Premium Only Content

Gen Z and millennials prioritize financial openness in dating

A new era of dating? America's younger singles are banking on love in more ways than one, as traditional financial expectations may be losing ground.

A new survey of 2,000 singles or casual daters, split evenly by generation and region, revealed that 42% of baby boomers and 45% of Gen X still abide by tradition and believe the man should pay for a date.

Though 36% of Gen Z share the same sentiment, they’re more likely than any other generation to say that whoever plans or schedules the date should pay (28% vs just 16% of baby boomers) or even that it should be split evenly between both parties (23% vs just 17% of Gen X).

The younger generations also appreciate financial transparency more than the older ones. Half of both Gen Z and millennials find it attractive when a casual date is open about how much money they make, compared to just 37% of Gen X and 23% of baby boomers.

Gen Z is even more than twice as likely as baby boomers to find someone who is a “big spender” attractive (34% vs 16%).

Almost two in five Gen Z (37%) feel pressure to spend a lot of money on dates and one in five (19%) have even gone so far as to ghost someone because of their poor financial habits.

Still, finances ranked in the top three most stressful conversations to have with a date. While relationship history (29%) and sex (26%) ranked as the top two, finances (25%) didn’t fall far behind, even outranking religious beliefs (17%), marriage (12%) and kids (11%).

For baby boomers, finances are just as difficult of a conversation as politics and current events (both 26%).

Conducted by Talker Research on behalf of banking app Chime, results revealed that the exact timing of these conversations is a hot debate as well.

About one-third (31%) believe two people who are dating should start talking about personal finances somewhere between the first and third date.

Another 34% firmly believe that financial conversations should be saved for when you’re in a committed relationship.

With many putting off heavy-hitting financial conversations, crypto and car bros may be in luck as 23% of Gen Z would rather discuss topics that they have no knowledge or interest in over finances and 26% would rather chat about their deepest darkest fears.

Sixteen percent of baby boomers would rather disclose who they voted for in the last election and 19% of millennials would reflect on their exes and past dates.

Still, rising costs and inflation have impacted the dating lives of 74% of all Americans polled and 31% have actually canceled a date due to financial reasons.

QUOTE: “According to the results, Americans are divided over the ‘right’ way to talk about who pays for a first date, and whether it should be on the actual date (37%) or a message before it even begins (31%),” said Janelle Sallenave, Chief Spending Officer at Chime. “With so many Americans feeling anxiety over the payment situation, discussing expectations beforehand can alleviate awkward moments.”

The survey, which also polled 1,000 men and 1,000 women, found that a little more than one in five men (21%) have gone into debt by dating, compared to just 16% of women.

Similarly, men feel more pressure to appear more financially stable than they actually are (39% vs 30%).

Nearly half of men (47%) even believe that the man should pay for all of a date, and only about a third of women agree (34%).

However, men and women only have slightly different ideas of what’s an “acceptable” amount of money to spend on someone they’ve been dating for six months.

Women tend to keep it under $100, or an average of $98, while men are more likely to shovel out an average of $109, bringing the average cost of a date to a little over $100.

Though both men and women find spending more than you make to be a “financial ick” (31% and 35%), women are more likely to be turned off by someone who is stingy with their money (33% vs 19%).

Moreover, women are also more than twice as likely to be turned off when their partner doesn’t offer to pay for dates (29% vs 12%) or if their partner doesn’t have a good understanding of finances (24% vs 17%).

“These findings make it clear that financial norms around dating are shifting — especially among younger generations who are choosing transparency and equality over tradition,” said Sallenave. “Today’s couples are literally banking on love — swapping awkward assumptions for upfront money talks that lead to less stress, fewer surprises, and stronger relationships.”

Survey methodology:

Talker Research surveyed 2,000 Americans who are single or casually dating, split evenly by generation and region, with 1,000 men and 1,000 women; the survey was commissioned by Chime and administered and conducted online by Talker Research between June 2 and June 9, 2025.

We are sourcing from a non-probability frame and the two main sources we use are:

● Traditional online access panels — where respondents opt-in to take part in online market research for an incentive

● Programmatic — where respondents are online and are given the option to take part in a survey to receive a virtual incentive usually related to the online activity they are engaging in

Those who did not fit the specified sample were terminated from the survey. As the survey is fielded, dynamic online sampling is used, adjusting targeting to achieve the quotas specified as part of the sampling plan.

Regardless of which sources a respondent came from, they were directed to an Online Survey, where the survey was conducted in English; a link to the questionnaire can be shared upon request. Respondents were awarded points for completing the survey. These points have a small cash-equivalent monetary value.

Cells are only reported on for analysis if they have a minimum of 80 respondents, and statistical significance is calculated at the 95% level. Data is not weighted, but quotas and other parameters are put in place to reach the desired sample.

Interviews are excluded from the final analysis if they failed quality-checking measures. This includes:

● Speeders: Respondents who complete the survey in a time that is quicker than one-third of the median length of interview are disqualified as speeders

● Open ends: All verbatim responses (full open-ended questions as well as other please specify options) are checked for inappropriate or irrelevant text

● Bots: Captcha is enabled on surveys, which allows the research team to identify and disqualify bots

● Duplicates: Survey software has “deduping” based on digital fingerprinting, which ensures nobody is allowed to take the survey more than once

It is worth noting that this survey was only available to individuals with internet access, and the results may not be generalizable to those without internet access.

-

1:09

1:09

SWNS

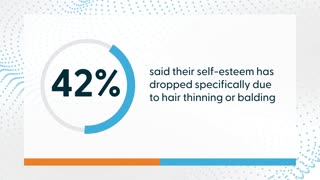

7 days agoWhy this is America’s No. 1 aging panic?

20 -

Glenn Greenwald

2 hours agoIsrael Pays Influencers $7,000 Per Post in Desperate Propaganda Push: With Journalist Nick Cleveland-Stout; How to "Drink Your Way Sober" With Author Katie Herzog | SYSTEM UPDATE #525

13.8K9 -

38:54

38:54

Donald Trump Jr.

6 hours agoDems' Meme Meltdown, Plus why California Fire Victims should be more Outraged than Ever | TRIGGERED Ep.279

70.2K68 -

LIVE

LIVE

SpartakusLIVE

1 hour agoNEW Black Ops 7 BETA || WZ too! And PUBG later?

172 watching -

LIVE

LIVE

MattMorseTV

3 hours ago $2.46 earned🔴CHILLING + TALKING🔴

427 watching -

1:00:02

1:00:02

BonginoReport

3 hours agoTerror Strikes Manchester Again - Nightly Scroll w/ Hayley Caronia (Ep.147)

30.1K34 -

LIVE

LIVE

Reidboyy

7 hours agoBIRTHDAY BETA STREAM!!!

36 watching -

2:05:44

2:05:44

Redacted News

4 hours agoHIGH ALERT! US AND ISRAEL SPEEDING TOWARD WAR WITH IRAN, INFLUENCERS BEING PAID $7,000 PER POST

123K53 -

LIVE

LIVE

Mally_Mouse

4 days ago🎮 Throwback Thursday! Let's Play: Kingdom Hearts 1 pt. 1

53 watching -

LIVE

LIVE

Quite Frankly

7 hours agoHidden History, The Culture War, Games We Play | Nerdrotic 10/2/25

552 watching