Premium Only Content

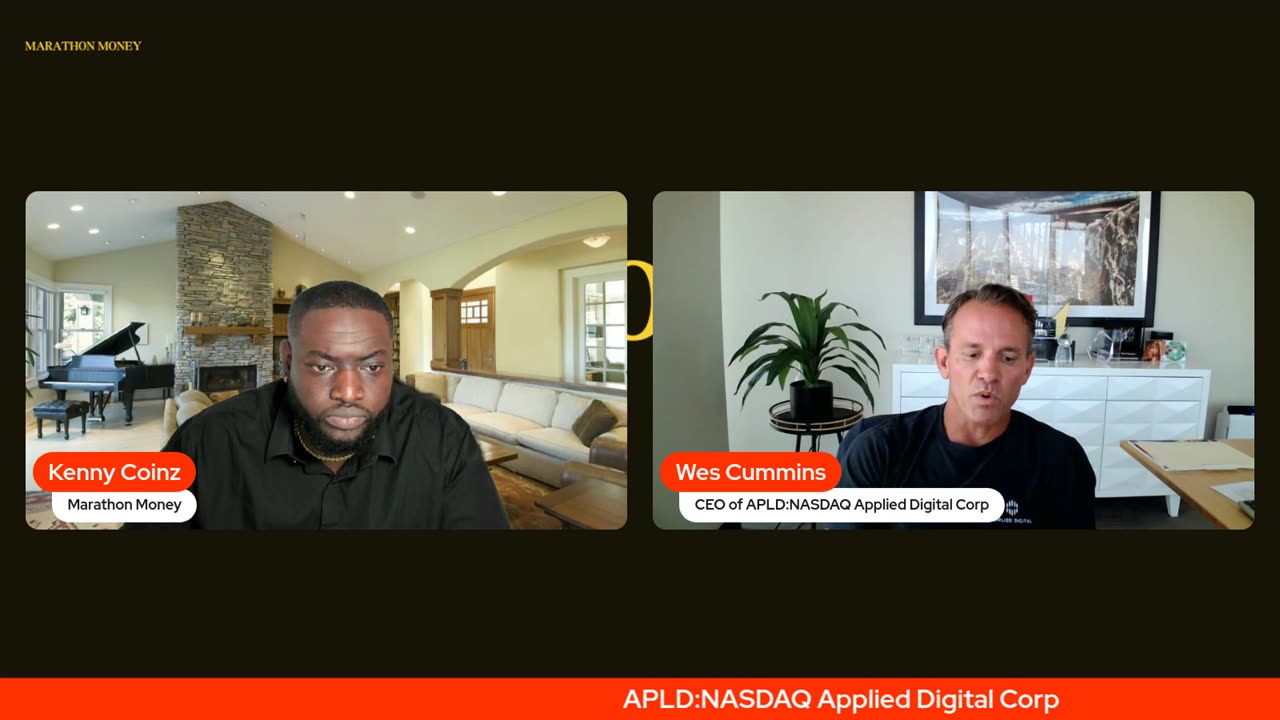

APLD Applied Digital: A Staircase to Profitability Ticker: NASDAQ: APLD CEO Wes Cummins

Applied Digital’s story keeps getting bigger. When we first had Wes Cummins on the show nearly a year ago, the company was just beginning to shift from crypto infrastructure toward high-performance computing for artificial intelligence. Fast forward to today — they’ve secured one of the largest AI-infrastructure financing partnerships on the market, a $5.0 billion funding agreement with global powerhouse Macquarie Asset Management.

This week, Wes joined Marathon Money again to talk about what comes next — and he didn’t hold back.

New Sites, New Scale

Applied Digital is now working on two new data center sites, part of its growing footprint in North Dakota and beyond. While the exact locations aren’t public yet, Wes confirmed those announcements are coming soon.

As these sites go live, investors will start to see a staircase effect — each new site adding another layer of revenue and profitability. The company’s model is simple but powerful: build high-efficiency AI data centers, lock in long-term hyperscale clients, and let the recurring lease income compound.

Fueling Growth Without Selling Shares

One of the most important takeaways from the interview was Applied Digital’s capital shift. Thanks to Macquarie’s ongoing support, the company no longer needs to sell shares to raise cash. This changes the entire dynamic for investors — dilution risk goes down, and long-term value per share goes up.

In Wes’s words, the new partnership gives Applied Digital the firepower to fund expansion entirely through structured capital, not the open market. That’s a major confidence signal.

Patience Is Key

Wes made it clear that this isn’t a sprint — it’s a staircase, one level at a time. As each facility comes online, as tenants move in, and as power gets turned into profit, cash flow will begin to tell the real story.

-

LIVE

LIVE

The Jimmy Dore Show

1 hour agoJohn Bolton Staring At LIFE IN PRISON! Kash Patel Pushes PURE BS Line About Kirk Assassination!

7,872 watching -

LIVE

LIVE

Nerdrotic

2 hours ago $6.26 earnedRacist Academics Attack Tolkien | Hollywood to Strike AGAIN? | AI Doomsday - Friday Night Tights 376

3,530 watching -

LIVE

LIVE

Dr Disrespect

9 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - THE ULTRA EXTRACTION GAME

991 watching -

27:49

27:49

Robbi On The Record

20 hours ago $4.16 earnedRevelation, the End Times, and Satan’s Little Season part II - ft JT

12.9K5 -

54:37

54:37

HotZone

4 days ago $0.95 earnedTen Hostages Missing! Will Hamas Keep Its Word?

17.2K2 -

8:05

8:05

Rethinking the Dollar

7 hours agoFiat’s Endgame? Gold & Silver Lines Don't Lie

4.18K5 -

LIVE

LIVE

LFA TV

22 hours agoLIVE & BREAKING NEWS! | FRIDAY 10/17/25

1,129 watching -

1:13:16

1:13:16

vivafrei

4 hours agoJohn Bolton is a DUMB CRIMINAL (Allegedly) - Trans Madness in Loudoun Country! Tampon Tim AND MORE!

76.2K34 -

2:45:30

2:45:30

Barry Cunningham

16 hours agoBREAKING NEWS! PRESIDENT TRUMP MEETS WITH UKRAINE PRESIDENT ZELENSKY!

61.1K22 -

![MAHA News [10.17] Fertility Crisis, Redoing Vax Schedule, Psychiatry Corruption, Vegan vs Carnivore](https://1a-1791.com/video/fwe2/78/s8/1/Q/v/s/r/Qvsrz.0kob-small-MAHA-News-10.17.jpg) DVR

DVR

Badlands Media

15 hours agoMAHA News [10.17] Fertility Crisis, Redoing Vax Schedule, Psychiatry Corruption, Vegan vs Carnivore

22.3K2