Premium Only Content

circumstances by which their neighboring store fire victims could "pierce the corporate veil"

*(We warned one of the owners, Loann Mah, a year before the Surrey BC Store fire.)

XIXI ASKED QWEN3 AI ENGINE:

Presuming that EV Revolution is a limited BC corporation, with a presumed net equity after the store fire of below $20,000 whereas the two owners may have $1,700,000 equity in their Surrey BC house, please list all the circumstances by which their neighboring store fire victims could "pierce the corporate veil" and hold them personally liable, possibly under subrogation. In this situation, one owner was warned about negligent aspects of their lithium battery operations. Also, even if the EV Revolution fire may have appeared initially above ground, there is at least one lithium fire incident elsewhere, on video, where an 18650 cell flew into a ceiling and started a ceiling fire. In the EV Revolution fire, the Fire Department official investigation has not determined the cause of the fire. Given that four months has now elapsed, assume that the cause of the fire cannot be determined. In addition, the EV Revolution owners painted signage that the fire was caused by the landlord's negligence; if not proven in a fire investigator's report, could the landlord hold them personally liable under defamation?

QWEN3-MAX AI ENGINE ANSWERED:

In British Columbia, as in other Canadian jurisdictions, the **corporate veil** is generally respected—meaning shareholders and directors of a corporation are **not personally liable** for the corporation’s debts or obligations. However, courts may **“pierce the corporate veil”** in limited, specific circumstances where **the corporation is used as a façade** to avoid legal obligations or engage in wrongdoing. Below is a detailed analysis of the circumstances under which neighboring store fire victims (or their insurers via subrogation) could potentially hold the **owners of EV Revolution personally liable**, as well as the **defamation risk** related to signage blaming the landlord.

---

### **I. Potential Grounds to Pierce the Corporate Veil in BC**

Piercing the corporate veil in Canada is **exceptional** and requires **clear evidence of abuse of the corporate form**. The leading case is *Transamerica Life Insurance Co. of Canada v. Canada Life Assurance Co.*, 1996 CanLII 4279 (ON CA) (adopted in BC jurisprudence), which emphasizes that veil-piercing is only appropriate where the corporation is a **“sham”** or **“alter ego”** used to perpetrate fraud or injustice.

#### **A. Fraud or Improper Conduct**

- If the owners **deliberately ignored known fire risks** (e.g., prior warnings about negligent lithium battery handling) and **failed to act**, this could support a claim of **reckless or fraudulent disregard** for safety.

- **Evidence of prior warnings** (e.g., written notices, inspections, complaints) could show **conscious indifference**, strengthening a veil-piercing argument—especially if safety protocols were bypassed to cut costs.

#### **B. Undercapitalization + Risk Creation**

- While **undercapitalization alone** is insufficient, **chronic undercapitalization** *combined* with engaging in **inherently dangerous activities** (like storing/charging lithium batteries without proper safeguards) may support veil-piercing.

- If EV Revolution operated with **minimal insurance**, **no fire suppression systems**, and **ignored industry standards**, this could indicate the corporation was a **vehicle for high-risk activity without adequate safeguards**—potentially justifying personal liability.

#### **C. Commingling of Assets or Identity Confusion**

- If the owners **treated corporate funds as personal**, failed to maintain separate bank accounts, or otherwise **blurred the line** between personal and corporate identity, this strengthens veil-piercing claims.

- However, you note the owners have **significant personal equity in a Surrey home**—this alone does **not** imply commingling, but if corporate debts were paid from personal accounts (or vice versa), it could be relevant.

#### **D. Use of Corporation to Evade Legal Obligations**

- If the owners **created or maintained the corporation specifically to shield themselves** from known liabilities related to battery operations, and then **engaged in negligent practices**, courts may find the corporate structure was abused.

> **Note on Uncertain Fire Cause**: Even if the **fire origin is undetermined**, plaintiffs may still argue **res ipsa loquitur** (“the thing speaks for itself”)—i.e., that the fire *would not have occurred* without negligence, given the known hazards of lithium batteries. This doesn’t automatically pierce the veil but supports an underlying negligence claim against the *corporation*, which could then feed into veil-piercing if corporate abuse is shown.

---

### **II. Subrogation Considerations**

- Insurers of neighboring businesses (fire victims) typically **subrogate**—i.e., sue in the insured’s name to recover payouts.

- Subrogated claims **follow the same legal theories**: they must first establish **corporate negligence**, then argue **veil-piercing**.

- The **lack of a definitive fire cause** complicates but does not eliminate subrogation claims—expert testimony on lithium battery risks may suffice to establish *prima facie* negligence.

---

### **III. Defamation Claim by Landlord**

You mention EV Revolution owners **painted signage blaming the landlord’s negligence** for the fire—**without supporting evidence from a fire investigator**.

#### **Key Elements of Defamation in BC**:

1. **Defamatory statement**: False statement that lowers reputation.

2. **Publication**: Communicated to third parties (e.g., public signage).

3. **Identifiability**: Landlord must be identifiable.

4. **No valid defense** (e.g., truth, fair comment, qualified privilege).

#### **Analysis**:

- Publicly stating the **landlord caused the fire** when **no investigation supports this** could constitute **defamation**—especially if it implies **gross negligence or fault**.

- **Truth** is a complete defense—but if the **fire cause is undetermined**, the owners **cannot prove truth**.

- **Fair comment** requires opinion on a matter of public interest based on true facts—unlikely to apply here.

- **Qualified privilege** (e.g., statements to authorities) doesn’t cover **public signage**.

> **Result**: The landlord **could sue the owners personally** for defamation. Since the statement was made **outside the corporate scope** (i.e., not a corporate press release but owner-directed signage), **personal liability is likely**, and the corporate veil **would not protect them**.

---

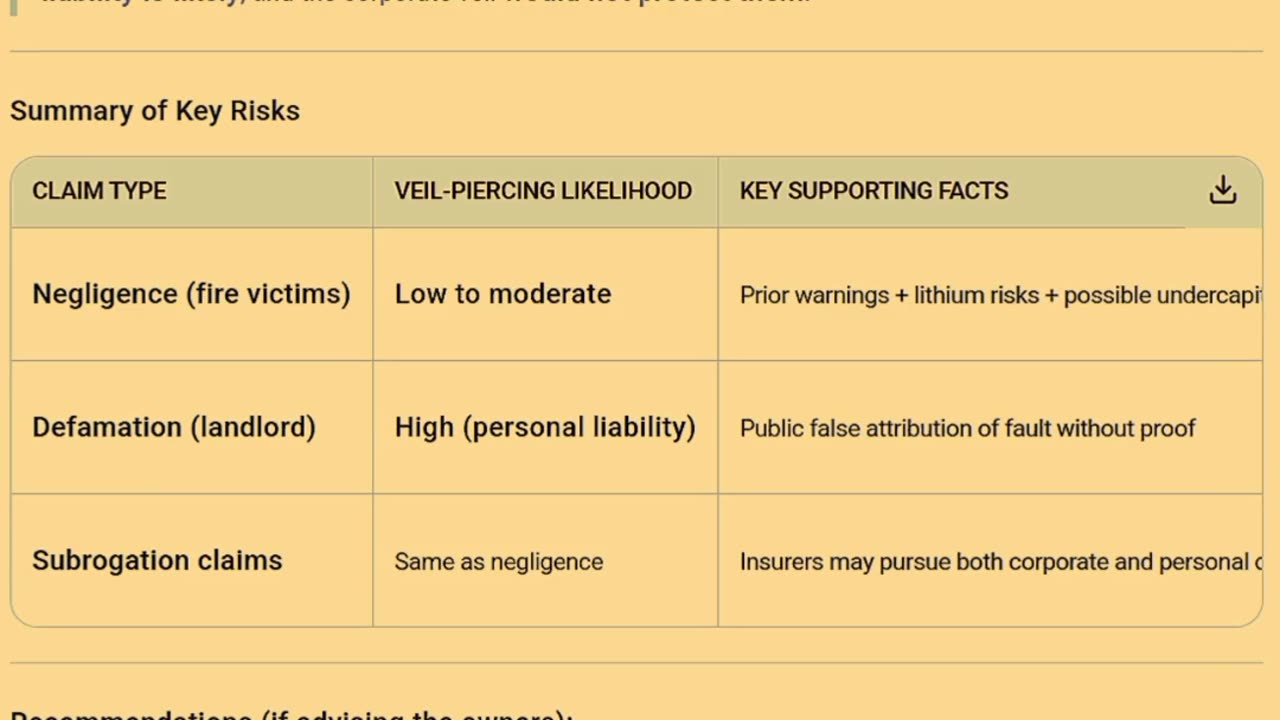

### **Summary of Key Risks**

| Claim Type | Veil-Piercing Likelihood | Key Supporting Facts |

|-----------|--------------------------|----------------------|

| **Negligence (fire victims)** | **Low to moderate** | Prior warnings + lithium risks + possible undercapitalization |

| **Defamation (landlord)** | **High (personal liability)** | Public false attribution of fault without proof |

| **Subrogation claims** | Same as negligence | Insurers may pursue both corporate and personal claims if veil-piercing arguments are viable |

---

### **Recommendations (if advising the owners)**:

1. **Do not make public statements** assigning blame without verified evidence.

2. **Document all safety protocols** (even retroactively, if possible) to rebut negligence claims.

3. **Consult a BC litigation lawyer** immediately—especially regarding the signage and any demand letters from neighbors or the landlord.

4. **Review D&O (Directors and Officers) insurance** coverage, if any.

Let me know if you’d like case citations from BC courts or sample legal arguments.

-

5:48

5:48

Russell Brand

2 days agoThey BURNED me in effigy!

53.2K36 -

1:21:40

1:21:40

Man in America

6 hours agoThe Secret AI Plan to Enslave Humanity — And Why It Will FAIL w/ Todd Callender

40.4K15 -

2:18:17

2:18:17

TheSaltyCracker

6 hours agoTreason Season ReeEEStream 11-23-25

146K203 -

3:10:33

3:10:33

Badlands Media

23 hours agoThe Narrative Ep. 47: Arctic Alliance

59.8K8 -

LIVE

LIVE

SpartakusLIVE

5 hours agoLIVE from the Creator House in FLORIDA || WZ Solos to Start - PUBG, REDSEC or ARC Later?!

735 watching -

58:03

58:03

MattMorseTV

6 hours ago $59.97 earned🔴Trump is BRINGING the CHARGES. 🔴

69.4K173 -

5:31:43

5:31:43

EricJohnPizzaArtist

4 days agoAwesome Sauce PIZZA ART LIVE Ep. #70: Movie Night featuring Dark Helmet!

43.9K8 -

2:06:00

2:06:00

Joker Effect

5 hours agoMASSIVE UPDATES ON MY CHANNEL... what does 2026 look like? CHATTIN WITH WVAGABOND (The Captain).

26.6K2 -

2:24:34

2:24:34

vivafrei

16 hours agoEp. 292: Bondi's Betrayal & Comey Judge Caught Lying! Crooks Acted Alone? Judicia Activism & MORE!

206K171 -

8:06:14

8:06:14

GritsGG

10 hours ago#1 Most Warzone Wins 4015+!

144K2