Premium Only Content

No Money Printer in Sight? The 2025 QE/Crypto Outlook Explained

Everyone keeps asking the same question: when will the money printer go brrr again? But based on the latest economic data and central bank communications (as of September 2025), the odds of another round of quantitative easing (QE) in the next 12 months look slim — just 10–20%.

Here’s why:

Growth is softening but still positive 📉 (US GDP grew 3.3% in Q2 2025, but projections for 2026 slow to ~1.3%)

Inflation is still above target 🏷️ — too sticky for aggressive money printing

Unemployment is rising, but not at crisis levels

The Fed and other major central banks are still focused on quantitative tightening (QT) and gradual rate cuts rather than blowing the doors open with asset purchases

QE is usually a “break glass in case of emergency” tool. Unless we see a sharper downturn, central banks are signaling that rate cuts, not balance sheet expansion, are their playbook for now.

👉 Watch this breakdown to understand the real QE vs QT outlook for 2025–2026, what it means for markets, and why the next pivot could look very different from the last cycle.

-

LIVE

LIVE

MattMorseTV

32 minutes ago🔴Trump’s Oval Office PROCLAMATION. 🔴

295 watching -

1:14:54

1:14:54

vivafrei

2 hours agoCash for Criminals? Did Judge Wrongly Release Accused Murderer? Epstein Doc Release! Swalwell Sucks!

27K14 -

The Quartering

3 hours agoToday's Breaking News! Greta FAKES Drone Attack, Animal Cruelty Spike & Cracker Barrel

64.4K11 -

1:15:17

1:15:17

Awaken With JP

3 hours agoKaren Strikes Again, There is No Crime, Communism Succeeds! - LIES Ep 107

14.5K11 -

LIVE

LIVE

Stephen Gardner

42 minutes ago🔥Tucker HUMILIATES Mark Cuban + Democrat Mayors ABANDON Party!

508 watching -

11:37

11:37

Robbi On The Record

12 days agoThe Devil is in the Branding..

21.8K17 -

LIVE

LIVE

The HotSeat

1 hour ago👉 STOP Blaming Each Other — Look at the Media!

518 watching -

![[Ep 744] ICE Storm Hits Chicago | Another Innocent Woman Slain in Auburn, AL | Islam Invasion](https://1a-1791.com/video/fww1/9b/s8/1/Y/a/w/g/Yawgz.0kob.1-small-Ep-744-ICE-Storm-Hits-Chica.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

1 hour ago[Ep 744] ICE Storm Hits Chicago | Another Innocent Woman Slain in Auburn, AL | Islam Invasion

172 watching -

1:39:20

1:39:20

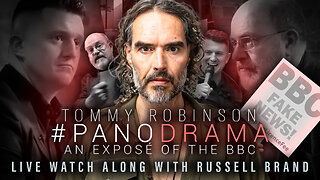

Russell Brand

4 hours agoMedia Lies & Setups? Tommy Robinson’s Panodrama Watch Along - SF630

100K16 -

1:56:56

1:56:56

MattMorseTV

4 hours ago $3.99 earned🔴Trump's MASSIVE Press Briefing UPDATE.🔴

9.82K30