Premium Only Content

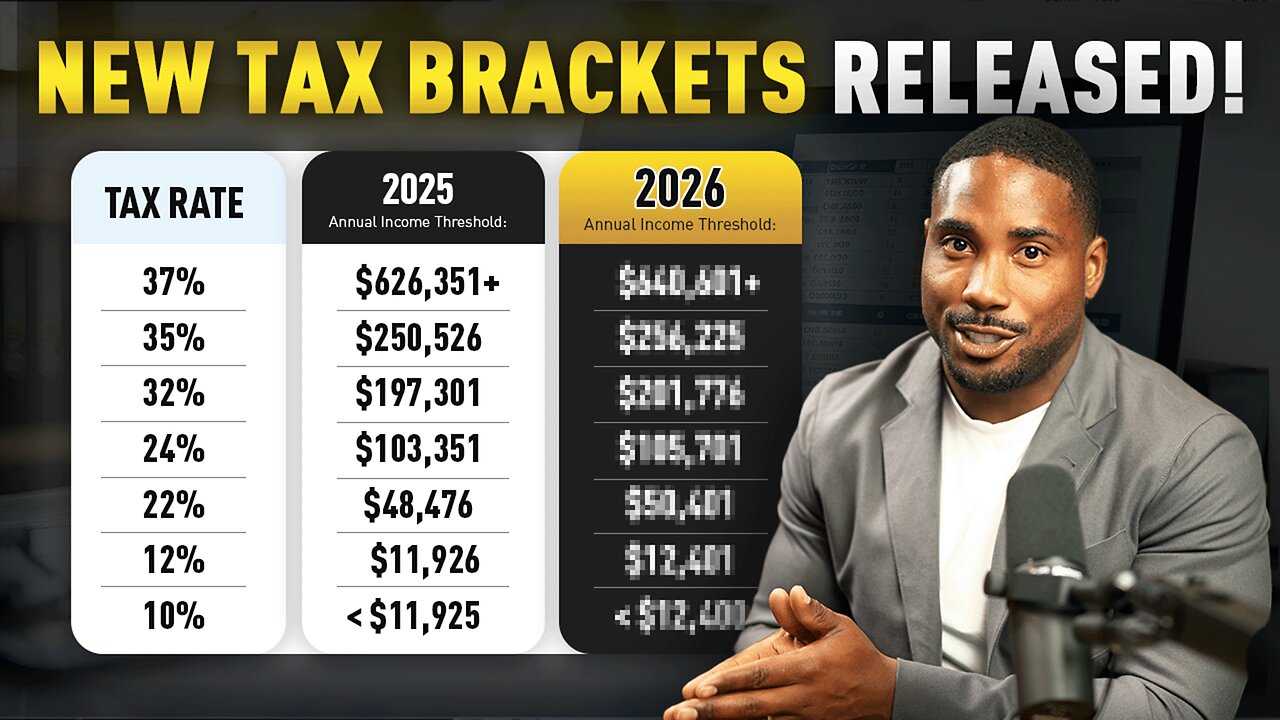

IRS Releases New Inflation-Adjusted Tax Brackets for 2026 | What This Means for You!

JOIN THE TAX-FREE MILLIONAIRE SUMMIT! OCTOBER 21-23, 2025

https://join.taxalchemy.com/tax-free-millionaire-summit-page?utm_source=youtube&utm_medium=description&utm_campaign=kd319-irs-releases-2026-tax-brackets

Book a Professional Tax Assessment Call ▶ https://start.taxalchemy.com/consultation?utm_source=youtube&utm_mediumv=description&utm_campaign=kd319-irs-releases-2026-tax-brackets

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd319-irs-releases-2026-tax-brackets

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd319-irs-releases-2026-tax-brackets

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

Every year, the IRS updates tax brackets to account for inflation, and understanding these changes is more important than ever. Even a small shift in the brackets can significantly affect how much you owe in federal taxes. Being aware of these adjustments ahead of time can help you plan your finances more strategically.

In this video, tax strategist Karlton Dennis breaks down all the key updates for the 2026 tax year. He explains the new brackets for single filers, married couples filing jointly, and heads of household—highlighting how each category is impacted differently. He also provides real-world examples to show exactly how these changes could affect your paycheck and year-end tax bill.

If you want to know exactly where you fall, what your marginal tax rate means for your bottom line, and how much you can expect to owe, this video is essential. Karlton also covers the updated standard deduction for 2026, which is especially important for taxpayers who won’t be itemizing deductions. Understanding these changes can help you make smarter choices about deductions, withholding, and potential tax-saving strategies.

CHAPTERS:

0:00 Intro

0:22 How Do Tax Brackets Work?

1:02 2026 Tax Brackets for Single Filers in 2026

1:59 2026 Tax Brackets for Married Filing Joint in 2026

2:59 Changes to the Standard Deduction

3:32 Tax-Free Millionaire Summit Promo

3:59 What This Means For You

5:37 The Bottom Line on 2026 Tax Bracket Adjustments

6:22 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxbrackets #taxrates #irsnews

-

9:13

9:13

Karlton Dennis

12 days ago9 Passive Income Ideas - How I Make 7 Figures Per Year!

32 -

UPCOMING

UPCOMING

freecastle

5 hours agoTAKE UP YOUR CROSS- CONTEND earnestly for the FAITH once for all entrusted to the Saints!

1151 -

1:09:38

1:09:38

vivafrei

2 hours agoLiquid Death-Gate! Text Message-Gate! Ostrich-Gate! AN

57K22 -

LIVE

LIVE

The HotSeat

1 hour agoAmericans Are Turning Back to God — While Terror Rises Again in Gaza

712 watching -

LIVE

LIVE

Owen Shroyer

1 hour agoOwen Report - 10-15-2025 - Government Shutdown Political Slop Show Continues

1,325 watching -

1:26:01

1:26:01

The Quartering

3 hours agoYoung Republican Smear, Woke Sidewalks Washed Away, Major Changes To X & More

90.2K34 -

1:36:03

1:36:03

Darkhorse Podcast

4 hours agoThe 296th Evolutionary Lens with Bret Weinstein and Heather Heying

16.3K10 -

LIVE

LIVE

StoneMountain64

1 hour agoI can't stop playing BATTLEFIELD 6

58 watching -

1:05:17

1:05:17

Jeff Ahern

2 hours ago $0.76 earnedNever Woke Wednesday with Jeff Ahern

16.3K2 -

1:24:59

1:24:59

Sean Unpaved

5 hours agoPrime Pulse: Yamamoto's Gem, Mendoza & Simpson's Title Quest, & NFL QB Rule Shift

31.6K1