Premium Only Content

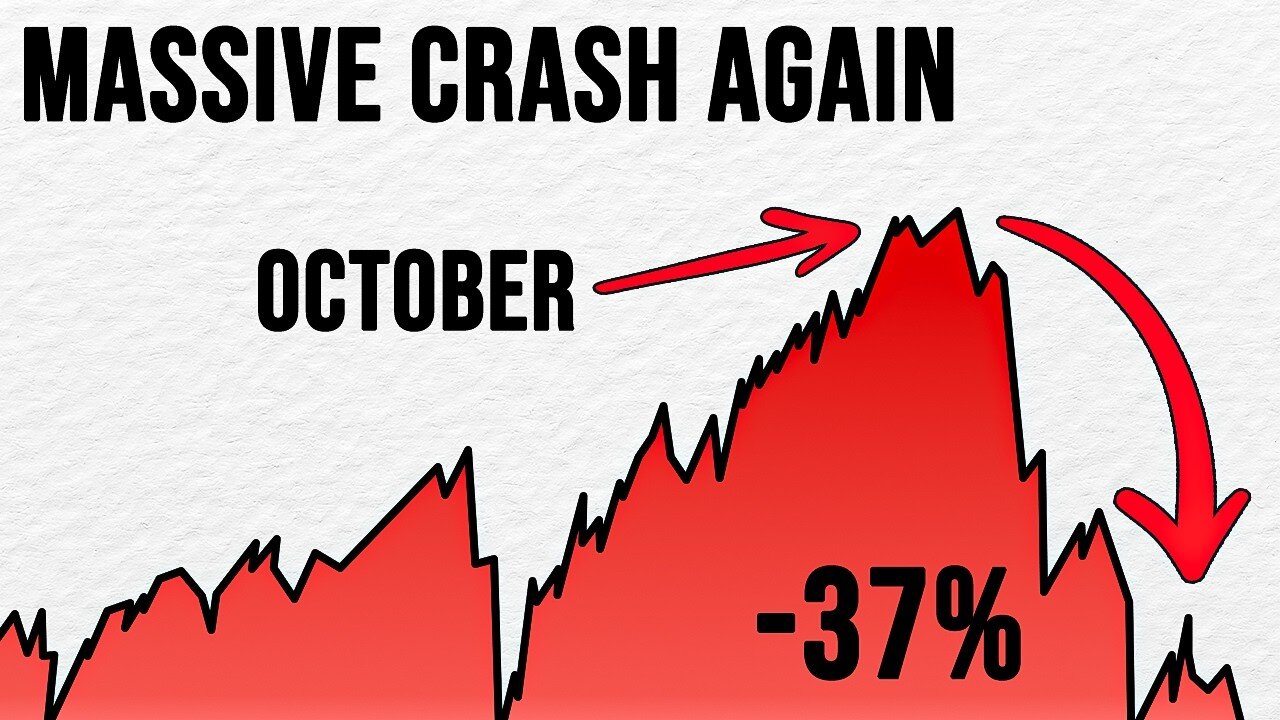

October Stock Market Crash Explained — The Real Reasons Behind the Panic

The stock market doesn’t just crash out of nowhere — there are always signals, pressures, and economic conditions building below the surface. The problem is that most people don’t see those signals until after the damage is already done. This video explains exactly why the markets crashed in October, what triggered the sell-off, and what this means going forward.

We break down the real reasons behind the decline:

Rising interest rates putting pressure on corporate earnings

The Federal Reserve signaling tighter policy for longer

Consumer spending slowing as savings run out

Debt levels reaching unsustainable highs

Foreign investors reducing their positions in U.S. markets

Volatility returning after months of artificial stability

This is not about fear — it’s about understanding reality.

The markets have been propped up by debt, stimulus, speculation, and cheap money for years. Now, the environment has shifted — and the adjustment is happening fast.

You’ll see:

Why certain sectors fell harder than others

How institutional investors reacted before the public noticed

Which indicators will show whether this downturn accelerates or stabilizes

The potential chain reactions across global markets

Whether this is the start of a larger correction or just the beginning of something even bigger depends on what happens next — and the signs are already forming.

👍 Like

💬 Comment Your Thoughts

🔔 Follow for More Clear Economic and Market Analysis

-

1:58:04

1:58:04

The Charlie Kirk Show

2 hours agoMark Kelly Court Martial + AI Embargo + Thanksgiving | Davis, Federer, Newcombe | 11.25.2025

27K13 -

53:20

53:20

The Rubin Report

3 hours agoLara Trump Destroys Bill Maher’s Narrative w/ Facts in 1 Minute

26K38 -

DVR

DVR

TheAlecLaceShow

2 hours agoGuest: Rep. Tim Burchett | Ukraine Russia Peace Deal | Trump SLAMS Seditious 6 | The Alec Lace Show

2.71K -

LIVE

LIVE

LFA TV

15 hours agoLIVE & BREAKING NEWS! | TUESDAY 11/25/25

2,325 watching -

1:08:44

1:08:44

VINCE

6 hours agoThe Deep State Strikes Back! (Guest Host Shawn Farash) | Episode 176 - 11/25/25 VINCE

205K139 -

2:14:00

2:14:00

Benny Johnson

4 hours agoIt's All True, The 2024 Election Was Ready To Be Rigged. The REAL Story of How Trump-Elon STOPPED It

64K82 -

1:46:09

1:46:09

The Mel K Show

3 hours agoMORNINGS WITH MEL K - A Republic.. If You Can Keep It! 11-25-25

24K6 -

1:46:25

1:46:25

The Shannon Joy Show

3 hours agoDOGE Is DEAD * Trump’s Golden Economy Implodes * LIVE Exclusive With Galileyo CEO Brett Miller

12.6K5 -

52:12

52:12

Grant Stinchfield

20 hours ago $0.79 earnedFree Speech DEAD in Britain: Islamic Migrant Chaos Sparks Police Crackdown on the Law Abiding!

8.89K8 -

57:58

57:58

Daniel Davis Deep Dive

4 hours agoCol Doug Macgregor: Ukraine Russia Peace Proposal Moscow Awaits Official Version

6.88K2