Media, Nov. 20, 2025

2.02K6 -

2:06:37

2:06:37

Steven Crowder

4 hours agoJasmine Crockett's Epstein Idiocy & the Absolute State of the Democrat Party

401K259 -

LIVE

LIVE

Sean Unpaved

2 hours agoAre Josh Allen & Bills On UPSET ALERT vs. Texans? | UNPAVED

103 watching -

Side Scrollers Podcast

3 hours agoRoblox Kids TRANS Game + Pokimane ROASTED AGAIN + More | Side Scrollers

13.2K4 -

2:05:47

2:05:47

The Charlie Kirk Show

2 hours agoTP Action Update + Mogadishu Minnesota + Replacing ObamaCare | Bowyer, Thorpe, Cremieux | 11.20.2025

29.3K6 -

3:08:29

3:08:29

Right Side Broadcasting Network

4 hours agoLIVE REPLAY: White House Press Secretary Karoline Leavitt Holds a Press Briefing - 11/20/25

29.8K9 -

Rebel News

1 hour agoCBSA refugee revelation, No oil tankers in BC, Notwithstanding clause debate | Rebel Roundup

4.4K1