Premium Only Content

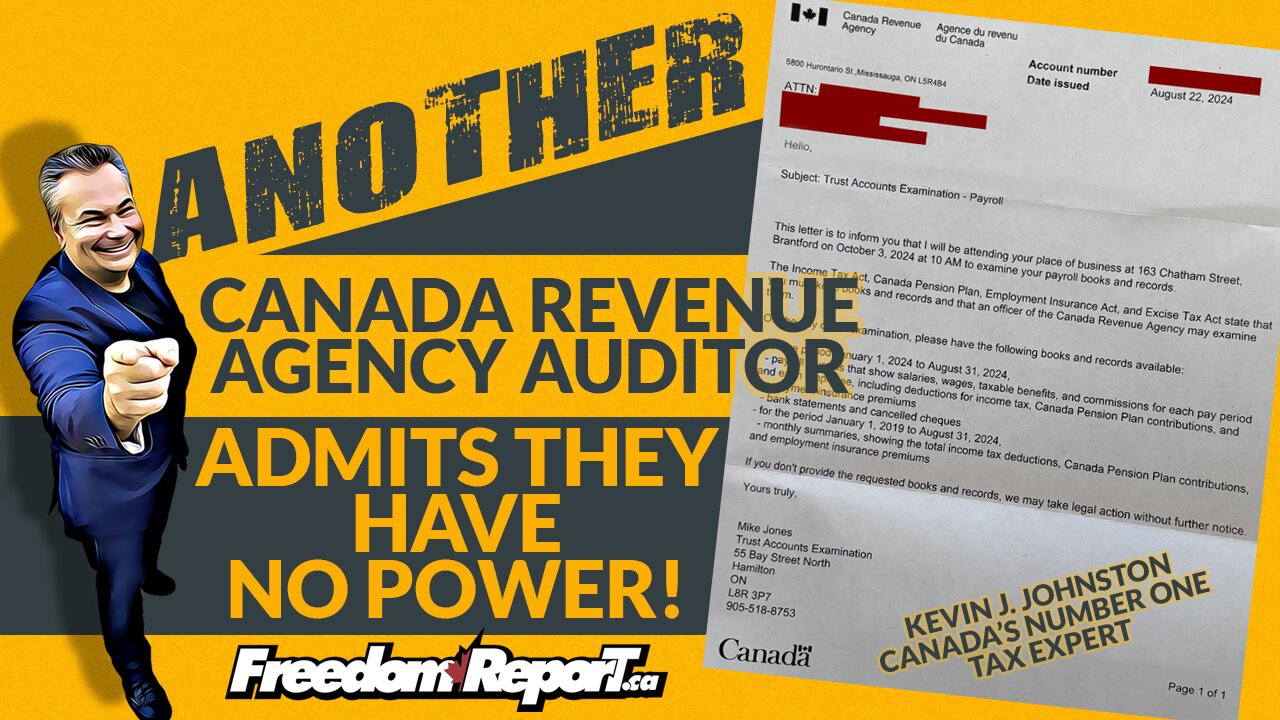

Another CRA Auditor Admits The CRA Has No Power and No Authourity - Kevin J Johnston

Another CRA Auditor Admits The CRA Has No Power and No Authourity - Kevin J Johnston

The call the CRA doesn’t want you to hear 💥📞🏛️

The room was quiet, the recorder light glowing red, and Kevin J. Johnston leaned in with that trademark calm ⚖️💼. On the other end of the line, a Canada Revenue Agency auditor started confidently… then hesitated… and kept hesitating. Kevin pressed with precise, surgical questions—statute, scope, consent, limits—each one a scalpel. 💉📑 What began as routine bureaucratic posture turned into the moment you could hear an institution blink. The auditor conceded that “authority” isn’t a magic word; consent matters, process matters, jurisdiction matters. Kevin translated bureaucratese into plain English: you don’t have to volunteer for an audit fishing expedition 🚫🎣. Bit by bit, the façade crumbled—no shouting, no grandstanding—just Kevin’s relentless, courtroom-ready logic and a paper trail mindset that would make any litigator nod. By the end, you could sense it: leverage had shifted. The gatekeeper had admitted the gate swings only when you allow it. 🔑🏦

Kevin didn’t gloat. He outlined the steps every corner-store owner, contractor, and scaling founder can use to stop being a target 🎯 and start being a tactician: incorporate properly, move legacy sole-prop messes into the right corporate structures, re-paper the last 4–5 years with pristine filings, and deploy a lawful share-sale strategy that isolates risk while preserving assets 💡📈. He reminded listeners that the CRA’s favorite tool isn’t law—it’s information you hand them freely. Silence is golden, and precision is platinum. He teaches both. When the auditor conceded that cooperation is fundamentally voluntary—that you can decline an audit demand that isn’t lawfully grounded—Kevin seized the moment to show exactly how to say “no” the right way: documented, time-stamped, and unimpeachably professional. 🧾🕰️

Then came the masterclass. Kevin broke down the real-world blueprint: purchase a distressed corporation for $1, legally assume liabilities, and sell the assets back for 10% of the total debt so the entrepreneur can breathe again 😮💨💸. He explained why you stop talking to the CRA, why you stop feeding their files, and why you let contracts—not conversations—carry the day. In that single recorded call, you could hear the difference between fear and strategy, between panic and planning. Kevin kept it cool, documented everything, and extracted the one sentence every Canadian business owner wishes they had on loop: you can decline what you never lawfully consented to in the first place. 🧠🔐

GOT CORPORATE DEBT? SELL ME EVERY PENNY OF IT! Fill Out The Form: www.KevinJJohnston.biz

What happened next felt like a master negotiator closing a chess game ♟️🏆. With the auditor’s own words on record, Kevin mapped the exit ramp: register the new company (sometimes two), re-file the messy years, execute the share-sale, and re-deploy assets where they belong. Clients stop bleeding cash, stop volunteering intel, and start building again. That’s the Kevin difference—he doesn’t rant; he re-engineers. He doesn’t argue; he audits the auditors. And he does it with the crispness of a Bay Street brief and the clarity of a coach who’s actually been on the field. 📊🧠💼

www.KevinJJohnston.com - #CRA #CanadaRevenueAgency #Tax #IncomeTax #Auditor

-

LIVE

LIVE

How To Beat The Canada Revenue Agency - Eliminate Income and Corporate Tax

1 day agoBANK LIES - The Tax & Money Show with Kevin J Johnston Episode 75

3271 -

LIVE

LIVE

Barry Cunningham

2 hours agoPRESIDENT TRUMP ANNOUNCES THE CHIPOCALYPSE! AND I'M HERE FOR IT! (AND MORE NEWS)

8,445 watching -

24:09

24:09

MYLUNCHBREAK CHANNEL PAGE

23 hours agoDams Destroyed The Ozarks

45.8K14 -

LIVE

LIVE

SpartakusLIVE

58 minutes agoVerdansk Duos w/ Nicky || Saturday Spartoons - Variety Later?!

340 watching -

1:32:54

1:32:54

Jeff Ahern

3 hours ago $24.16 earnedThe Saturday Show with Jeff Ahern

70.1K8 -

LIVE

LIVE

TheManaLord Plays

5 hours agoMANA SUMMIT - DAY 1 ($10,200+) | BANNED PLAYER SMASH MELEE INVITATIONAL

279 watching -

LIVE

LIVE

Major League Fishing

2 days agoLIVE Tackle Warehouse Invitationals Championship, Day 2

137 watching -

LIVE

LIVE

GamerGril

2 hours agoScream Queens 💕 Goth & Gore 💕 Unpossess

104 watching -

LIVE

LIVE

CassaiyanGaming

5 hours agoMYSTIVITHON - 12 HOUR CHARITY STREAM 🌊

44 watching -

2:14:16

2:14:16

Lara Logan

18 hours agoSTANDING AGAINST THE GLOBAL ELITE with Trump Ally President Milorad Dodik of Republika Srpska | Ep34

26.2K12