Premium Only Content

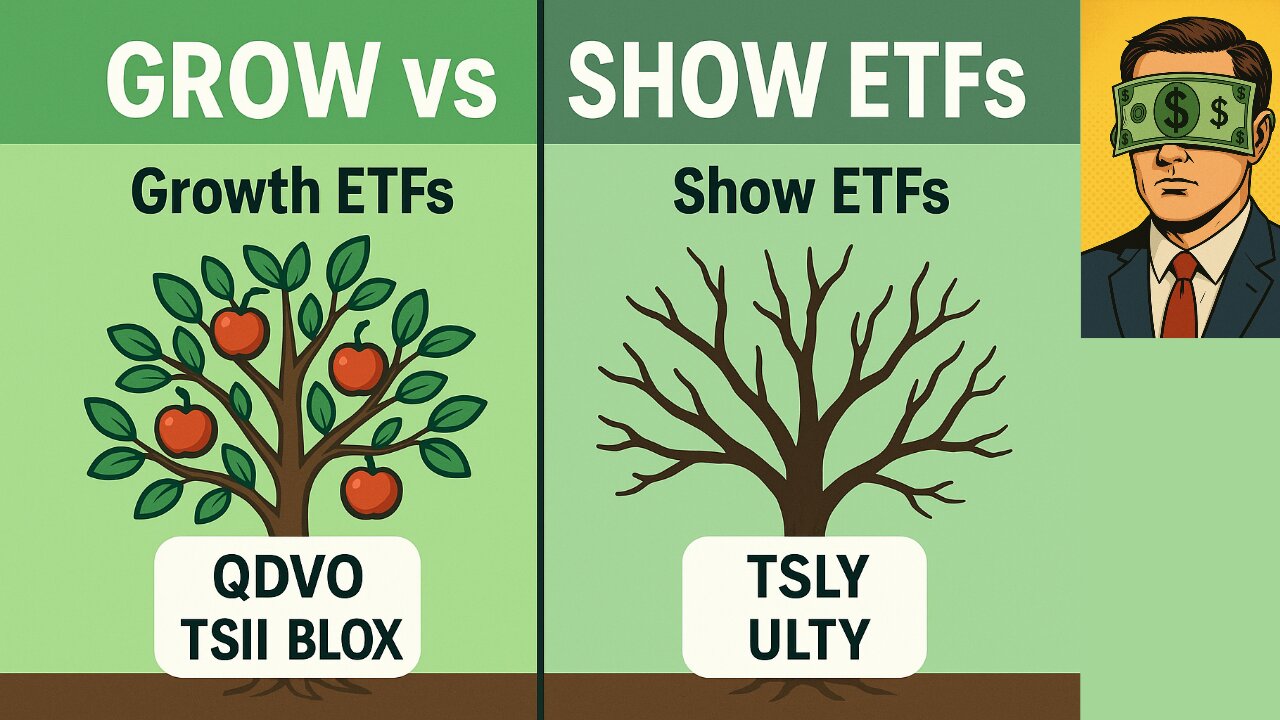

Don’t Be a Shower, Be a Grower: Beyond Yield in ETFs

Don’t get blinded by the yield. 🚫💦

It’s easy to chase flashy income numbers, but high yield alone doesn’t tell the full story.

In this video, I’ll break down why it’s critical to look beyond the “show” and focus on the real drivers of wealth:

✅ Risk-adjusted return (Sharpe & Sortino ratios)

✅ Total return (income + growth)

✅ Risk parity & hedging (balancing uncorrelated assets)

✅ Proper sizing (avoiding overexposure to fragile strategies)

Discord

https://discord.gg/zcp7Z3MtfC

Disclaimer: This is my personal journey, and markets can change, and results can vary drastically. Also, I have only been in these for a short period of time, who is to say it would continue to work out. Disclaimer: I am NOT a financial advisor. This is for entertainment purposes only. Please speak with a financial advisor, accountant, and lawyer and do your own due diligence before making any investment decisions. Please use your own judgment and take your own risks when investing. Past performance is not indicative of future gains.

The content may be incorrect, inaccurate, contain errors, subject to interpretation, situational, or not hold up in the long term.

#DontBeAShower #BeAGrower #ETFInvesting #QDVO #TSII #BLOX #TSLY #ULTY #DividendInvesting #RiskAdjustedReturn #RiskParity #TotalReturn #Hedging #PortfolioStrategy

-

2:55:50

2:55:50

The Pascal Show

11 hours ago $0.07 earnedMASSIVE CHAOS?! Transportation Secretary Hold Presser On Air Travel & More

1.25K1 -

1:06:35

1:06:35

TruthStream with Joe and Scott

1 day agoZero Limits Round Table with Joe Vitale, Lisa Schermerhorn and more of the cast!

3.51K -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

178 watching -

7:40

7:40

Blabbering Collector

12 hours agoLEAKED: Draco Malfoy, Hooch, Neville Longbottom! | Harry Potter HBO Show Update, Wizarding News

8.07K1 -

3:06:35

3:06:35

Badlands Media

15 hours agoDEFCON ZERQ Ep. 017: Tesla Tech, Ancient Power & The Fight for Human Consciousness

229K51 -

3:11:56

3:11:56

TimcastIRL

8 hours agoDOJ Launches FULL INVESTIGATION Into TPUSA Antifa RIOT, Media Says Mostly Peaceful | Timcast IRL

254K77 -

3:16:27

3:16:27

Barry Cunningham

11 hours agoBREAKING NEWS: SOLVING THE HOUSING CRISIS BY UNDERSTANDING VETERANS DAY! AND IT'S MOVIE NIGHT!

81.6K33 -

8:58:17

8:58:17

SpartakusLIVE

9 hours agoWZ Solos to Start || NEW Battlefield 6 - REDSEC Update Later

26.1K1 -

1:01:56

1:01:56

ThisIsDeLaCruz

17 hours ago $9.81 earnedInside Kenny Chesney’s Sphere Part 1: Exclusive Backstage Pass

39.1K2 -

2:09:50

2:09:50

DLDAfterDark

7 hours ago $2.41 earnedA Complete Look Into The Glock "V Series"! Pistol In Hand! VERY GAY!!

23.2K2