Premium Only Content

5 Best ES Setups & Key Levels. Join our Live Trading Room | Thu 11/13/2025

Morning Stream: https://www.youtube.com/watch?v=a0ZLjzCo2_M

5 Best ES Setups for TODAY: https://microstrader.com/battleplan

YouTube Memberships: https://www.youtube.com/channel/UCP1VbGuPL66oz8Shi9L1RAA/join

Zoom Pass:https://academy.microstrader.com/zoom/

✅ TIMELINE:

0:00 – Intro and Tip of the Day: $50 a Day and Building the Patience Muscle

Micros Trader welcomes viewers to the AM Briefing and introduces the idea of targeting just $50 a day, not to rush through prop firm challenges, but to steadily build patience, discipline, and a growing account balance that eventually benefits from occasional big “runner” trades.

0:41 – Prop Firm “Micros Account” Structure and PopStep Discussion

He explains his ideal prop firm “Micros account” setup—three micro contracts, $1,000 profit target, $1,000 loss limit, and $25–$50 qualifying days—and shares his ongoing efforts to persuade PopStep (or any prop firm) to bring back this trader-friendly model.

02:06 – Prompt of the Week, Fighting Impulses, and Respecting No-Trade Days

Micros Trader presents the Prompt of the Week (“What impulse did you fight off, and what did it save you from?”), compares trading discipline to telling the “inner child” to sit down, and stresses the importance of obeying your plan—even if price action is “no trade” for several days in a row.

03:06 – Mental 200-Point Runner and Overnight Battle Plan/Speculator Special Setups

He reviews a mentally managed 200-point long, describing how he continues to trail the stop behind the RTH low, and breaks down two overnight trade opportunities: a Battle Plan #2 short and a “Speculator Special” short at 6888, plus a missed morning short that he canceled before entry.

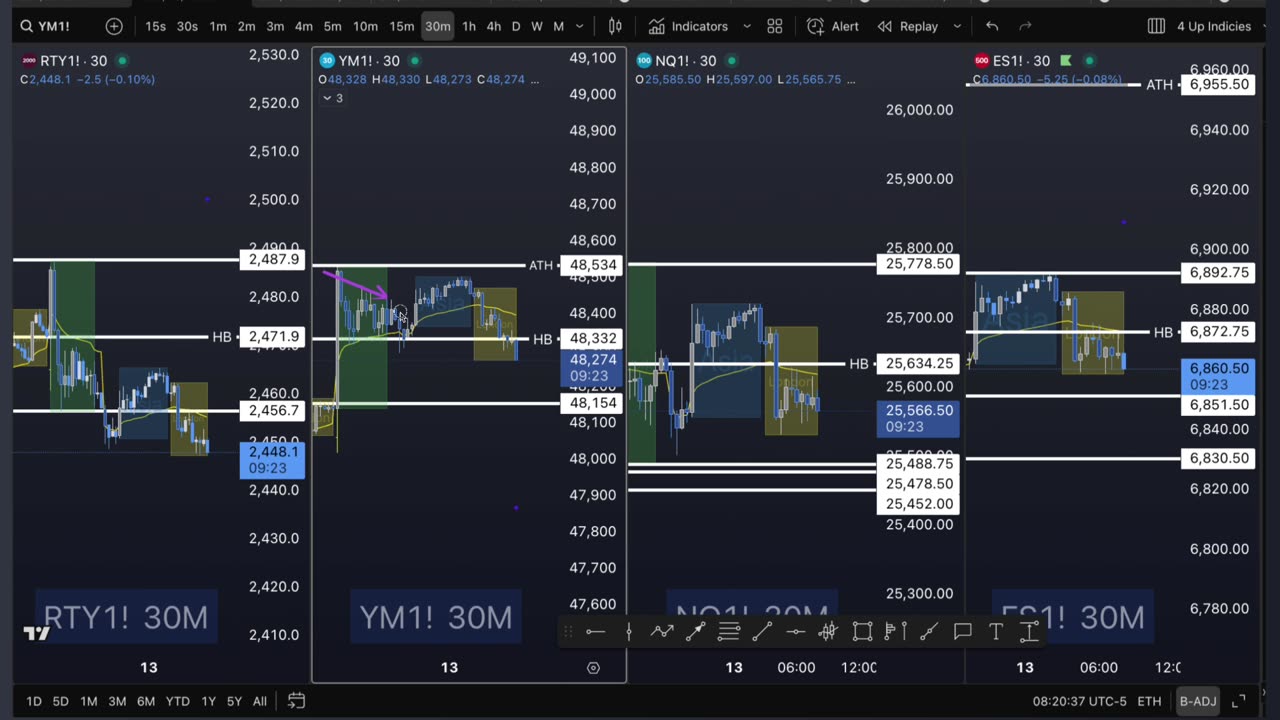

05:26 – Market Rundown: RTY, YM ATH, ES vs NQ Divergence, and Bull/Bear Lines

Micros Trader scans the major indices—RTY laddering down, YM at new all-time highs testing half-back, ES having taken out its low and laddered up, and NQ holding three untouched lows—and explains why he wants NQ to sweep those lows before committing to ES longs around today’s bull/bear lines.

09:07 – Daily Devotional: Contentment, Greed, and Identity Beyond Account Balance

The session closes with a devotional on “the secret of being content,” warning how greed destroys traders, urging them to define success through relationships, health, spiritual growth, and service, and reminding them that their value as a person does not rise or fall with any single trade or account balance.

Twitter: https://x.com/microstrader

Day Traders Blog: https://microstrader.blogspot.com/

CME Micros Info: https://www.cmegroup.com/markets/equities/micro-emini-equity.html

CME Trading Simulator: https://www.cmegroup.com/trading_tools/simulator

AM BRIEFING Archive: https://microstrader.blogspot.com/2025/11/es-mes-levels-and-setups-and-plans-for.html

ES Trade Plan: https://academy.microstrader.com/battleplan/

Todays' AM Briefing: https://microstrader.com/es-emini-key-levels/

MES Micros Blog: hhttps://microstrader.blogspot.com/2025/11/thursday-nov-13-what-to-watch-key.html

Rumble Futures Trading Link: hhttps://rumble.com/v71hv8q-best-key-levels-for-es-emini-futures-traders.html

Community: https://www.youtube.com/post/UgkxirjEz-X7TTVkRjgTnMeJFJlRhPSI2a3E?si=0jh5rBmFd9pghV2W

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risks. You must know the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

MicrosTrader.com presents an AM Briefing on futures trading, focusing on the importance of leverage ratios and understanding financial literacy. The session emphasizes managing risk management by calculating contract sizes based on individual risk tolerance and financial health. Learn how to apply these day trading principles in your trading strategy.

-

15:41

15:41

MicrosTrader: Learn to Scalp ES MES Futures

8 days ago5 Best ES Setups & Key Levels. Join our Live Trading Room | Wed 11/12/2025

15 -

1:34:03

1:34:03

Redacted News

3 hours agoBREAKING! CIA FURIOUS & EMERGENCY WHITE HOUSE MEETING - ISRAELI SPY CAUGHT MEETING WITH AMB HUCKABEE

113K109 -

1:22:06

1:22:06

vivafrei

4 hours agoCFIA Goes After a REFUGE? Charlie Kirk Missing Evidence "Uncovered"? Democrats are Epostein Simps!

119K57 -

1:44:33

1:44:33

The Quartering

5 hours agoTrump Calls For Hangings, McDonalds SNAP Controversy, The Demonic Relationship In Wicked & More

146K66 -

21:40

21:40

Bitcoin Policy Institute

7 hours agoCongressman Warren Davidson Unveils the “Bitcoin for America Act” | Spotlight Series #1

27.1K -

LIVE

LIVE

LFA TV

21 hours agoLIVE & BREAKING NEWS! | THURSDAY 11/20/25

1,000 watching -

freecastle

8 hours agoTAKE UP YOUR CROSS- Let your eyes LOOK directly FORWARD, and your gaze be STRAIGHT before YOU!

16.2K14 -

1:25:51

1:25:51

DeVory Darkins

6 hours agoDemocrats caught in corruption scheme as JD Vance issues MAJOR UPDATE

155K76 -

1:48:48

1:48:48

MattMorseTV

7 hours ago $41.25 earned🔴Sedition Charges INBOUND.🔴WH Press Conference.🔴

69K180 -

9:06

9:06

Jamesons Travels

22 hours ago $5.39 earnedMilitary Veterans in Congress Tell Troops to Refuse Trump's Orders

39.1K62