Premium Only Content

Why Overallocating Leaves You With Less Bitcoin

Morgen Rochard: The $1M Bitcoin Fantasy That Makes You Save Less

Take your Self-Custody seriously and Get a Microseed:

- https://microseed.io

Get the Best Bitcoin Watches ever:

- 10% Discount with Code: "Robin"

- Here: https://www.coinvigilante.com/?ref=robinseyr

Contact the CyberSecurity & Self Custody Experts from the Bitcoin Way:

- 30 mins free call with my link: https://thebitcoinway.com/robin

Want to mine Bitcoin? I personally use simplemining!

- Go to: https://simplemining.io

Guest's contact: https://x.com/MorgenRochard

Summary

In this conversation, Morgen Rochard discusses his journey in financial planning, particularly in relation to Bitcoin. He shares insights on the evolving role of financial advisors in a Bitcoin-centric world, the importance of personal finance education, and the challenges of integrating Bitcoin into traditional financial planning. The discussion also touches on the significance of emergency funds, the complexities of borrowing against Bitcoin, and the value of family and parenting. Morgen emphasizes the need for individuals to take charge of their financial futures, especially in light of uncertain state pensions and the realities of living in a fiat world.

Takeaways

Morgen has been involved in Bitcoin since 2013 and started advising clients in 2016.

Bitcoin enhances personal finance and will change the financial landscape over time.

Financial advisors face challenges from both traditional finance and Bitcoin communities.

The average person should still save and plan for emergencies, regardless of Bitcoin holdings.

Emergency reserves are crucial for financial security, even for Bitcoiners.

Borrowing against Bitcoin carries risks and should be approached cautiously.

Spending Bitcoin should be balanced with saving and investing for the future.

Parenting teaches valuable lessons about responsibility and caring for others.

State pensions are uncertain, and individuals should plan for their financial futures accordingly.

The integration of Bitcoin into personal finance requires a shift in mindset.

Chapters

00:00 Introduction and Background

01:58 The Role of Financial Advisors in a Bitcoin World

06:46 Current State of Traditional Financial Advisors

12:06 Navigating Reality in a Bitcoin Economy

16:01 Common Questions from Bitcoiners

28:47 Future Considerations for Bitcoiners

30:34 Innovative Financial Planning Strategies

34:01 The Importance of Emergency Reserves

38:13 Spending Bitcoin: A Balanced Approach

39:58 Faith and Financial Security

44:38 Retirement Planning with Bitcoin

52:02 The Reality of State Pensions

56:51 The Value of Long-Term Savings

01:00:50 Parenting and Financial Wisdom

This content is for educational and/or entertainment purposes only.

The views expressed by Robin Seyr and his guests are their own and do not constitute financial advice.

Nothing in the title, thumbnail, description, or video/audio is to be interpreted as investment, tax, or legal advice.

I am not a financial advisor and do not provide financial services as defined by MiCA or other financial regulations.

Mentioning or featuring any product, service, or company does not imply endorsement.

Some links may be affiliate links — using them helps support the show at no extra cost to you.

Always do your own research. Investing in cryptocurrencies involves risk and may not be suitable for everyone.

Viewers and listeners are responsible for complying with their local laws and regulations.

-

1:00:32

1:00:32

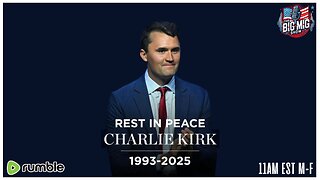

VINCE

4 hours agoRest In Peace Charlie Kirk | Episode 123 - 09/11/25

324K304 -

LIVE

LIVE

LFA TV

7 hours agoLFA TV ALL DAY STREAM - THURSDAY 9/11/25

4,829 watching -

LIVE

LIVE

Bannons War Room

6 months agoWarRoom Live

7,995 watching -

25:21

25:21

The Shannon Joy Show

2 hours agoA message of encouragement and a call for faith and unity after the tragic killing of Charlie Kirk

65.3K13 -

1:31:37

1:31:37

The Big Mig™

3 hours agoIn Honor Of Charlie Kirk, Rest In Peace 🙏🏻

54K14 -

1:36:35

1:36:35

The White House

5 hours agoPresident Trump and the First Lady Attend a September 11th Observance Event

108K43 -

1:38:49

1:38:49

Dear America

5 hours agoWe Are ALL Charlie Now! This Isn’t The End. We Will FIGHT FIGHT FIGHT

189K197 -

2:09:21

2:09:21

Badlands Media

12 hours agoBadlands Daily: September 11, 2025

68.8K20 -

2:59:26

2:59:26

Wendy Bell Radio

8 hours agoA Watershed Moment

89.2K214 -

4:24

4:24

Bearing

9 hours agoCharlie Kirk ♥️

24.5K48