Premium Only Content

Why Raising Interest Rates Fails to Fight Inflation

Raising interest rates doesn't slow money creation; it is a direct injection of money from the public sector into the private sector. This process is inherently inflationary, creating money out of nothing and directing it to the ownership class. This suggests that central banks may be under pressure to preserve the wealth of asset owners.

Full episode: https://youtu.be/E450WRL0MJU

Website: https://irida.tv

Stay on top of the web's most forbidden news at https://dissentwatch.com/

Telegram: https://t.me/iridatv

https://discord.com/invite/9RSvcMQB

X: https://x.com/irida_tv

Facebook: https://facebook.com/iridatv2021

Minds: https://www.minds.com/iridatv/

Telegram: https://t.me/iridatv

This video explains why the conventional wisdom about interest rates is wrong and why high interest rates are actually a significant source of inflation. We break down the surprising truth about the Federal Reserve's policies, revealing why do high interest rates cause inflation. The Federal Reserve interest rate hikes are not slowing down the money supply, but are instead a large-scale Federal Reserve money injection. We show you the evidence that directly challenges the orthodox view, proving that do high interest rates reduce money supply is a myth. Discover how central banks create money and the immense power they hold.

This discussion delves into modern monetary theory and features insights from thinkers like warren mosler interest rates. We will give you a clear, easy-to-understand explanation of how interest rates work. We also investigate the question, do interest rates affect loan demand, using a look at the data from a federal reserve report on loans. Learn how to make money on treasury bills, and understand why savings accounts earn more interest than you might think. We explore why are high interest rates bad for the economy and provide empirical evidence on why do interest rates keep going up.

We look at real-world examples from countries like turkey inflation and interest rates, and argentina interest rates and inflation, which show a strong correlation between high rates and high inflation. The question does the fed print money is addressed head-on, with a surprising conclusion. We discuss how these policies function as a basic income for the rich and the link between high interest rates and corporate profit. This video will change the way you think about central banking and the global economy.

-

39:31

39:31

Her Patriot Voice

12 hours agoBlack Conservative Surrounded + ROBBED By Leftists!

431 -

13:25

13:25

The Gun Collective

12 hours agoWOW! A LOT of new GUNS just dropped!

5054 -

LIVE

LIVE

BEK TV

22 hours agoTrent Loos in the Morning - 9/04/2025

422 watching -

8:13

8:13

Geoff_Tac

1 day agoMAC 1014 Shotgun (Benelli Clone)

522 -

22:30

22:30

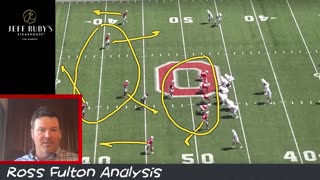

Ohio State Football and Recruiting at Buckeye Huddle

12 hours agoOhio State Football: How Matt Patricia Confused Arch Manning and Texas

2.77K -

9:07

9:07

MattMorseTV

17 hours ago $3.61 earnedTrump just BLASTED the CCP.

22.6K43 -

58:44

58:44

The Official Corbett Report Rumble Channel

11 hours agoTurning the Tide on 9/11 with Curt Weldon

3.9K15 -

10:47

10:47

Nikko Ortiz

15 hours agoThese Tik Tok Clips Are Extremely Painful...

17.4K3 -

8:12

8:12

VSOGunChannel

18 hours ago $0.43 earnedATF Still Wants to Take Your Incomplete Guns

2.44K8 -

44:06

44:06

Esports Awards

17 hours agoUber: The Voice of Overwatch, VALORANT & Esports’ Biggest Moments | Origins Podcast #27

1.52K