Premium Only Content

Bitcoin Adoption & NUPL-Z | The 401(k) Push Explained

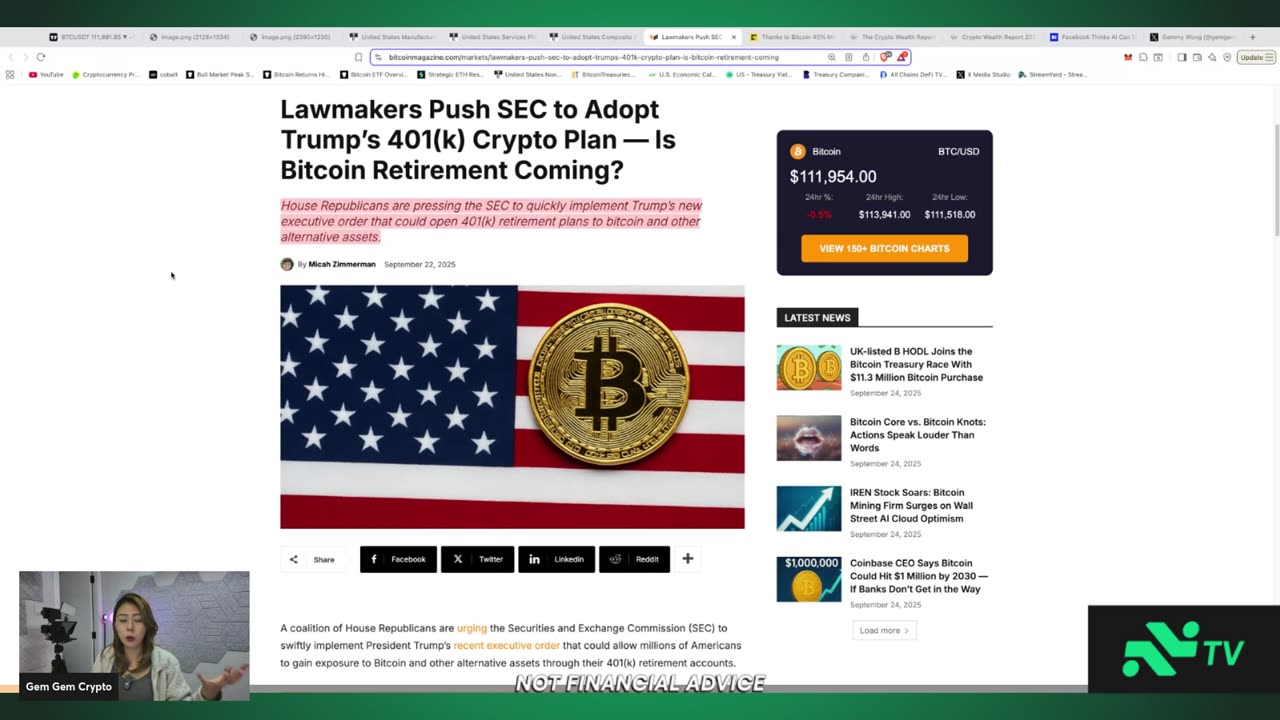

Bitcoin’s market sentiment is at a critical point, and today we’re breaking it all down with beginner-friendly tools like the NUPL-Z chart and the Short-Term Holder Cost Basis. These on-chain indicators reveal whether investors are sitting on paper profits or losses, and how that shapes market tops and bottoms. Right now, the data shows we’re not in the “euphoria zone” yet, with strong support forming around $111K. That suggests the biggest move of this cycle could still be ahead. We’ll walk through exactly how to read these charts, why they matter, and what they’re signaling for Bitcoin’s next chapter.

But that’s not all. We’ll also cover fresh macro and adoption news shaking the crypto space: the latest US PMI flash report and what it means for inflation and Fed policy, lawmakers pushing to open the $12.5 trillion 401(k) market to Bitcoin, and a record 40% surge in crypto millionaires as the global market cap tops $3.3 trillion. Each of these stories connects back to Bitcoin’s cycle and long-term trajectory. By the end of this stream, you’ll have both the big-picture macro context and the on-chain signals to understand where Bitcoin really stands right now.

-

32:09

32:09

Comedy Dynamics

13 hours agoBest of Jesus Trejo: Stay at Home Son - Stand-Up Comedy

1.46K -

55:43

55:43

TruthStream with Joe and Scott

1 day agoHoney and Lisa 11/17: How powerful we are, Trauma release, Becoming Sovereign (next healing event 11/20/25 @ noon eastern and 4pm eastern) #513

4.54K10 -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

602 watching -

1:00:27

1:00:27

Coin Stories with Natalie Brunell

1 day agoMike Alfred’s Full Investment Playbook: Inside Bitcoin, Miners & AI

36.3K2 -

2:34:07

2:34:07

Badlands Media

13 hours agoDEFCON ZERQ Ep. 018: Global Smokescreens & the Deep State Energy War

215K64 -

2:05:03

2:05:03

Inverted World Live

7 hours agoHouse Votes to Release Epstein Files w/ Emilie Hagen & Denise Bovee | Ep. 143

63.7K4 -

3:02:27

3:02:27

TimcastIRL

8 hours agoEpstein Transparency PASSED UNANIMOUSLY, Trump To SIGN Release | Timcast IRL

256K123 -

6:26:43

6:26:43

SpartakusLIVE

9 hours agoARC is SO ADDICTING - I just CAN'T stop || NEW SCHEDULE, NEED SLEEP

89K3 -

4:53:41

4:53:41

Drew Hernandez

1 day agoEPSTEIN TRANSPARENCY ACT PASSES: POLITICAL THEATER OR FULL DISCLOSURE?

74.4K9 -

6:33:47

6:33:47

StevieTLIVE

8 hours ago#1 SOLO Warzone POV 6.9 KD

41K1