Premium Only Content

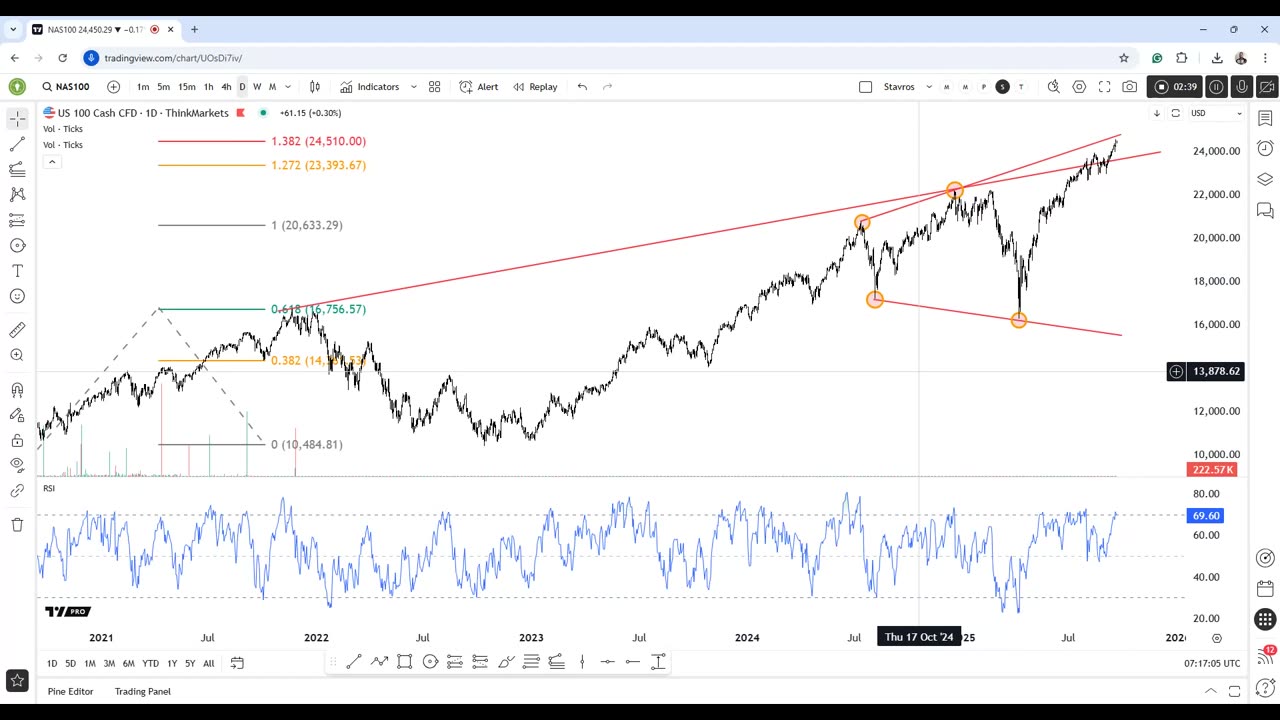

Nasdaq records near critical resistance! More to go or crash?

1

Grab this chart

154

Strong economic data suggest the soft landing scenario remains intact. Manufacturing strength, combined with improving employment data, appears to provide support. The Fed's dovish pivot also offers liquidity tailwinds, while the Nvidia-Intel partnership signals continued investment in US stocks.

But is the market reading the signals?

Strong employment data could actually be bearish for equities since it reduces the urgency for the Fed to cut. The Fed's dot plot already shows fewer 2026 cuts (only one instead of three) with higher growth and (slightly higher) inflation projections. The Nvidia-Intel deal also excludes Intel's struggling foundry business, a core problem for the company.

Technicals are not too promising either. Multiple resistance factors converge just a tad higher if not at current levels:

Long-term trendline from November 2021

138% Fibonacci level

Triangle pattern measured move completion

100% Fibonacci expansion target

Indicators flash warnings too:

RSI second divergence since May (price up, momentum flat)

Volume oscillator 13% below zero - lack of institutional buying

Missing third-wave volume surge - typical bull pattern absent

Fifth-wave characteristics suggesting impulse completion

As we trade in the historically worst month for equities, where the NASDAQ typically underperforms the S&P 500 during September selloffs, a high-probability short setup could be underway:

Entry: 24,700-24,750 area (resistance test)

Stop: Above 25,000 (avoid false breakout)

Targets: 23,700 → 22,730 → 22,200

Risk-Reward: Approximately 2.6:1 to first major support

Prefer a 5-wave decline if bear case confirms, followed by a 3-wave up, then continuation lower.

Watch 24,500 as it appears to be a decision point where multiple technical and fundamental factors converge.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

-

LIVE

LIVE

Dr Disrespect

1 hour ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - FULL SEND INTO THE RED

1,229 watching -

LIVE

LIVE

The Rubin Report

1 hour agoWatch Joe Rogan’s Face as Elon Musk Exposes How Dems Are Cheating in Plain Sight

2,157 watching -

1:01:07

1:01:07

VINCE

3 hours agoThe Walls Are Closing In On The Deep State | Episode 160 - 11/03/25

142K78 -

LIVE

LIVE

LFA TV

18 hours agoLIVE & BREAKING NEWS! | MONDAY 11/3/25

4,102 watching -

1:31:18

1:31:18

Graham Allen

3 hours agoErika Fights Back: Vows To EXPOSE TRUTH & DEMANDS Trial Goes Public!! Left Says Her Grief Is FAKE!

109K74 -

LIVE

LIVE

Badlands Media

8 hours agoBadlands Daily: November 3, 2025

2,193 watching -

Wendy Bell Radio

7 hours agoThings Will Get Worse Before They Get Better

60.8K95 -

LIVE

LIVE

The Big Mig™

3 hours agoICE Will Use Private Bounty Hunters, LFG

4,562 watching -

1:08:17

1:08:17

Chad Prather

10 hours agoHow to Get Along With People You Don’t Even Like (Most of the Time)

94.5K29 -

1:45:29

1:45:29

MTNTOUGH Podcast w/ Dustin Diefenderfer

10 hours agoTaya + Colton Kyle: Can American Marriages Survive 2025? | MTNPOD #140

17.3K