Premium Only Content

Michael Potter - The Cashless Society

SUMMARY:

------------------------------

I’m excited to share Michael Potter’s lively, data-driven talk, “The Cashless Society” — a timely reality-check on whether Australia has actually ditched cash. Potter, a research fellow at the Centre for Independent Studies who has worked in the Parliamentary Budget Office, Treasury and Prime Minister & Cabinet (he even advised John Howard on the GST), walks the room through Reserve Bank of Australia banknote data with clarity and good humour. He shows that the number and value of $50 and $100 notes have risen, that there are predictable seasonal spikes around Christmas and Easter, and that one-off events such as a 2002 cash reissue and the GFC produced notable surges. When you examine value as a share of GDP the picture is mixed: totals have peaked, dipped and spiked, and low-denomination notes seem to be declining while high-denomination notes are more common. Potter isn’t arguing policy so much as describing “what is” — a measured portrait of a payments landscape where digital growth coexists with persistent demand for large-denomination cash. If you want calm, evidence-based insight into Australia’s payments future, this talk is a must-watch.

RUMBLE DESCRIPTION:

-----------------------------------

Join us for Michael Potter’s clear-eyed presentation, “The Cashless Society” — a measured, evidence-first dive into whether Australia has truly gone cashless. Michael Potter, research fellow at the Centre for Independent Studies with prior roles at the Parliamentary Budget Office, Treasury and Prime Minister & Cabinet (he advised John Howard on the GST), takes us through Reserve Bank of Australia data on banknotes and paints a surprisingly nuanced picture.

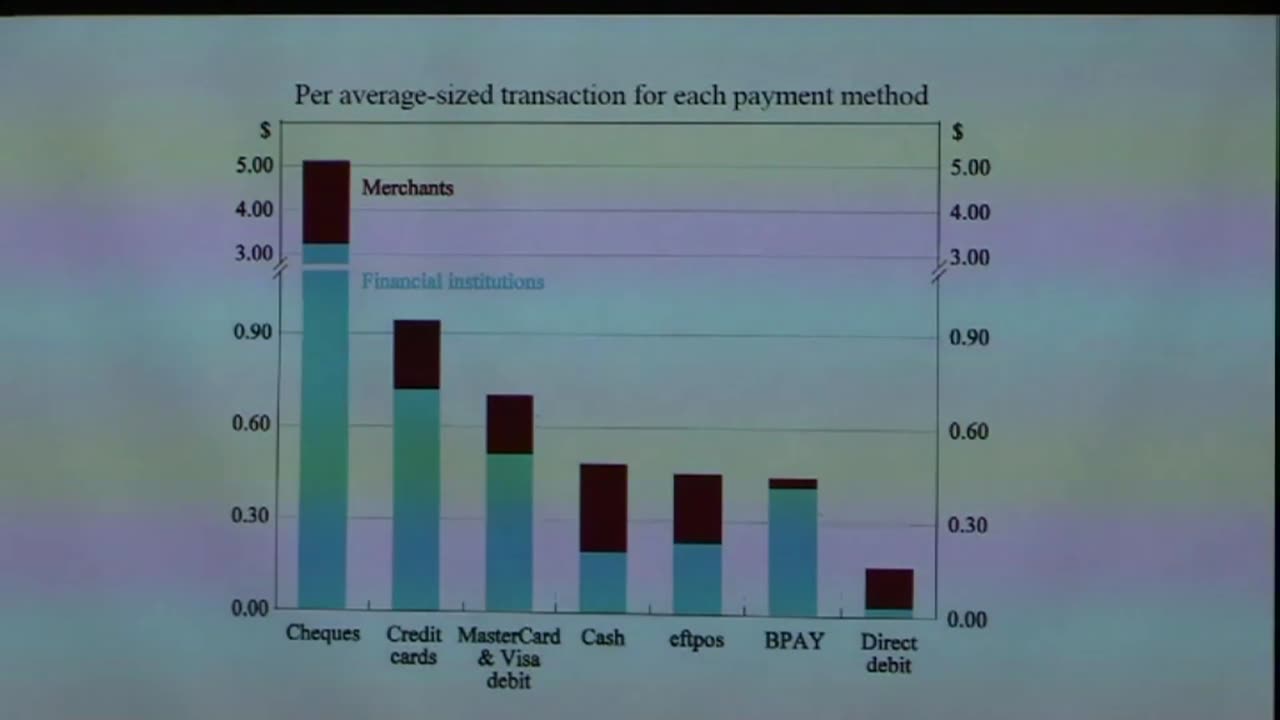

Using RBA figures, Potter contrasts two ways of looking at cash: the number of notes on issue and the value of those notes as a share of the economy. Key takeaways: the absolute count of $50 and $100 notes has trended up, seasonal spikes show up around Christmas and Easter, and specific years (a 2002 bank-organised cash change and the GFC) produced large one-off jumps. When you examine value relative to GDP the trend isn’t a simple downhill line; totals peaked, dipped and spiked and the overall story is mixed. There’s also an observable shift away from low-denomination notes and modest growth in high-denomination notes.

Potter’s aim is descriptive rather than prescriptive — he’s showing “what is”, not telling government what to do. That makes this talk a great primer if you want to understand the real statistics behind the headlines about cards, apps and contactless payments.

Watch, leave a comment and tell us what you think: is a fully cashless Australia inevitable, or are cash and large notes likely to stick around longer than we expect? If you like clear, data-backed economics talks, hit subscribe for more.

⚠️ CONTENT DISCLAIMER ⚠️

The views, opinions, and statements expressed in this video are those of the individual speaker(s) and audience members. They do not necessarily reflect the views, opinions, or positions of Western Heritage Australia or its affiliates.

This content is presented for educational and informational purposes as well as to facilitate public discourse on important social and political issues. We provide a platform for diverse Australian voices to be heard, to assist the public in forming their own informed opinions.

Western Heritage Australia does not endorse, verify, or take responsibility for the accuracy of statements made by speakers. All claims, statistics, and opinions remain the responsibility of the original speaker. Viewers are encouraged to conduct their own research and consult multiple sources when forming opinions on these topics.

This video may contain strong political opinions, controversial viewpoints, strong language, or mature themes. Viewer discretion is advised.

-

LIVE

LIVE

The Mel K Show

6 hours agoMel K & Mike L | The Tylenol Piece: It's a Marathon, Not a Sprint | 10-19-25

10,151 watching -

LIVE

LIVE

MattMorseTV

54 minutes ago🔴They just tried it... AGAIN.🔴

1,244 watching -

LIVE

LIVE

Nerdrotic

2 hours ago $3.79 earnedUncovering Egypts Greatest Mysteries w/ Hugh Newman| Forbidden Frontier #121

3,897 watching -

LIVE

LIVE

vivafrei

8 hours agoEp. 287: Bolton INDICTED! Gaza Ceasefire BREACHED? Alex Jones Injustice Continues, ANTIFA & MORE!

7,696 watching -

16:16

16:16

Robbi On The Record

3 hours agoThe Dark History of Halloween | What You Should Know

1197 -

LIVE

LIVE

DHG

18 hours agoRE4R - BIORAND X3 ENEMY MULTIPLIER MOD - PROFESSIONAL

99 watching -

LIVE

LIVE

Barry Cunningham

4 hours agoPRESIDENT TRUMP INTERVIEW WITH MARIA BARTIROMO! THEN WE TALK MONEY AND OPPORTUNITY!

1,385 watching -

LIVE

LIVE

FusedAegisTV

1 day agoλ Black Mesa λ (Half Life 1 Remake) █ Western Retread

32 watching -

LIVE

LIVE

Spartan

2 hours agoOMiT Spartan | God of War Ragnarok and then Halo

47 watching -

24:34

24:34

HaileyJulia

9 days agoThis Christian Morning Routine Changed Everything for Me

17.5K6