Premium Only Content

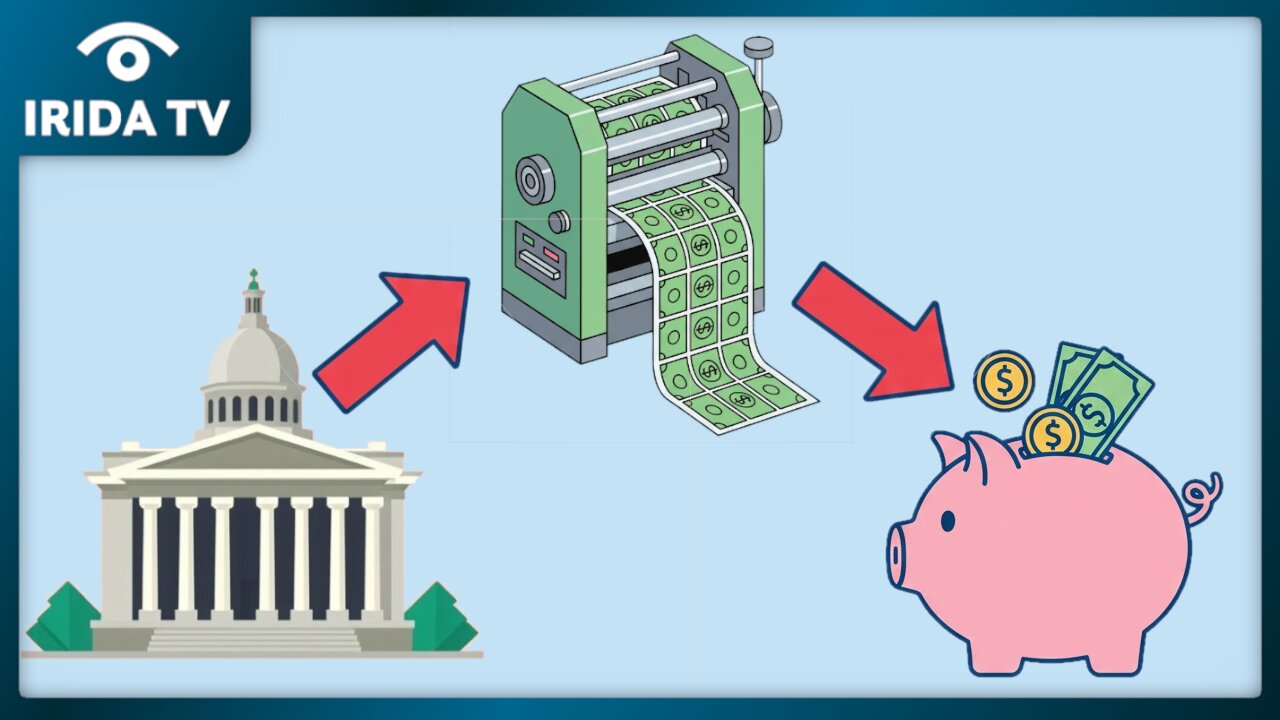

The Government Deficit Is Your Savings // MMT Debate with Stefan Molyneux

The financial constraints that limit government spending are commonly misunderstood; a sovereign nation can never run out of its own currency, but it absolutely can run out of people and resources.

Website: https://irida.tv

Stay on top of the web's most forbidden news at https://dissentwatch.com/

Stefan Molyneux: https://freedomain.com/

Telegram: https://t.me/iridatv

https://discord.com/invite/9RSvcMQB

X: https://x.com/irida_tv

Facebook: https://facebook.com/iridatv2021

Minds: https://www.minds.com/iridatv/

Telegram: https://t.me/iridatv

Modern Monetary Theory explained in this long-form economic debate, revealing the shocking truth that the government deficit is private savings. We tackle the widely misunderstood concept of the national debt explained through the lens of MMT vs Austrian economics. A sovereign nation, we argue, asks: can the government run out of money? The answer is no, but the looming Baby Boomer financial crisis is real, driven by labor shortages MMT identifies, along with the resource constraints economic theory often ignores.

We analyze the risks of MMT and inflation and explore the emerging crypto vs fiat currency debate as it relates to future monetary systems. Understanding federal government deficits is crucial, as is recognizing the real constraints on government spending. We dive into history, explaining why austerity causes recession and how MMT full employment goals are undermined by misdirected policy. The discussion then moves to economic policy structural reforms needed to maximize capacity, and examines how does cryptocurrency affect state power. We clearly define what is net financial assets and analyze the financial implications of aging population, especially considering potential MMT Bitcoin taxation challenges. Finally, we discuss the impact of taxation welfare dependency regulation on overall economic output.

-

LIVE

LIVE

Kim Iversen

1 hour agoIsrael VIOLATES Ceasefire Deal | Kamala Says She's Most Qualified EVER

1,297 watching -

LIVE

LIVE

Dr Disrespect

6 hours ago🔴LIVE - DR DISRESPECT - BATTLEFIELD 6 - THE PERFECT WEAPON

1,449 watching -

1:23:55

1:23:55

Benny Johnson

2 hours ago🚨Trump LIVE Right Now at Emergency Press Conference with FBI Director Kash Patel in Oval Office

21.9K23 -

3:22:05

3:22:05

Right Side Broadcasting Network

8 hours agoLIVE: President Trump Hosts a Press Conference with FBI Director Kash Patel - 10/15/25

92.1K11 -

44:24

44:24

Clownfish TV

4 hours agoCNN is Angry 'The Male Gaze' Returned! TRADWIVES and SYDNEY SWEENEY are Blamed?! | Clownfish TV

5.09K10 -

LIVE

LIVE

LFA TV

20 hours agoLIVE & BREAKING NEWS! | WEDNESDAY 10/15/25

1,213 watching -

LIVE

LIVE

freecastle

5 hours agoTAKE UP YOUR CROSS- CONTEND earnestly for the FAITH once for all entrusted to the Saints!

172 watching -

1:09:38

1:09:38

vivafrei

2 hours agoLiquid Death-Gate! Text Message-Gate! Ostrich-Gate! AN

57K24 -

1:19:39

1:19:39

The HotSeat

2 hours agoAmericans Are Turning Back to God — While Terror Rises Again in Gaza

3.58K -

LIVE

LIVE

Owen Shroyer

1 hour agoOwen Report - 10-15-2025 - Government Shutdown Political Slop Show Continues

1,348 watching