Premium Only Content

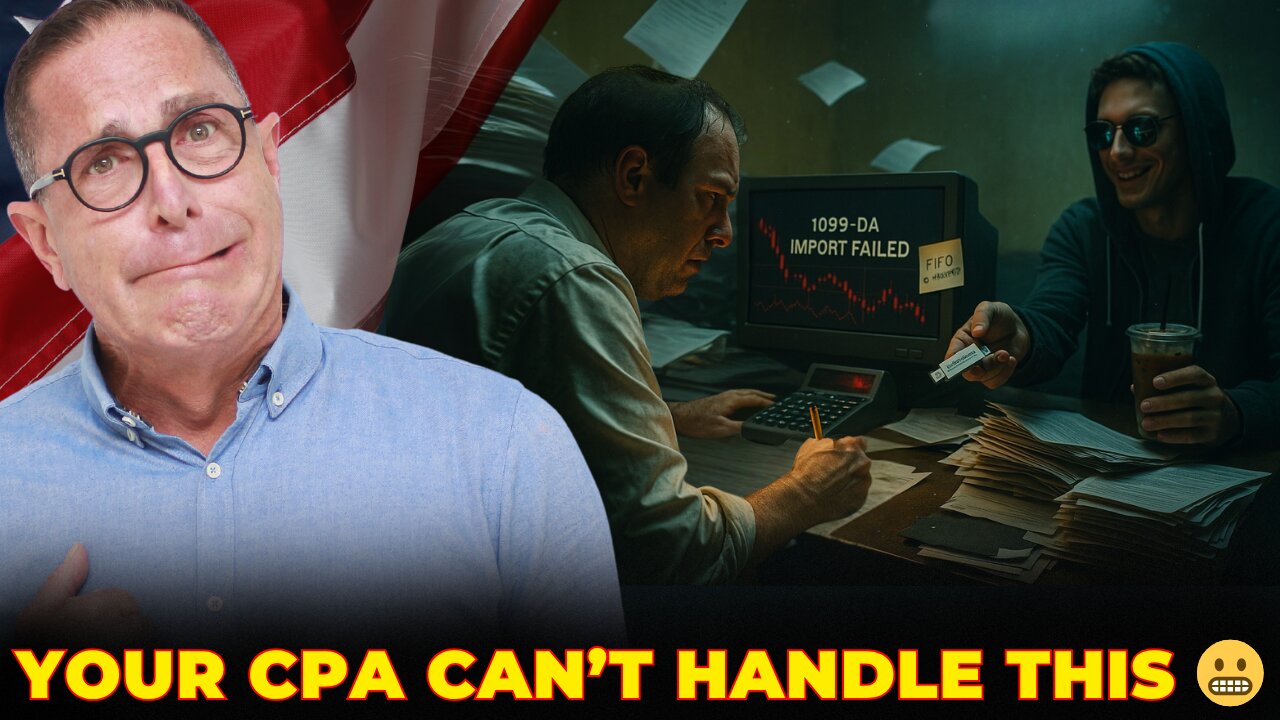

Your Accountant Is NOT Ready For 1099-DA Crypto Tax Form

The 2025 tax season is bringing the biggest change to crypto tax reporting in years.

Centralized exchanges will now send the IRS a Form 1099-DA, detailing every single one of your crypto sales, exchanges, and even transfers.

For active traders, this could be a document that is dozens of pages long.

Is your current accountant prepared to handle this?

In this episode of the Clinton Donnelly Show, we break down exactly what the 1099-DA means for you as a US crypto investor.

He'll cover why standard tax software fails with complex DeFi transactions and how misclassifying trades can lead you to overpay the IRS by thousands. Don't get caught unprepared.

Stop overpaying on your crypto taxes. Get a consultation from the experts at CryptoTaxAudit 👉 https://www.cryptotaxaudit.com/crypto-tax-consultation

🔗 Official IRS Reference 👉 https://www.irs.gov/forms-pubs/about-form-1099-da

🕒 Timestamps :

00:00 — Why your CPA will quit in 2025

01:05 — 1099-DA reporting begins

02:10 — Broker-dealer FIFO-by-wallet rule explained

03:35 — Why accountants can’t keep up

04:45 — IRS audit surge expected in 2026

05:10 — DeFi and cross-chain bridging nightmare

06:40 — Why software can’t fix this

07:30 — CryptoTaxAudit’s solution and real-world results

08:20 — Authority proof: 5,000 tax returns, zero audits

08:50 — Final call to action

#CryptoTaxes #1099DA #IRS #CryptoTaxAudit #CryptoTaxFixer #DeFi #CryptoTrader

🎙️ About Clinton Donnelly

Clinton Donnelly, LLM, EA, founded CryptoTaxAudit.com, the leading crypto tax and IRS audit defense firm. Known as the “Crypto Tax Fixer,” he has helped thousands of U.S. investors file bulletproof crypto tax returns and defend against IRS scrutiny.

🏆 In 2025, CryptoTaxAudit was named Cryptocurrency Taxation Services of the Year by Financial Services Review.

Our team specializes in:

✅ Complex gain calculations and wallet tracking

✅ Expat and foreign disclosure compliance

✅ IRS audits, defense, and forensic strategies

✅ Audit-resistant crypto tax preparation

📬 Work with us:

👉 https://www.cryptotaxaudit.com/tax-prep-waiting-list

⚠️ NOTICE

Beware of scammers in comments or Telegram groups. We will never ask for your personal information on social media.

📜 Disclaimer: This video is for educational purposes only. Always consult a licensed tax professional before making financial or tax decisions.

🔍 Related Search Terms: irs 1099-da crypto, crypto tax 2025 rules, crypto accountant quitting, how to report crypto on taxes 2025, fifo vs lifo crypto tax, broker dealer cost basis rule, crypto tax audit 2026, defi bridging taxes, cryptotaxaudit review, clinton donnelly crypto tax fixer

-

5:32

5:32

The Clinton Donnelly Show

1 month agoThe New Broker Dealer Rule: What It Means for Crypto Taxes in 2025

671 -

LIVE

LIVE

LFA TV

11 hours agoLIVE & BREAKING NEWS! | THURSDAY 11/20/25

7,689 watching -

LIVE

LIVE

AP4Liberty

10 hours agoTrump–Musk Alliance 2.0: What Their Sudden Reconciliation Means for America’s Future

189 watching -

22:20

22:20

World2Briggs

17 hours ago $0.12 earnedEveryone Is Leaving These 15 States. Truth Behind the Trend.

22.1K7 -

4:24

4:24

Gamazda

18 hours ago $1.65 earnedDeep Purple – Smoke On the Water (Live Piano Cover in a Church)

3.42K13 -

12:54

12:54

Brad Owen Poker

13 hours agoI Make Final Table! I’m Going To $10,400 WPT World Championship!!

10.8K1 -

10:00

10:00

TheMightyMcClures

22 days agoWe Fed 500 Families!

12.3K4 -

6:23

6:23

The Shannon Joy Show

13 hours agoWas Covid a MILITARY OPERATION?

11.9K4 -

LIVE

LIVE

The Bubba Army

22 hours agoTRUMP SIGNS EPSTEIN BILL! - Bubba the Love Sponge® Show | 11/20/25

1,952 watching -

27:24

27:24

DeVory Darkins

21 hours agoTrump secures RECORD BREAKING INVESTMENT as Charlotte Schools issue SHOCKING Update

38.5K48