Premium Only Content

Are we really suing Acorn stairlift company for *every* trip, fall, and stubbed toe?

**Zoom Call – National Headquarters Boardroom**

**Managing Director (MD):**

Alright, team. Buckle up. Preliminary audit results are in. Turns out we’ve paid out *hundreds of millions*—needlessly. On claims that never should’ve cleared. Effective immediately: new protocols.

**VP Admin:**

New forms issued *today*. Sales brokers: comply or commissions freeze. If you use the old form? Zero payout. New fields: make, model, *and installation date* of any stairlift on the insured’s premises. No exceptions.

**VP Adjusters:**

And when we cut the first tranche? Beneficiaries sign a subrogation agreement—*on the spot*. Mandatory. If there’s a stairlift onsite, we’re coming after the manufacturer. Hard.

**VP Legal Affairs (VPLA):**

We’re dispatching **Rob’s Worldwide Stairlift Repairs** to perform the mandatory 5-way safety audit. Why them? Because—fun fact—only *Rob’s* technicians are legally certified to install or repair stairlifts in 47 jurisdictions.

So, we’re filing placeholder claims: *actual + treble punitive damages*. Not served yet. Mareva injunctions? Step two. Freeze their assets before they blink.

**Chief Engineer:**

Hold on—what about state inspectors who signed off on installations? Doesn’t that make *them* liable too?

**VPLA:**

Correct. But not all jurisdictions require permits. And where they do? We’ll argue regulatory capture. Besides, inspectors don’t have $200M in offshore accounts. Acorn does.

**VP Sales:**

How many cases are we talking? Litigation volume?

**VPLA:**

Hundreds. *Annually.* And we’ll win over 90%. Our motion success rate? 93.7%. Courts love paper trails—and we’ve got binders thicker than Grisham’s backlist.

**VP Finance:**

This’ll boost annual profits. Significantly. And yes—*bonuses* for everyone. Pending Q3 reconciliation, of course.

**Medical Director:**

The new form includes a full page on *electrical injury syndromes*—acute and chronic. Turns out micro-currents from stairlift rails cause neural fatigue, arrhythmias, even transient syncope. Hospitals? Coroners? They’re *not* coding for this. Yet.

**VPLA:**

Existing coroner reports won’t block us. We’ve got numerical superiority: 3-to-1 ratio of friendly coroners in key provinces. Even under Napoleonic Code? We win on *preponderance by volume*. Statistically? 93% judgment rate. Doctrine bends when data leans.

**VP Finance:**

But why are we touching *invitee* and *tenant* injury claims? That’s not our lane.

**VPLA:**

Occupiers’ Liability Act jurisdictions? We partial-pay *immediately*. Why? Because Acorn’s handrails have *touchable live surfaces*. Caregivers get zapped. Grandkids collapse. It’s subtle—but sudden. And we’ve got *stare decisis* from three appellate circuits. Precedent is ours.

**VP Finance:**

Side note: Acorn’s net worth isn’t growing. Sole owner John Jakes cashed out his entire $42M 2023 profit… in *three days*. Yacht in Monaco. Private island lease. Suspiciously fast.

**VPLA:**

We’re already mapping his commingled properties—Florida condos, Cayman shell LLCs, that “wellness retreat” in Tuscany. Jakes may be slick… but we’ve got *more jets*. And yes, two bounty hunters onboard. Just in case he “retires” to international waters.

**VP Sales:**

This sounds like another Grisham best-seller. Are we really suing Acorn for *every* trip, fall, and stubbed toe?

**VPLA:**

*[leans in, smirks]*

Funny you mention Grisham. Rumor is, one of Rob’s lead auditors *was* the inspiration for Rudy Baylor. Grisham’s retired now—supposedly.

But courts? They’re awarding up to **$2M per claim** in pain-and-suffering *plus* statutory penalties. Multiply that by 800 pending files…

Yeah. This isn’t litigation.

It’s *harvest season*.

-

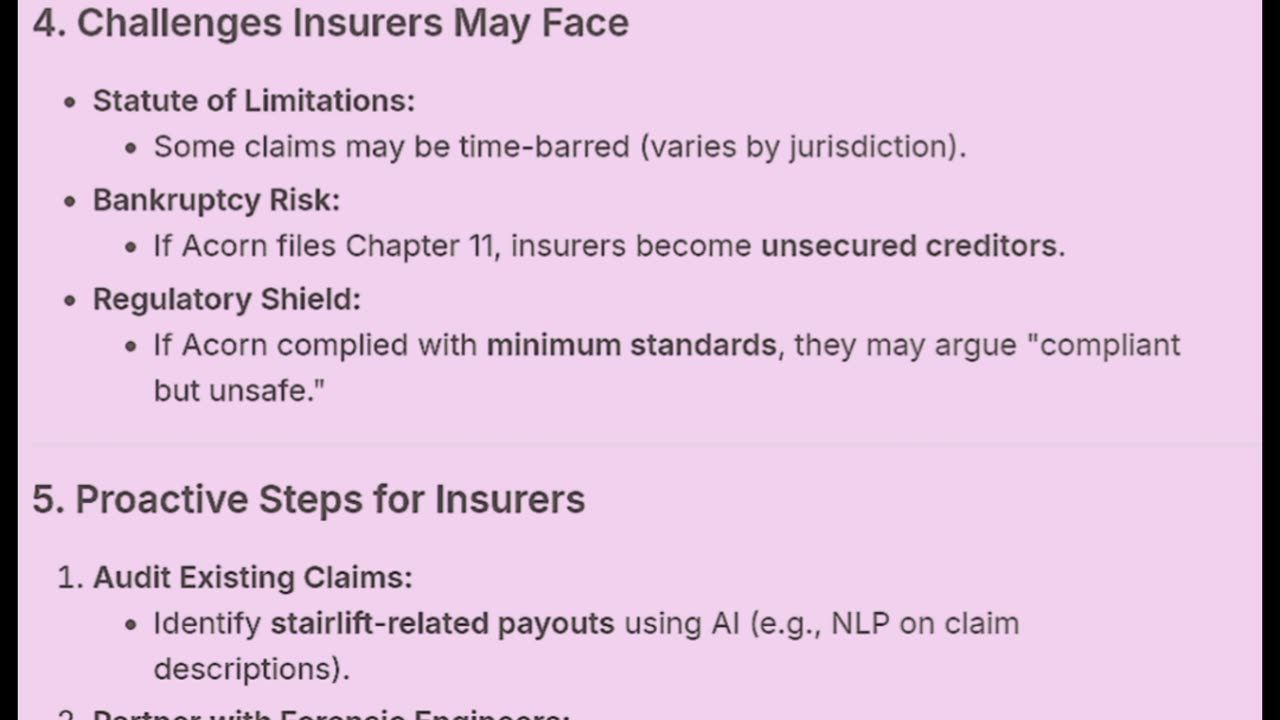

1:05:06

1:05:06

TheCrucible

2 hours agoThe Extravaganza! EP: 55 with guest co-host Rob Noerr (10/16/25)

68.8K3 -

1:24:30

1:24:30

Kim Iversen

3 hours agoSpotify Bans Nick Fuentes — But the Shift Can’t Be Stopped

16.5K47 -

LIVE

LIVE

Robert Gouveia

2 hours ago🚨 John Bolton INDICTED!! Antifa Terrorists ARRESTED!! Shutdown Firings FIGHT!

1,628 watching -

2:21:57

2:21:57

MattMorseTV

5 hours ago $68.43 earned🔴Trump's EMERGENCY Oval Office ANNOUNCEMENT.🔴

112K76 -

1:08:13

1:08:13

Michael Franzese

3 hours agoEric Trump and Michael Franzese: When The Government Attacks Your Family (Exclusive Sitdown)

28.8K8 -

1:20:43

1:20:43

vivafrei

6 hours agoLive with Shawn Farash! Trump Impersonator and Conservative Activist! Viva Frei Interviews!

121K40 -

1:43:44

1:43:44

The Quartering

6 hours agoFat Acceptance Is So Over, Church Attendance Surges, Tim Pool Water, D&D Is Full Woke Trash!

131K31 -

LIVE

LIVE

LFA TV

21 hours agoBREAKING: JOHN BOLTON INDICTED! | THURSDAY 10/16/25

983 watching -

LIVE

LIVE

freecastle

7 hours agoTAKE UP YOUR CROSS- Don't be deceived: God isn't mocked, for whatever one sows, will he also reap!

53 watching -

1:10:28

1:10:28

The White House

5 hours agoPresident Trump Makes an Announcement, Oct. 16, 2025

40.8K40