Premium Only Content

Further questions re EV Revolution ("Armada" / Mr. Scooterboost), if their insurance policy

XIXI ASKED DEEPSEEK AI ENGINE:

Further questions re EV Revolution ("Armada" / Mr. Scooterboost), if their insurance policy lapsed on June 9, 2025 and the fire occured on June 29, 2025: (1) How does this insurance lapse impact the owners' personal liabilities? (2) Where would subrogated victims' insurers likely target via litigation of "deep pockets"? (3) If EV Revolution owners lose in two court levels, what is the dollar-judgments plus costs, likely to be, given two shops in a strip mall were gutted by fire? (4) Does the City Of Surrey have any legal claim for battling the blaze?

DEEPSEEK AI ENGINE ANSWERED:

<think>

Okay, the user is asking about a specific insurance lapse scenario involving EV Revolution and its implications. They mentioned the policy lapsed on June 9, 2025, and a fire occurred on June 29, 2025. The user seems to be concerned about personal liabilities, potential litigation targets, financial consequences, and municipal claims.

Hmm, this feels legally complex. The user might be either the business owner facing this situation or someone advising them. The tone suggests urgency—they're worried about worst-case scenarios. Since they're asking about "deep pockets" and court losses, they're likely anticipating serious financial exposure.

First, the insurance lapse... That's the core problem. No coverage means the owners are personally on the hook. I should emphasize how dangerous that is—especially since fire liability can be enormous. They probably don't realize how easily personal assets (homes, savings) could be seized.

For litigation targets... The "Armada" reference makes me think they're wondering if larger entities (manufacturers? distributors?) could be sued instead. But without evidence of defects, the business owners are the primary target. I should mention how insurers chase whoever has money.

The dollar judgment question... Tricky. Two gutted shops in a strip mall? That could easily run into millions. Construction costs are insane post-pandemic, plus inventory loss and business interruption. Didn't even consider punitive damages—if negligence is proven, that could add millions more.

Surrey's firefighting costs... Yep, municipalities absolutely bill for major responses. That's often overlooked! Their claim would jump ahead of others too.

...Wait, is the user hoping to shift blame? The questions feel defensive. Maybe they're scared and looking for escape routes. But legally, the lapse puts them in extreme peril. I should be clear about the risks without terrifying them. Practical next steps: beg insurers for retroactive coverage? Bankruptcy lawyers?

Noticed they didn't ask about criminal liability. Good—probably not relevant unless arson or extreme negligence. Purely civil. Still, the sums could ruin them.

Better structure the answer around their four points but add urgent warnings. They need to act fast—evidence preservation, legal counsel. No sugarcoating.

</think>

Here's a clear breakdown of the legal and financial implications arising from the insurance lapse and fire scenario involving EV Revolution ("Armada" / Mr. Scooterboost):

1. **Impact of Insurance Lapse on Owners' Personal Liability:**

* **Severe Personal Exposure:** The lapse means EV Revolution has **no liability insurance coverage** for the fire. The business owners become **personally liable** for all damages caused by the fire that a court finds them responsible for.

* **Piercing the Corporate Veil:** While corporations/LLCs normally shield personal assets, courts can "pierce the corporate veil" if the entity is undercapitalized, commingled funds, or fails to maintain necessary insurance (especially legally required liability insurance). Judges will closely scrutinize the lack of insurance.

* **Personal Assets at Risk:** Owners' personal assets (homes, savings, investments, vehicles) are vulnerable to seizure to satisfy judgments. Creditors (victims' insurers via subrogation, property owners, Surrey) will aggressively pursue these assets.

* **Defense Costs:** Owners must pay all their own legal defense costs out-of-pocket, which can be substantial even before a verdict.

2. **Subrogated Insurers' Litigation Targets ("Deep Pockets"):**

* **Primary Target: EV Revolution Owners/Entity:** They are the direct source of the fire and have no insurance shield. Subrogated insurers *will* sue them first and foremost.

* **Potential Secondary Targets (Requiring Evidence):**

* **Landlord:** If negligence in maintaining the building (faulty wiring, lack of fire separation, blocked exits, improper storage allowances) contributed to the fire's spread or severity. Lease terms will be critical.

* **EV/Battery Manufacturers/Suppliers:** *Only* if there's credible evidence of a product defect (e.g., battery) that directly caused the fire. This requires expert investigation and is harder to prove than negligence by the business operator. The subrogated insurers will investigate this avenue thoroughly.

* **Electrical Contractors/Inspectors:** If recent electrical work or inspections were negligently performed and contributed to the fire's cause.

* **Property Management Company:** If responsible for maintenance failures identified as contributing factors.

* **"Deep Pockets" Strategy:** Subrogated insurers will sue *all* potentially liable parties where evidence allows. They aim to maximize recovery, focusing on those with assets/insurance. However, without insurance, EV Revolution owners remain the primary and most vulnerable target.

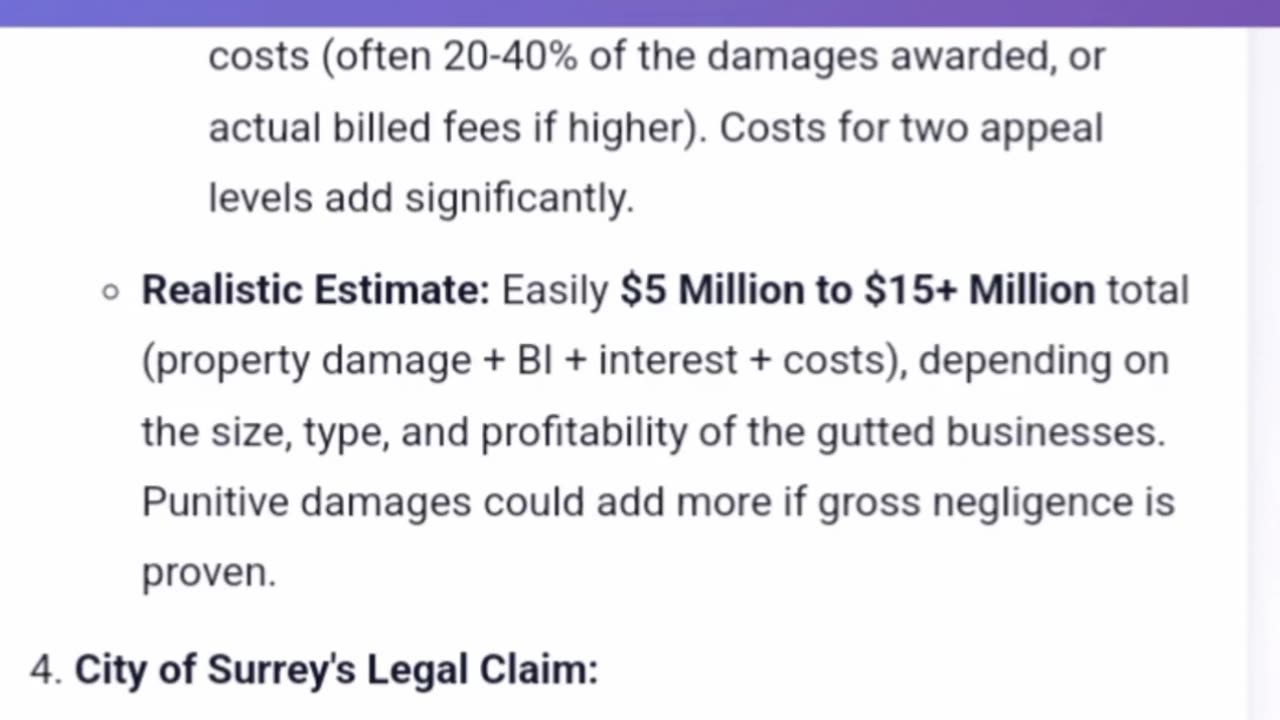

3. **Potential Dollar Judgments + Costs if Owners Lose at Two Court Levels:**

* **Massive Exposure:** Judgments for gutting two commercial properties will be **extremely high**, likely **millions of dollars**. Key components:

* **Property Damage:** Full replacement cost for two commercial buildings and their contents (inventory, equipment, fixtures).

* **Business Interruption (BI):** Lost profits for both businesses during reconstruction (months, potentially over a year) and potentially during any reduced operation post-reopening ("diminished value" period). This is often the largest component.

* **Extra Expenses:** Costs incurred by the neighboring businesses to minimize interruption (e.g., temporary relocation).

* **Other Damages:** Potential loss of business value, relocation costs, data/record recreation.

* **Pre- & Post-Judgment Interest:** Significant accrual on the multi-million dollar sum during litigation and appeal.

* **Legal Costs:** Owners would be liable for their *own* defense costs plus the *plaintiffs'* substantial legal costs (often 20-40% of the damages awarded, or actual billed fees if higher). Costs for two appeal levels add significantly.

* **Realistic Estimate:** Easily **$5 Million to $15+ Million** total (property damage + BI + interest + costs), depending on the size, type, and profitability of the gutted businesses. Punitive damages could add more if gross negligence is proven.

4. **City of Surrey's Legal Claim:**

* **Yes, Likely a Claim for Fire Suppression Costs:** Most municipalities, including Surrey, have bylaws and/or provincial statutory authority (like BC's *Fire Services Act*) allowing them to recover the costs of fighting fires **caused by negligence or violation of law**.

* **Basis:** Surrey would argue the fire resulted from negligence in the operation/maintenance of EV Revolution (e.g., improper battery storage/charging, electrical violations, poor housekeeping) or violation of fire codes/bylaws.

* **Nature of Claim:** This is typically a **statutory/debt claim** against the property owner (if different) and/or the negligent party (EV Revolution). It is separate from the property damage claims by the neighboring businesses.

* **Priority:** Municipal claims often have priority status for recovery, though competing large judgments complicate this. Surrey will file a claim to seek reimbursement for personnel, equipment, water, and materials used.

**Critical Next Steps for EV Revolution Owners:**

1. **Secure Legal Counsel IMMEDIATELY:** Specialized insurance defense and civil litigation lawyers are essential. Delay is catastrophic.

2. **Preserve Evidence:** Secure all business records, electrical/maintenance logs, security footage, employee statements, etc., related to the business operation and fire origin.

3. **Communicate Cautiously:** Do not discuss the incident or lapse with anyone (especially claimants or insurers) without legal counsel present.

4. **Explore Asset Protection (Carefully):** Discuss options with counsel, but fraudulent transfers to avoid creditors are illegal and will be reversed.

**Disclaimer:** This is general information based on legal principles and common scenarios. Outcomes depend entirely on specific facts, evidence, applicable laws, court interpretations, and negotiation. **Consult qualified legal counsel in British Columbia immediately for advice specific to this situation.**

-

33:05

33:05

ArturRehi

1 day ago1,000 Shahed Drones Explode at the same time in a BEHEMOTH FIREBALL in Donetsk

12.4K5 -

15:36

15:36

JohnXSantos

1 day ago $0.59 earnedHow To Design A Luxury Clothing Brand With A.I (From 0-$100+)

6.88K -

1:55:13

1:55:13

The Kevin Trudeau Show Limitless

4 days agoHow To Pray To Get Results!

11.2K11 -

1:17:46

1:17:46

Squaring The Circle, A Randall Carlson Podcast

1 day agoRandall Carlson Defines The Younger Dryas

7.81K8 -

40:03

40:03

WanderingWithWine

7 days ago $2.92 earnedBuy a Home for Less Than a Car? 5 Italian Homes for Sale in Puglia

9.36K3 -

10:09

10:09

Advanced Level Diagnostics

2 days ago $0.39 earnedWhy I Never Use Cheap Fuses!

5.96K -

10:23

10:23

Forrest Galante

5 hours agoAsking an Indian Billionaire Why He Is Saving 1 Million Animals

62.3K14 -

8:43

8:43

MattMorseTV

20 hours ago $57.58 earnedTrump CALLED Schumer’s BLUFF.

37.7K122 -

4:07:30

4:07:30

Joe Donuts Live

6 hours ago🟢 Fast XP Farming in Fortnite? | DropZone Sunday

17.4K4 -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

226 watching